|

As I have discussed before, I have predominately used Interval International for my exchanges. The two Hyatt weeks which I own have very favorable exchange rates with Interval International which allows me to get almost 5 weeks of travel for my one week (albeit in a studio).

As I previously discussed, I now have control over another timeshare week that I own that trades through RCI. I have been reviewing and spending more time on RCI to determine how I can maximize the RCI week that I own. The first impression is that it is significantly harder to maximize timeshare ownership through RCI. While this is my initial reaction, this may change but there are some key fundamental differences on the way that RCI works for its "weeks" program. Exchange Trading Power The key difference between Interval International and RCI is that RCI uses "Exchange Trading Power". RCI provides a value associated with the week that you deposit that is based on the desirability of the resort, desirability of the week, the amount of lead-time for the specific week that you deposited as well as various other factors. Once you deposit your week, you are given a trading power. This trading power can be used to exchange into another comparable week provided that the exchanged week is equal to or less than the amount of trading power assigned to your week. While there are various nuances and intricacies associated with this, this generally means that you cannot exchange a less desirable week for a very desirable week since the trading power will not allow you to do so. For example, if you own a ski week during mud season, you will almost never be able to exchange that for a Christmas week at the beach. Interval International Difference As I stated, most of my direct experience has been with Interval International so I am keenly aware of how to maximize ownership with Interval International. With Interval International, my Hyatt weeks are given a point value and I can use those points to exchange into any other week provided that I have enough points. While Interval International does have something similar to trading power which they call Travel Demand Index, the way that this is used for Hyatt properties is materially different in that the amount of points required for a specific size unit varies depending on three time periods where there is low, medium and high seasons. For example, if I owned a 2 bedroom Hyatt week that was worth 1300 points, I can exchange that week for ANY 2 bedroom unit throughout Interval International (mud season week or Christmas week). I only would get restricted on my ability to exchange my 2 bedroom week if I my week was allocated less than 1300 points. At that period of time, the only 2 bedroom week that I would be able to obtain would be a 2 bedroom unit during low or medium seasons, which generally are very undesirable and don't really exist. However, I could use my low demand 2 bedroom unit and get a prime week in a studio or one bedroom. While they both use something similar to determine "trading power", the material difference between Interval International and RCI is that RCI is vastly more restrictive in that there system uses a point system between approximately 1-35 where if you deposit a week that has exchange trading power of 10, you almost never can exchange into a similar week that has a trading power of 30. To do so, you would have to combine additional weeks and pay additional fees for the ability to do where you would exchange 3 weeks for 1. For further clarification, Interval International, when trading Hyatt weeks, only have three distinct seasons where you may be limited on the ability to exchange. RCI, on the other hand, has significantly more restrictions where if you have a week that is only 1 trading power below a desired week, you are prohibited to exchange into it unless you combine it with another week and pay an additional fee. Based on my initial review, this prohibits you from getting outsized value out of your RCI week as they attempt to level the playing field by forcing you to get an equal value week. Conclusion Trading power is one of the most confusing aspects of timeshare ownership. When you are sold on a timeshare, the general pitch is that you can exchange your weeks / points into any week / resort desired. The truth is that this does not occur and the quality of your owned week, as determined by Interval International or RCI, will significantly impact your ability to exchange your week for something desirable or to maximize ownership. While this topic will likely need to be discussed in more detail, the general idea is that RCI is significantly more restrictive in allowing you to exchange a low demand week for a high demand week. Interval International allows you to do so which is how I am able to exchange into prime weeks while owning a less desirable week. While there are significant more details to add to this post, the point was to give a general overview of trading power and to understand a key difference between Interval International and RCI. One other material point is that RCI does have RCI Points and RCI Weeks and this is based on my comparison of owning a week with RCI Weeks. The RCI Points system is different and will review that during another post to determine if you can get outsized value from that program. Please ask questions or add some details below! If you have been a reader of TTG, you will notice that I have heavily posted strategies and deals predominantly concerning Interval International. As I have explained before, I own two Hyatt timeshare weeks and my grandfather had given me a week at Arroyo Roble which is a timeshare located in Sedona Arizona. The two Hyatt weeks are affiliated with Interval International and the Arroyo Roble timeshare is affiliated with RCI. My grandfather gave me his timeshare with the understanding that he would use it while he could and upon his passing, I would be able to use it. He wanted to transfer it to me before his passing to make it easier on me and his family. While I have had access to RCI, I mostly stayed with Hyatt's and Interval International properties and focused most of my strategies concerning those systems. Unfortunately, my grandfather passed away this September. Fortunately, it was a quick illness but still very unfortunate and he will be missed. Now that he is gone, the timeshare is officially mine and I have been able to explore RCI more and see some potential opportunities with RCI. While I still believe that Interval International does have higher quality timeshares than RCI since Interval International is affiliated with Hyatt, Marriott, and some Four Seasons, RCI does have some very nice timeshares including some Wyndham's and Hilton properties. Going forward, I should be exploring RCI more and finding more diamonds the rough. Stay tuned. Please reach out if you have any specific questions with RCI!

With the world shut down, airlines ceasing services and hotels shutting down, travel plans have simply stopped. While I normally have dozens of trips planned, I have been cancelling our trips one after the other as the airlines change schedules and the news continues to get worse.

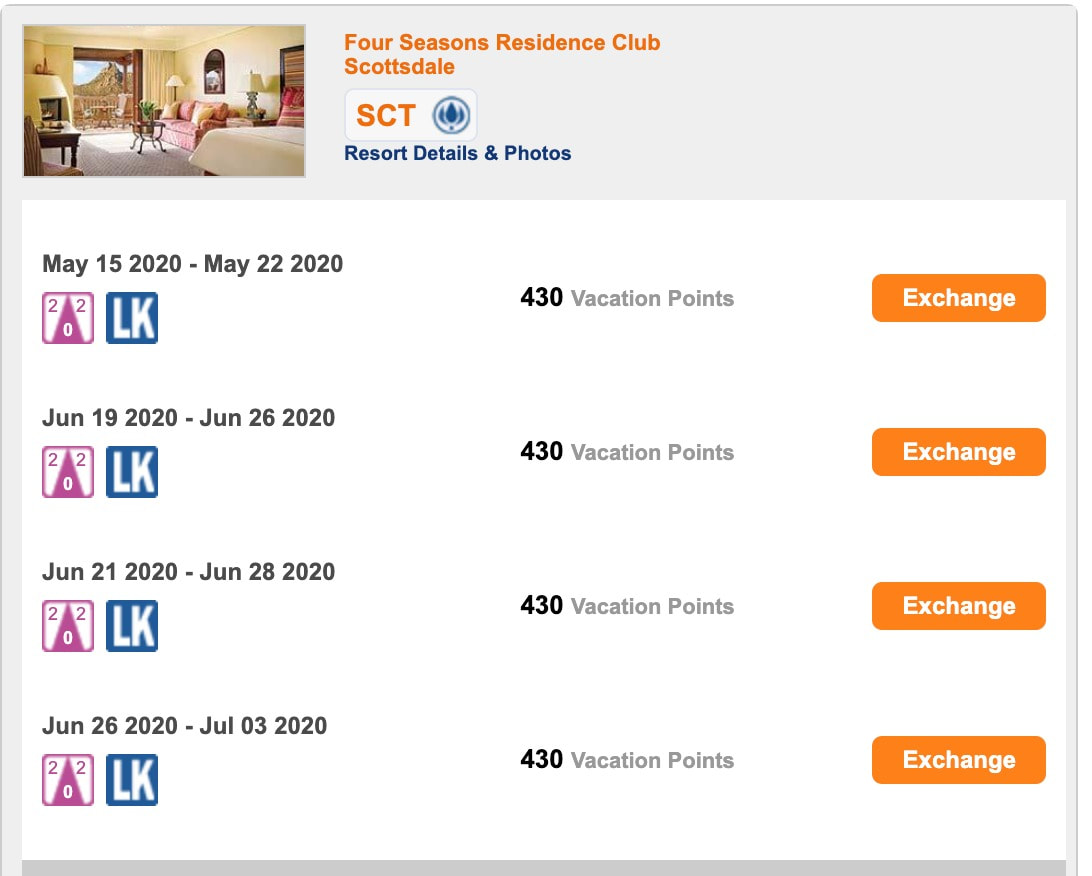

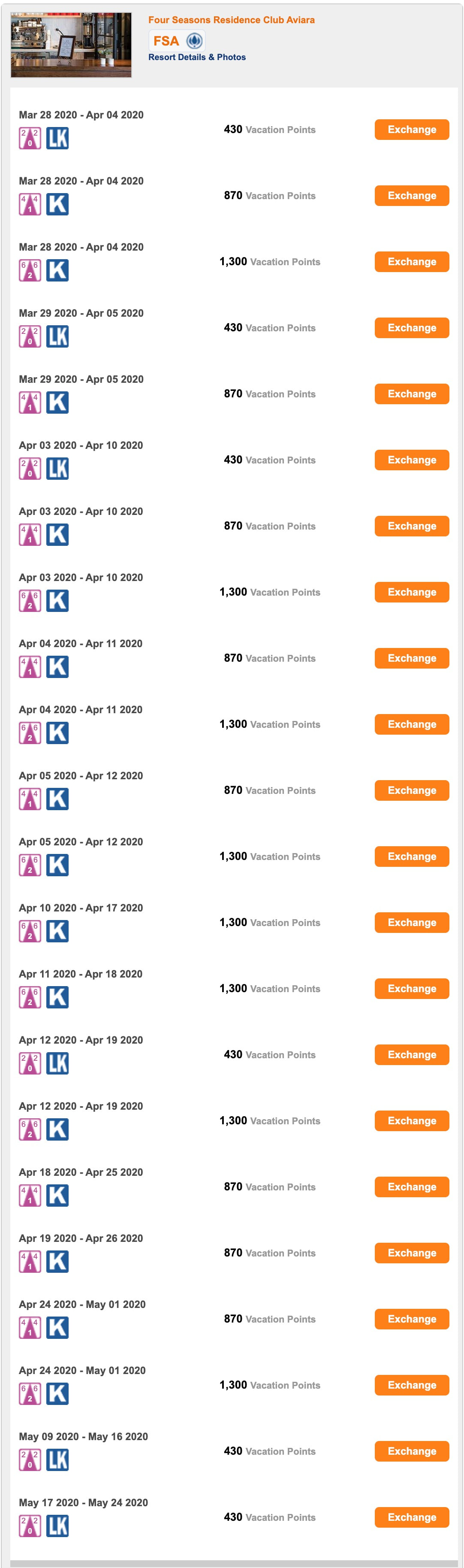

I have no desire on being on a plane at the moment. The close quarters with a bunch of strangers who are potentially carrying this virus is stressful. However, while the world is fearful at the moment, the reality is that this will not last forever. While there have been many talks about flattening the curve in two weeks, the fact remains that this virus will be around for a while. While we hopefully won't be confined in our homes indefinitely, I would guess that we likely will be home for the next 4-6 weeks. After staying at home for this length of time, I would guess that most of us will want some fresh air and get away from their house. While planes and cruises are going to be off-limits for a little while longer, the ever popular recession coined "stay-cation" will likely come back in full force. Instead of getting on a plane, perhaps a road trip or simply heading to a local resort will become the new normal for at least the foreseeable future. Considering that this will likely be my plan, I have been perusing Interval International and RCI to see their availability. Not surprising, availability has been unbelievable. Almost everyone has cancelled their trips for the next 3-4 months which has provided some opportunities for those who want/need to get away from the house. While California is currently on a shelter in place order, this will not last forever and do foresee that things will begin to lift in the next 3-4 weeks. The Four Seasons Aviara is a tough timeshare to get into as it is one of the nicest throughout the system. Here is their availability for the next couple of months.

Here are some great weeks at the Four Seasons Scottsdale:

Conclusion

While I strongly advocate staying at home for the foreseeable future for the benefit of the world, there are some outrageous opportunities for some great weeks at some great resorts. I know that we are all likely ready for a break from our house and each of us will have their own comfort level for wanting to travel, I do encourage you to review some of these available weeks and bring back the stay-cation or road trip. This type of timeshare availability does not come around often and if you have a timeshare in your backyard or one that can be easily reached by car, this could be a good opportunity to get out of house, support the travel industry and take advantage of this rare occurrence of being able to get a week at almost any resort desired. Please post below some of the weeks that you may get!

These past few weeks have been incredible. Who would have ever guessed that a virus would literally shut down the entire world. While I had personally thought that a recession was on the horizon, I don't think that anyone could have guessed that the entire world would shut down with life coming to a standstill at a moments notice.

While I am sure that you are tired of hearing about COVID-19 (I sure am), the fact is that it is here and do not see it radically disappearing in the near future. This obviously has and will have tremendous effects on everyone's daily life but the one industry that is absolutely reeling from the effects is the travel industry. Airlines have reduced services with some grounding their entire fleet, hotels have done the same and various other ancillary travel services are feeling the immediate contraction. While I have no intention of downplaying the seriousness of the virus where people are sick and dying, traveling has become a way of life for a lot of people. Travel has so many benefits from seeing different cultures, trying new foods and making your realize that the world is actually a small place where everyone is really interconnected. The entire blog was started in order to show people how timeshares can be used to travel around the world in luxurious accommodations for a very reasonable cost. Timeshares have such a horrendous reputation that most people simply have no desire to learn about them, much less purchase one, since they are widely considered a scam. While there are serious and material issues with timeshares, the goal is to understand them and use them for your benefit! Finding Opportunities While most people likely have no immediate plans of traveling for the next few months or even the next year, I would venture to say that we will travel again. There is so much to see out there and people will travel again. Things will be as good as they were before. When, I do not know, but I am confident that things will boom yet again. During this time while travel is non-existent and work has slowed down / stopped for many of us, this actually becomes a great time to take advantage of opportunities that do not come along too often. I purchased my first Hyatt timeshare in 2008 via re-sale. I started the buying process and was just about to close on it when I was laid off from my job. With the Great Recession upon us and no foreseeable method to obtain income, I was left with the choice of walking away from the purchase or going forward. I ended up going forward with the purchase and paid $6,500 for that timeshare. About a year later during the most significant part of the recession, the same timeshare was selling for $1.00. Do I regret the purchase? Absolutely not. While I would have loved to purchase the timeshare for a $1.00, having the timeshare during 2008 forced me to travel when I wouldn't have been able to afford it before. There were abundant airfare deals to encourage people to travel. The timeshare gave me the opportunity to travel affordably while I had no income but had the time to do. There are some many times during our lives where we have the income to travel but don't have the time and there are others where you have the time but not the income. Travel doesn't need to be expensive and timeshares are one way to travel well and affordably. I foresee this upcoming economic period as something similar to 2008 While the underlying reason for the recession is different and while this recession is directly targeting the travel industry, there will be some incredible deals with timeshare, hotels, airfare, cruises, etc. Now is the time to do you research to figure out whether a timeshare can work for you and your travel style, determine what timeshare brand may be the most beneficial and to look throughout the marketplace to determine the current costs for timeshares so that you can snatch up the deals as they occur. There will be some fabulous opportunities to get some quality timeshares for cheap! Conclusion It may be hard to start thinking about traveling while the world around us is imploding but I am confident that this will pass. It will pass and we will get back to traveling and seeing the world. When we emerge from this difficult time period, the best thing to do is be prepared. Now is the time to review and research. While there are likely a lot of lessons to be learned from the pandemic, the one that resonates the most with me is that life is short and we don't know what tomorrow will bring. We are all "stuck" at home with our families and hopefully enjoying some of this time where life has slowed down. While we all have some more time on our hands to think about life and the future, I know that some of the best times that we have had as a family has been traveling, enjoying different cultures and foods and taking us out of our comfort zone. My recommendation is to use this time now to prepare for that future and make sure that travel stays a part of your life.

First, I want to apologize to my readers for the long delay in posting new content. The past year has been full of various distractions which has caused me to have to focus on other things. Over time, I'll give you some additional details on what has transpired on my personal front but they have all been positive developments. The downside was that other aspects of my life required my full attention to the detriment of TTG.

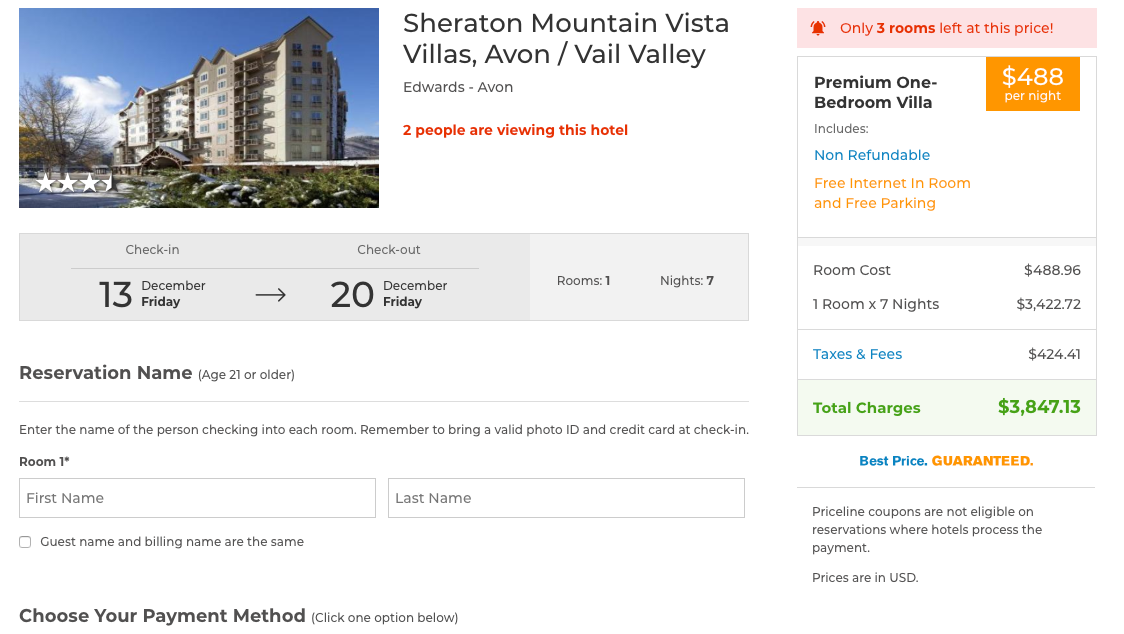

For better of worse, the COVID-19 pandemic has given me some more time to spend with my family, catch up on things that I have wanted to do and now, re-focus on TTG. Going forward, I do hope to have more time to bring you new content relating to timeshares and travel. While the entire world is on lockdown with little to no travel plans planned for the future, the opportunity for some exciting deals is on the horizon. For those of you who have wanted to travel but couldn't, be prepared to see some incredible travel deals in the near future. The past decade has been an economic boom that has allowed many of us to travel throughout the world. Airlines had expanded at a rapid pace that allowed many of us to jet set around the world. Loyalty programs and timeshares allowed us to do so at a very affordable level. As this new chapter of the world begins, I don't know what it will bring. For many of us, hard times are ahead as jobs and companies will contract and shut down. For others, this type of economic turmoil brings about many opportunities and can allow you to see clearer on what is important for you and your family and what you want to accomplish in this life. The last year has been full of change for me and it appears that this next year will be the same. Change is occurring quickly and hope to be able to refocus on bringing you good and relevant content on timeshares and travel. Please reach out with any questions that you may have or content that you would like to see! I hope that the new chapter of TTG will be better than ever! Timeshare Strategy: Interval Getaways and Interval Exchanges - a pricing discrepancy to be aware of.4/3/2019 For those of you who are new to the site or to timeshares in general, Interval International has two options to reserve timeshare weeks. Interval Getaways are weeks which you rent for cash and Interval Exchanges are those weeks where you trade your week or points in exchange for the week. Interval Exchanges have exchange fees on top of whatever week or points that you use and currently run $209 per week. E-Plus (the ability to retrade your exchange for 3 times for no additional fee) is in addition to that fee for $59 but as discussed many times before, I highly recommend adding that to almost any exchange simply to give you added flexibility for your plans. Here are some good posts to review on these subjects: Interval Getaways Interval Exchanges E-Plus Most times, my preferred timeshare strategy is to use the points allocated to me via my Hyatt Residence Club weeks and use it to exchange for highly desirable weeks using Interval International. I find that it is a great way to maximize value out of your week and get outsized value for your timeshare. My Exchange While that strategy is my go to strategy, a recent week that I confirmed questioned this strategy. I booked a ski week at Sheraton Mountain Villas in Avon / Beaver Creek, Colorado for December 13-20, 2019 using points. I used 870 Hyatt Residence Club points to exchange for the a 1 bedroom suite. While it is the week before Christmas, it is still a very good ski week. I was very happy with this trade as I looked up retail pricing for this particular week and if I booked with a third party travel agent, the week would have cost me over $3800. Outrageously expensive in my opinion considering the out of pocket cost to me for an exchange.

As a reminder, I now pay about $1300 per Hyatt Residence Club week which provides me with 2,000 Hyatt Residence Club points. Just taking into account my maintenance fees, I pay about $0.65 per point. Since this reservation cost 870 points, the true cost to me would be $565.50 ($0.65 x 870 points) PLUS the exchange fee of $209 and my obligatory e-plus add on for $59.00.

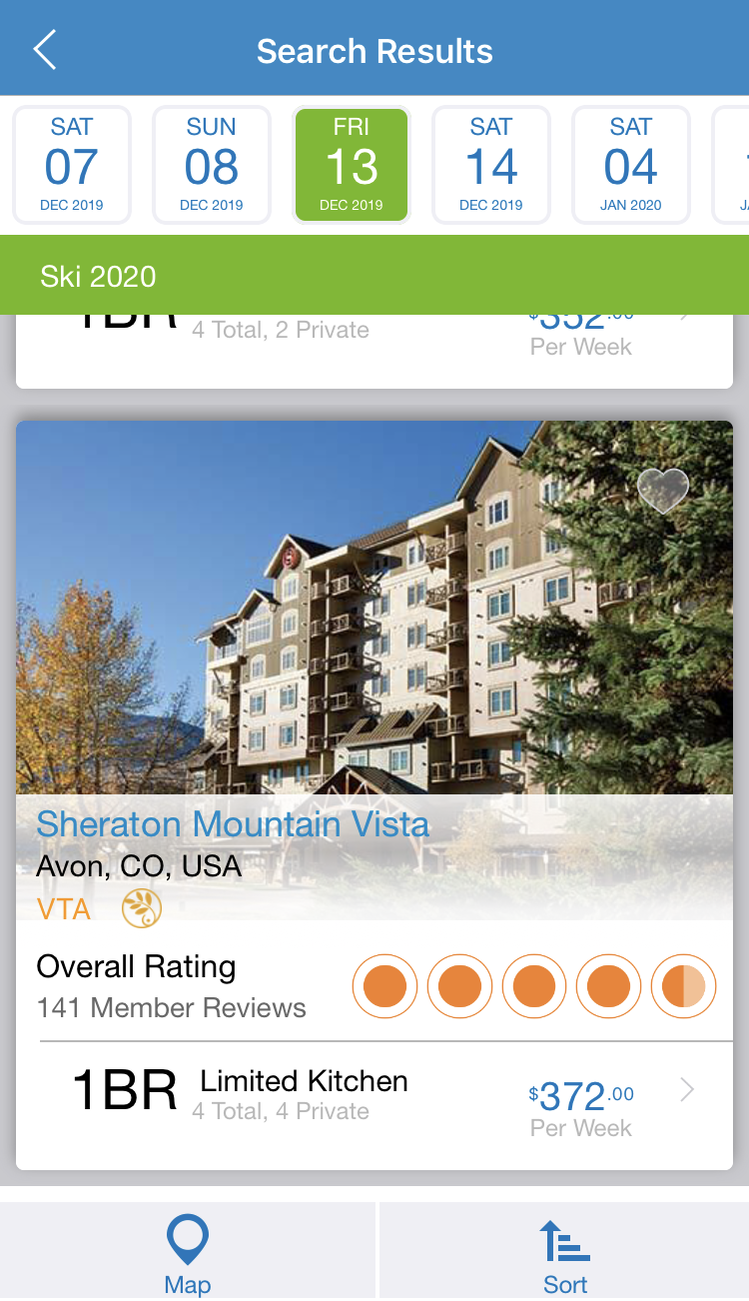

Therefore, taking all the numbers into the cost for this one week rental would be $833.50. When you compare the retail price disclosed above, $833.50 for a prime ski week in Avon / Beaver Creek, Colorado is an absolute bargain. It is roughly 78% off the retail price of the ski week. As I stated, I thought I did very well with this trade and was happy with it. I have not been to a Sheraton property before but many of them get very good reviews and this one has been on my radar for a while. Getaways I have discussed the benefit of using the Interval International iPhone app in the past. They recently updated it to provide more functionality but my general use is to provide the Getaway alerts. In that post, I gave a better overview Getaway alerts but generally, you can set up alerts on the app so that you will get notified when certain resorts and weeks become available to book with cash. I always have plenty of ongoing alerts for high desirable properties as if they ever become available, they can disappear quite quickly. If you see a week that you want, book it immediately as it will likely disappear within minutes. I ALWAYS have an alert set up for ski season to see if there are any deals to be had. The other day, my phone buzzed for an alert for Ski Season 2019. I quickly opened the app and looked at what one of my chosen resorts matched. It was a match for the same week which I confirmed at the Sheraton Mountain Villas. To my amazement, the cash price of the week was ONLY $372! As you can see, I could book the same exact week that I confirmed with points for $372 for the week or only $53 per night. Conclusion As you can see, even if I went forward with my exchanged week, I still came out materially better than if I simply booked directly with the resort or with a third party travel agent. $833 for a prime ski week in a spacious 1 bedroom condo in a top notch ski destination is hard to find and even if I didn't stumble upon the crazy deal above, I would have felt good about this exchange. However, the point of this post is that you need to look / monitor multiple avenues to get the most value out of your timeshare. In this example, I purchased e-plus for this week for an extra $59. By paying this additional fee, I am able to re-trade the exchanged week for up to 3 times with no additional fee by Interval. Since I had e-plus associated with this week, the best option to maximize my use of points would be to book the week using cash for $372 per week and use my exchanged week / already allocated points for a much higher and better use. By paying $59, I was able to save $461.50 (833.50 - $372) and get a great ski week for an extremely nominal amount of money. However, just so you are aware, booking Getways are completely non-refundable. Once you book it, you cannot re-trade a Getaway booking so you need to be absolutely sure that you can make the trip. Finally, always make sure to check exchanges and getaways to determine the best pricing. Even great exchanges could be available for less money using Interval Getaways. It can definitely pay to do you research. A good tip would be to set up an alert on the Interval app following an exchange so that you can monitor whether that week becomes available for paying cash. If it does, you can do a similar calculation and see if you wanted to keep you exchanged week or pay cash and use the exchanged week for something more valuable. Have you discovered any similar pricing discrepancies? Make sure to comment below. Spring Break 2019: A Timeshare Fail, A Timeshare Strategy Success and An Unbelievable Windfall3/28/2019

Timeshare Fail

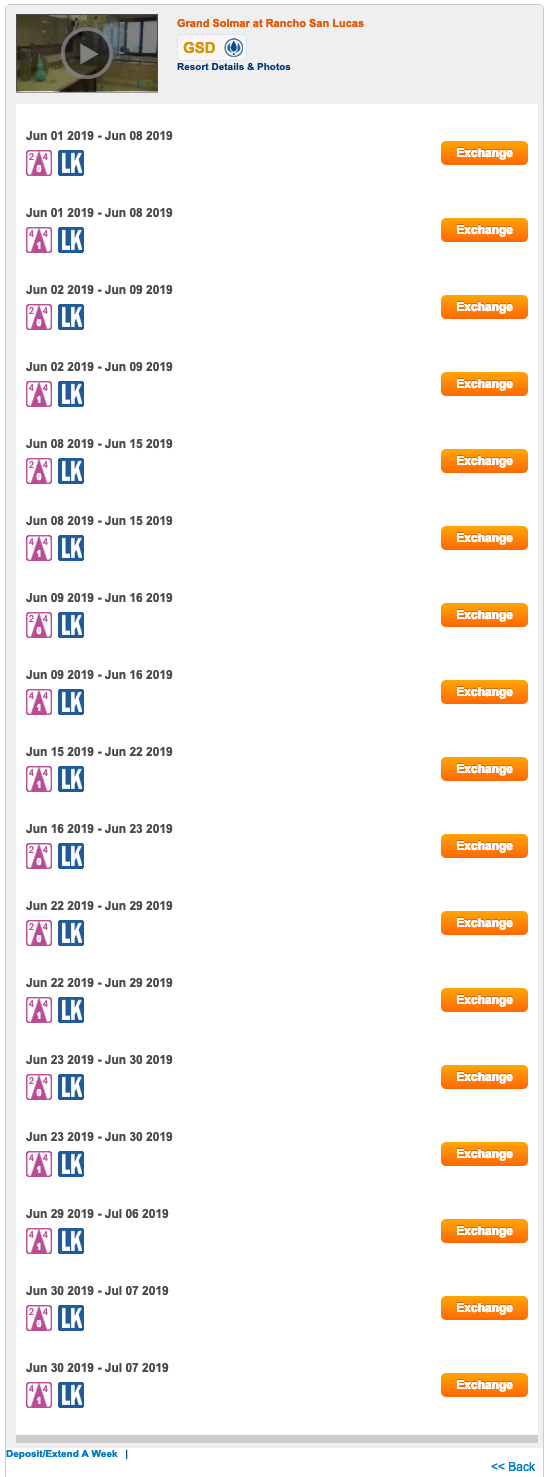

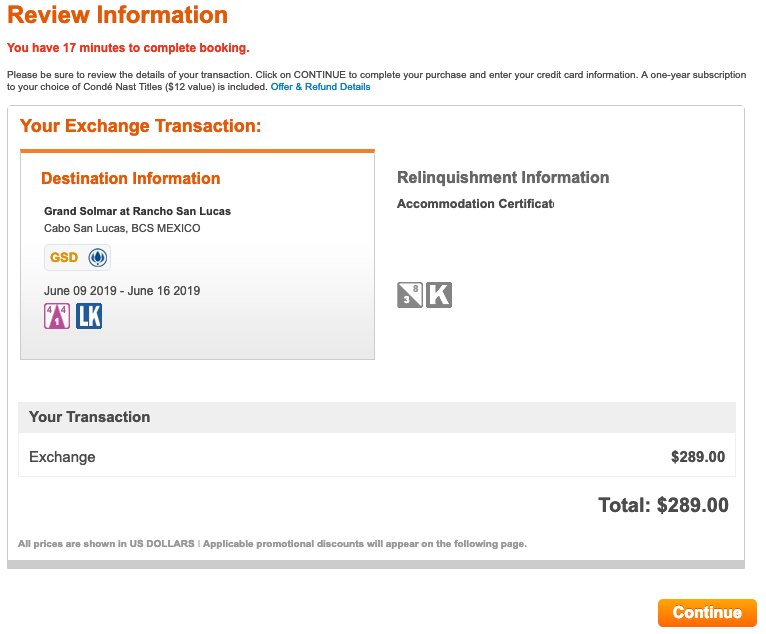

Last week was spring break for many schools around the nation. It is a very hectic time to travel. Unfortunately, when you have children in school, if you want to travel, you are forced to travel on their schedule. We usually take a ski trip during spring break and this year was no exception. As you may know, we are very fond of Park City. The issue with this year was that our school district changed the standard week of spring break. Instead of it occurring during the 2nd week of March, they changed it to the 3rd week of March. As an avid planner, this thoroughly disrupted my timeshare strategy of booking 2+ years in advance. I had various weeks and resorts selected for the second week of March and was patiently waiting for a match. Once the school schedule came out about a year ago, I had to revise the request first and only had one year to make a match. Since this was almost the end of ski season, I wasn't extremely worried as I did not think that it would be very desirable week. We generally go to Park City for various reasons (easy travel, great skiing, good restaurants, and plenty of timeshare options) and we made the trip last year for the second week of March. Last years ski season was horrible and we skied on slush while it was 70 degree weather. Fortunately, this year was much, much better but didn't think that getting a desirable timeshare would be an issue. Unfortunately, I was wrong and nothing came through. I was quite surprised with that but I only put in requests for the top resorts in Interval International, which for Park City are the Marriott Summit Watch, Marriott Mountainside and the Westgate Park City. There are some nice properties with RCI including the Wyndham Park City, Sundial Lodge and Hilton Grand Vacations but do not exchange my week with RCI and only use RCI for Extra Vacation (cash bookings). If I chose lesser desired properties, I may have had better luck. In any event, this was a timeshare fail for this year. For those of you that need to travel during peak times such as Christmas and Spring Break, this is a good example of why timeshares may not be ideal. Getting top quality resorts during these peak time periods can be difficult, if not impossible, so if you have to travel during these time periods, you may be disappointed with timeshare ownership. If you are flexible and can travel during cusp seasons or off-peak times, timeshare ownership can be very worthwhile. Timeshare Strategy As I have explained before, timeshare availability can be difficult which is why you need to always have a "plan B". Many times, my plan B entails making a reservation using hotel points so that in the event that my timeshare does not get confirmed, I still have a hotel reservation to use and can therefore buy my non-refundable airfare or use frequent flyer miles without worrying about accommodations. Generally, hotel points have flexible cancellation policies so you can reserve a week using points and once you get confirmed into a timeshare, you can cancel the week and get your points back. If nothing gets confirmed, the worst case is that you use your points for a "free" vacation. Here is a post I have done on the topic. Here is also another one of my "timeshare fails" which actually worked out extremely well. This is a great strategy and definitely encourage you to use this strategy. For this week, while a timeshare did not come through, I had booked a week at the Hyatt Place in Park City. The hotel is located on the main road and about a 2 minute drive to the base of the Canyons, 5 minutes to the base of Park City and about 10 minutes to Deer Valley. The location is ideal. The hotel use to have a complimentary shuttle that would bring you to any of the above resorts but apparently discontinued it. Without the shuttle, you generally need a car or you can use the free bus system. While the bus system is free and convenient, a car is generally easier to go around the area when and where you desire. The hotel is fairly new but without the shuttle, it is hard to recommend. Regardless, the hotel is a category 4 hotel (will likely decrease if there don't reinstate the shuttle) which requires 15,000 points per night. During ski season, rates can be $300-$400 per night so it is a decent return on points. Since I needed to buy non-refundable flights, I used my strategy and booked a week on points waiting for the timeshare to get confirmed. As months went by without any activity, I started to get a bit nervous and was thinking about alternatives. While doing so, I came across rates at the Hyatt Place for $132 per night for my needed week. Hyatt points are very valuable to me and have been lucky enough to get almost 8 cents per point on some hotel redemptions. You can read about our recent stay in Maui at the Andaz Maui where we had $28,000 vacation for about $1,200 out of pocket. Getting less than 1 cent per point is awful so I cancelled my points stay and booked using cash. I'll save my points for a better redemption value. While I still wanted to get a timeshare, the "plan B" was to stay at the Hyatt Place for $132 per night. Not a bad alternative even though I really wanted a timeshare. As you can see, you need to use a strategy to ensure no issues. If I didn't have this as a back up plan, I would have either lost my non-refundable tickets and not went on vacation or would be forced to book last minute rates during ski season which likely would have been astronomical in price. Timeshare availability can be unpredictable so you need to have good backup plans in place to avoid an undesirable expensive vacation or be stuck at home. Unbelievable Windfall Despite not getting a timeshare, we had a great week in Park City. The conditions were great and the weather was perfect. It was ideal spring skiing. We headed to the airport on Saturday, checked in and patiently waited for our flight. The airport was extremely chaotic as there were a lot of people traveling. It was spring break in a lot of destinations. The customer service representatives indicated that the flight was oversold and they were looking for volunteers. I immediately sprang up and ran to the desk and put our family of four on the list. The entire day of flights back home were full so they offered to book us on the next flight or would give us additional compensation if we wanted to fly out the next morning. Being a Sunday and flexible, we took them up on their offer. We got a decent amount of compensation, gave each of us $15.00 per meal voucher (breakfast, lunch and dinner) and put us up in a hotel for the night. We were very happy with the deal. In the past, the airlines generally offered vouchers to be used for future flights. After the United incident where they dragged a passenger off the plane, the airlines re-thought their compensation offers and now offer about a dozen options for gift cards. This includes retailers such as Amazon, Best Buy, Gap and others. They also allow you to receive an Amex prepaid card which is basically good as cash. We all chose an Amex gift card for our "troubles" and had an enjoyable day exploring Salt Lake City. The next day we returned to the airport and found the same chaotic airport. We again headed to the gate and were again greeted by customers service representatives requesting volunteers. Again, I sprang up and volunteered again. Unbelievably, they needed our seats again and offered us even more compensation. We again got Amex gift cards, meal vouchers and another hotel stay. We headed back to Salt Lake City for another enjoyable day of sightseeing. As you know, we fly a lot and travel a lot and if we are flexible, I am always looking to get bumped and receive some compensation. I have probably volunteered about 3-4 times in the past year and they never seem to need me. Getting bumped 2 days in row was lucky and extremely beneficial and extended our fantastic spring break without too much inconvenience. The next day we went to the airport again and were met with the same situation. I couldn't even believe that they still needed volunteers but they did and we volunteered again and they gave us even more compensation. 3 in a row. We got our hotel, meal vouchers and compensation and went on our merry way yet again. By day 4, we were a little tired of this routine and our kids were missing school so we were prepared to get on the plane and finally make it home. It was unbelievable but they still needed volunteers. My wife and I looked at each other and said why not. We put our name on the list and went for 4 bumps in a row. Instead of offering overnight accommodations, they put 2 of us on the next flight and 2 of us on standby with us confirmed for an evening flight. I didn't think it was possible and was prepared to go home. However, they needed our sits again and we received even more compensation and more meal vouchers. WE GOT BUMPED 4 TIMES IN A ROW! We all proceeded to the next flight and it was truly unbelievable but they were still asking for volunteers. We were on a roll and put our name on the list again. Unfortunately, another family beat us to the list and we didn't get bumped again. However, 4 bumps in a row was great and we were nicely compensated for our troubles and enjoyed our added time in Salt Lake City. The craziest thing about all of this was that our original flights were FREE! I booked us all using frequent flyer points so they essentially paid us to get back their free seats! Crazy! Conclusion I hate traveling during the busy time periods as everything is more of challenge. Getting timeshares, getting to your destination, getting rental cars, getting restaurant reservations and just getting around is more difficult. However, when you have school age children, we don't have much choice if you want to travel. For those of you that need to travel during this time, plan as far in advance as possible and use my timeshare / hotel point strategy. It has saved me multiple times and highly recommend it. Take a look at this post for some good ways to get a bunch of points quickly. While I hate traveling during these peak times, this ended up working in our favor. I won't give you the final tally of our compensation but we arrived home with large smiles on our face having had our entire week paid for by Delta plus much more! This was definitely a very memorable spring break! I'm not sure whether we will ever experience a similar windfall but it was fun while it lasted. Have you been bumped multiple times before? Share your story below! I have talked about Accommodations Certificates before and while the choices can have a lot to be desired, there have been some significant "diamonds in the rough". I was recently targeted again for 2 additional Accommodations Certificates from Interval International which allow you to receive up to a 3 bedroom unit for $289 exchange fee for an entire week. The destinations or available timeshares for these weeks are generally not prime weeks or prime resorts but if you are diligent, there can be some amazing deals. I was searching for some opportunities using my certificates and came across the Grand Solmar at Rancho San Lucas which had almost every single week of June available in a one bedroom unit. Cabo in June should be a decent time of year and while it will be hot, it is prime vacation time. Here is the current availability that I am seeing: This resort has been on my radar for a while and it looks like a great property. Here are the reviews from Tripadvisor where it gets almost a 5 star rating. As you can see, the TOTAL COST of this entire week in a 1 bedroom unit is ONLY $289 for 7 nights or about $41 per night. This property DOES NOT require an all inclusive meal plan but per the terms and conditions, it is available for a supplemental fee. You need to be very careful when you book these accommodations certificates as some properties have MANDATORY all inclusive fees which can easily add $1,000's to your reservation.

Conclusion:

This is a stellar deal to travel well, in luxury and cheap! Timeshares definitely have their issues but deals like this continue to show me (and hope you too) that timeshares are not all that bad. I have made this offer before but haven't actually had success but I generally don't use these accommodation certificates since I plan our travel so far in advance that these "last minute" items don't work for our travel plans. However, if any of my readers would like one of these units or others, I would just have them pay the $289 fee plus the $69 guest certificate and you can book one of these weeks. Make sure to leave your comments below and if you are interested in one of these weeks, please indicate what week and I will respond. Alternatively, you can e-mail me directly at theguru@thetimeshareguru.com. Thanks for reading and let me know your thoughts on this deal!

Top Timeshare Locations In Europe

Given that the continent attracts a steady stream of visitors from all over the globe, it’s no surprise that Europe is home to some incredibly desirable timeshares. In virtually every country and every major city across the country, there are places that people invest in as homes away from home, giving them the chance to spend regular time at a desired destination, and possibly even use said destination as a base from which to wander around Europe. To narrow down all of the potential options is quite a task, and naturally there are dozens of excellent ones that won’t appear here. The following, however, should certainly be counted among the most desirable timeshare locations in Europe. St. Christopher Club - Hamburg, Germany When you imagine tourism or even long-term vacations in Germany, there are other cities that will come to mind first. Berlin and Munich in particular are far and away the country’s most famous destinations, and naturally draw significant crowds of foreign visitors. Both can be lovely to see and explore, but some ultimately find that Hamburg is the more appealing city. Located on the Elbe River to the north, it’s grown trendy enough in recent years that one of the web’s most visible travel sites even wrote specifically about reasons to visit this city instead of Berlin. These reasons included fresh food, excellent shopping, a beautiful city centre, and vibrant culture, among other things, ultimately painting the picture of a wonderful place for an extended foreign stay. There are multiple options for timeshares here, not the least of which is the fact that Hamburg has developed a very active home rental market. That’s not a traditional timeshare, naturally, but in a way it’s a means of enjoying the same benefits of a timeshare without the organizational hassle. The Renaissance Hamburg Hotel also comes up as a nice professional venue for this sort of residence, and possibly even use said destination as a base from which to wander around Europe. Aeolos Beach Club - Corfu, Greece If your goal in seeking a European timeshare if to find a beautiful place to relax a few weeks out of the year, or your own personal paradise in general, you really can’t do much better than the Greek Isles. Famously beautiful and situated on just about everybody’s travel bucket list, these islands exemplify what’s so special about the Mediterranean region and offer unparalleled views, quiet accommodations, and a sense of peace and contentment that’s impossible to put into words. Corfu is an island that represents all of this, and is the home of the Aeolos Beach Club, which may be the most recommended timeshare option in Greece. It’s a fairly affordable resort despite its hillside location overlooking the sea, its lovely rooms and individual units, and amenities like an in-house restaurant and spa.

47 Park Street - London, United Kingdom

It’s important to remember that there are timeshare options in some of Europe’s most famous capitals as well, including London. Now, Park Street may not itself be one of the city’s more renowned spots, but it’s right in the thick of the action. The street is adjacent to the magnificent Hyde Park, and a walkable distance (albeit a rather long walk) from Buckingham Palace. And if your taste for London comes partially from the innumerable works of fiction focused there, you might also be intrigued to know that Park is one over from Baker Street. This is the famed home of Sherlock Holmes, in everything from the modern series Sherlock, in which it’s presented in a fairly realistic manner, to a Holmes-based online game, which specifically asserts that "the action unfolds" at 221B Baker Street, Holmes’s famous apartment. Not a bad neighborhood for those who want to step into their own fantastical versions of London! As for the residence itself, 47 Park Street is thought by some to be one of the nicer timeshare options in all of Europe. Also known as the Grand Residences by Marriott in the Mayfair area, 47 Park Street is effectively a beautiful corner hotel full of townhouses and suites, with 24-hour service and timeshare arrangements in place. It’s high-class city living in a city of royals.

Ca De Venezia - Venice, Italy

Like London, Venice is one of Europe’s truly remarkable cities that attracts visitors of all kinds, from all over, all year round. It’s a stunning and unique destination, truly unlike any other place in the world, and packed with enough sights, activities, and pure visual appeal to keep anyone busy for weeks on end. So, naturally, it’s a popular place for extended stays as well! Ca De Venezia is actually a more casual option as compared to some of the home-away-from-home options discussed above, but it’s still a highly recommended, hostel-style timeshare option for those who just want regular access to the city. It’s a homey, apartment-style mini-resort, located east of the city centre and Grand Canal, where you’ll have some peace and quiet without sacrificing quick access to the main attractions. Pestana Grand Hotel - Madeira, Portugal Madeira may be the most obscure location listed here, but once you get to know it, it’s hard to resist it as a potentially regular vacation destination. A small island, and actually an autonomous one off the coast of Portugal, it’s a dreamy island unlike most others in Europe. It has its nice beaches and tourist spots, certainly, but also outstanding local food, high mountainous hiking trails, lush greenery, and bustling, authentic little towns. It’s a place you can fall in love with in a day, and then envision enjoying for a great deal longer. Somewhat ironically, the Pestana Grand Hotel is perhaps the most traditional luxury resort of the timeshare options mentioned here, almost clashing with the island’s image as a whole. That’s not a bad thing, however. All it means is that you can stay in luxury and comfort while enjoying everything else the island has to offer. |

Archives

April 2020

Categories

All

Archives

April 2020

|

RSS Feed

RSS Feed