|

As I posted about here, I received an offer for a free two night stay at the Hyatt Wild Oak Ranch in San Antonio, Texas.

I believe that I was targeted for this offer since I am a Hyatt owner and live in the immediate vicinity of San Antonio. The Hyatt Wild Oak Ranch is one of my families favorite resorts. It is one of the material reasons that I actually first bought a Hyatt timeshare. We tend to visit the resort at least 2-3 times per year. We have been coming to the Hyatt Wild Oak Ranch since about 2007. In all that time, they had grandiose plans to build out the property with additional buildings, more amenities, another large pool area and additional restaurant facilities. Since 2007, while there have been some changes, the resort has mostly stayed the same. It appears that the Hyatt Wild Oak Ranch has finally made progress on its expansion and just completed a brand new building on property called Cedar Elm. The likely reason for the offer was to allow existing owners to see the new building and potentially up sell them to the new Hyatt Portfolio program. As you might expect, a timeshare presentation is required in order to get your two nights free. In a separate post, I'll give you a review of that experience but I can tell you now that I am not looking forward to yet another timeshare presentation. If you read this blog regularly, I have been doing a lot of these tours in order to give my readers better insight into the timeshare industry. Check-In We checked into the resort without issue and was fortunately placed in the new building. We received a two bedroom unit which is absolutely huge. It is an absolute pleasure to have some much space and have my family of four each have their own bed. The Room The new two bedroom units are fairly similar to the older units but has some nice updates. The TV's are large and new, (there are 3 TV's in the unit), the appliances are new and of high quality and the furnishings, while still a bit rustic for my taste, are very comfortable. Here are a bunch of photos that I took of the room. Scroll through them all to see the entire unit!

Conclusion:

As you can see, the room is huge and well appointed. I would not say that there is a tremendous difference between the new units and the older units but if you do stay, definitely request to be in the Cedar Elm building. Stay tuned for additional post on the Hyatt Wild Oak Ranch and my thoughts on the timeshare presentation! Have you ever stayed at the Hyatt Wild Oak Ranch?

Timeshares are a great way to travel but they simply do not work for every trip. Additionally, the only way that I personally am able to travel as extensively as I do is through frequent flyer points and credit card points which allow me to book airfare for free or fares that are significantly discounted.

I have not gone into a lot of details of this subject but I have discussed the importance of getting miles in this post. Credit card signup bonuses are one of the best and easiest way to quickly accumulate various types of points. It is a quick and easy way to travel for free. Current Offer for the Chase Sapphire Preferred I wanted to quickly get this post out because Chase recently increased the signup bonus for one of their most popular cards, the Chase Sapphire Preferred Credit Card. There are two offers currently available - one offer for 50,000 ultimate reward points with the annual fee of $95 waived and the second new offer for 60,000 ultimate reward points with the annual fee of $95 NOT waived. Both offers also allow you to add an authorized user and once the authorized user makes one purchase, you will be given an additional 5,000 points so the offers below are really 55,000 or 65,000 ultimate reward points. Redemption Options Both are truly stellar offers as ultimate reward points are a fantastic travel currency. These ultimate reward points can be redeemed in various ways including the following:

Favorite Transfer Partners One of my favorite transfer partners is easily Hyatt as you can use 60,000 ultimate reward points to stay 4 nights at the Andaz Peninsula Papagayo which I reviewed here. Nightly room rates vary by season but if you redeem these points over Christmas break, this one credit card offer can easily save you close to $5,000 as rates at that particular hotel are going for over $1200 per night! One of my other favorite uses of ultimate reward points is actually through Flying Blue, the loyalty program of KLM / Air France. This is a lesser known partner as KLM and Air France are based in Europe but they are partnered with Delta. As a result, you can use ultimate reward points to book Delta flights with Flying Blue. One of the best sweet spots in this program is the ability to fly to Hawaii from anywhere in the United States for only 30,000 points. Therefore, you can get two round trip flights to Hawaii solely by signing up for one credit card! If you are a couple, both spouses can sign up for these cards and get double the amount! Many people are concerned with credit cards as they could impact your credit score. However, while they may be a little impact to your score at first, if you pay it off every month (which you NEED TO DO), your score can actually go up since you will have a positive credit history. Conclusion I truthfully think that both offers are fantastic as the Chase Sapphire Preferred card is a great card for everyday use. However, in an effort to make sure that this is clearly transparent, the 50,000 offer below is my referral link and the 60,000 is a public offer. My preference would be to receive the 60,000 ultimate reward points but some people prefer to save the $95 and take a lower offer. You should be aware that if you already have the Chase Sapphire Reserve card, you will be ineligible for this bonus so it is not worth applying for at this time. If you are not involved in getting free travel through credit card signup bonuses, you are missing out on tremendous offers. I have posted this before but this is definitely a good read if you want to know how credit cards can help maximize travel. Timeshares can be a great tool to receive cheap accommodations but frequently flyer miles and credit card points give you the ability to get to your destination for free which can easily save thousands of dollars but more importantly, can give you the flexibility to travel anywhere in the worth without regard to cost! What credit cards do you use?

I keep a fairly close eye on Park City timeshares since I spend a decent amount of time there during the Ski Season.

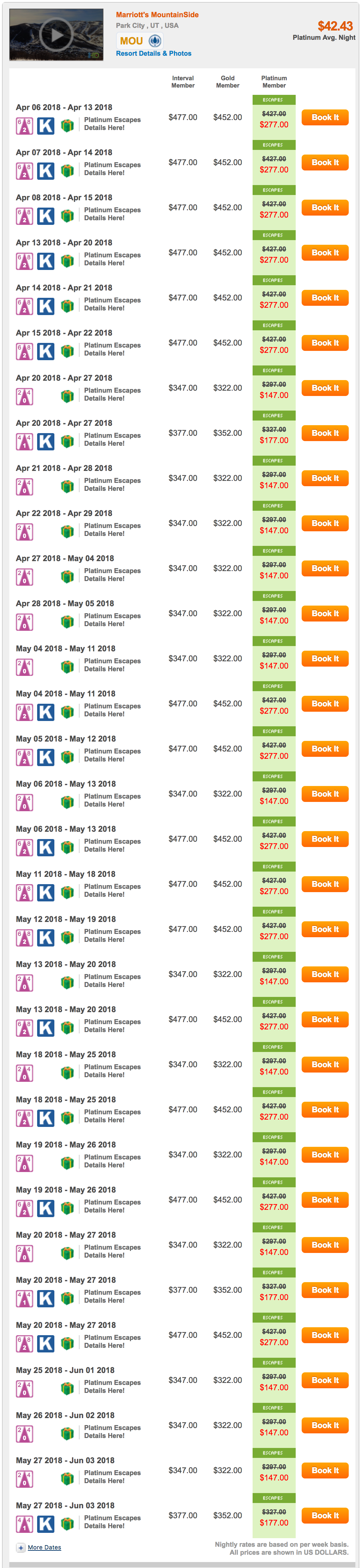

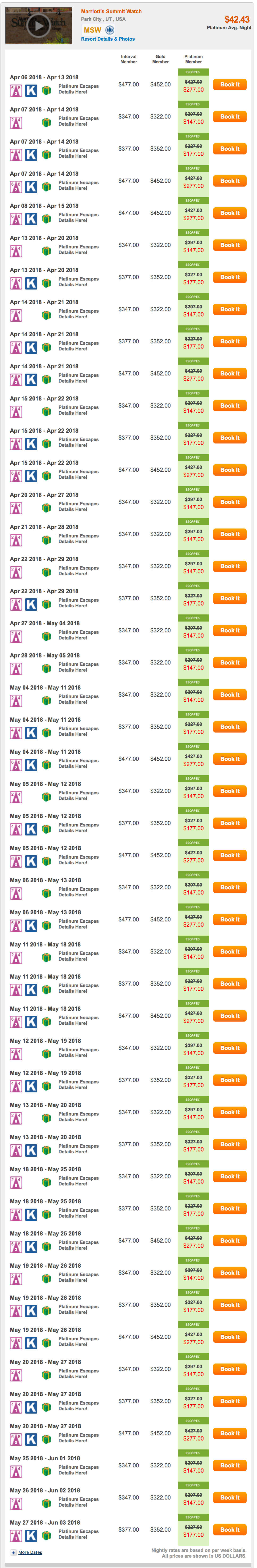

While this season has not been a great snow year, the conditions have been improving and there still is a massive amount of terrain open. It looks like Park City Mountain, including the Canyons, and Deer Valley will be closing on April 8, 2018. However, Alta and Snowbird which are about 30 minutes away tend to have a longer season and generally stay open until mid to late April. I just received an e-mail from Interval International with some fantastic deals that are offering weeks for Platinum members at $147 PER WEEK in a studio unit with it increasing to $177 for a one bedroom unit and increasing to $277 for a 2-bedroom unit. These prices are almost impossible to beat as the cost for the week is less expensive than most one night stays. Take a look below at the offered rooms at these properties! Also, for those of you that are chasing Marriott and/or SPG status, timeshare weeks count toward your annual requirement making this a very cheap "mattress" run while also getting a few days of prime skiing! Marriott MountainsideMarriott Summit Watch

As I recently posted, Interval International recently provided some select users with additional accommodations certificates. In case you are unfamiliar with accommodations certificates, here is a post that I did on these giveaways that give you a "free" week where you only pay an exchange fee of $274.

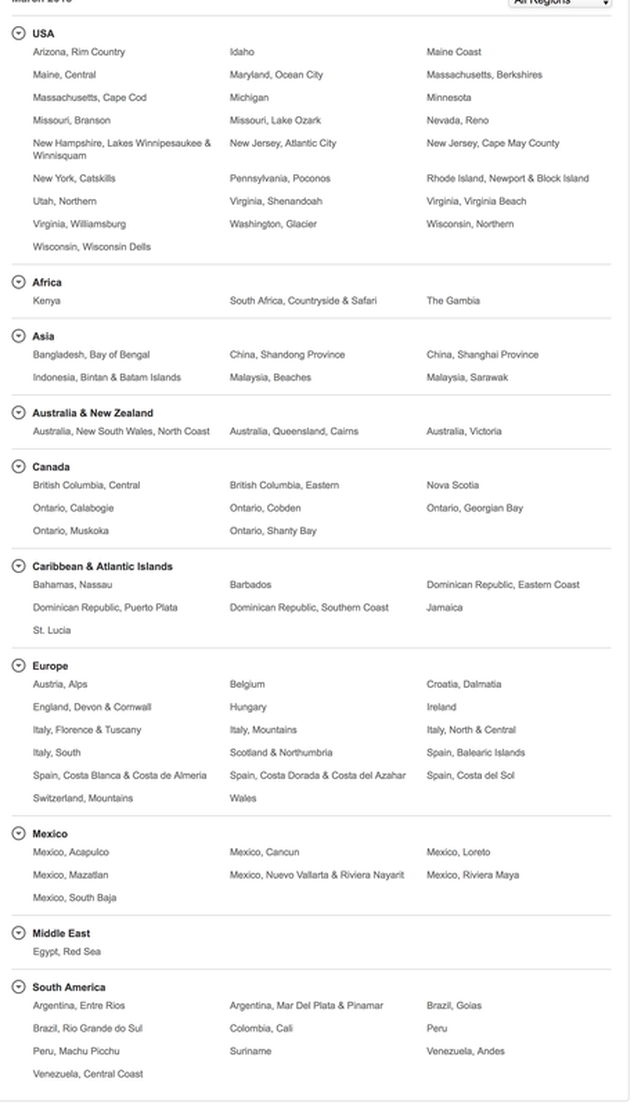

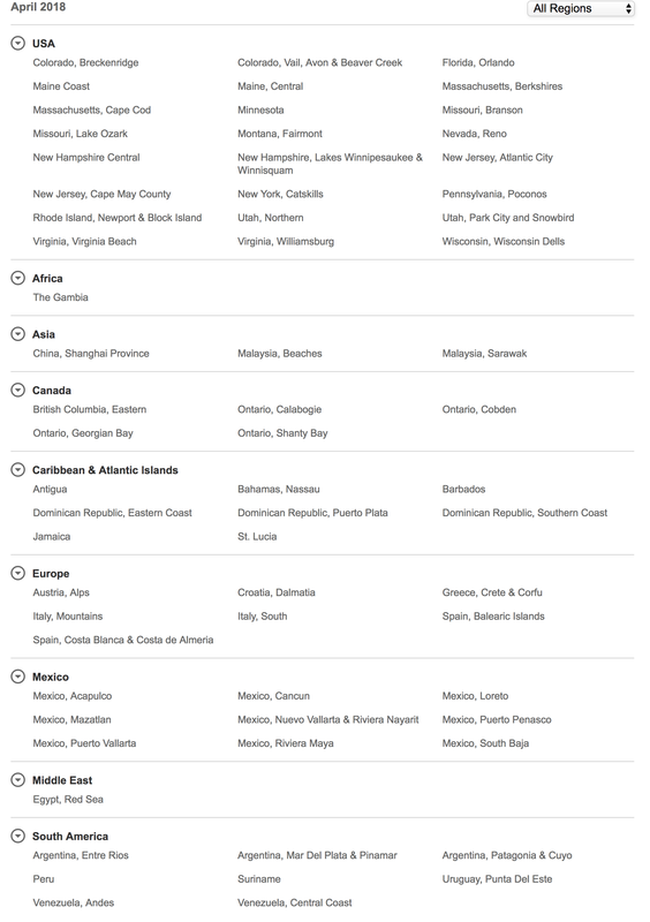

In this past month, I was given 2 extra accommodations certificates to bring the total available to me to 3. Many times, there are less than desirable properties or timeframes but on occasion, there can be some tremendous weeks available but generally only available at last minute options. As a timeshare owner, I have learned that you need to plan well in advance in order to get great weeks. I have been successful with this strategies and get a tremendous amount of value out of my timeshare. However, since I am accustomed to planning so far out, when these accommodations certificates become available, I can rarely use them as I am generally all booked up for my travel for the next 1-2 years. I HATE to see these weeks go to waste as I periodically look at some of the offers and there can be some stellar resorts and locations available. In this post, I pointed out some diamonds in the rough that I found in previous examples. OFFERING READERS THE CHANCE TO GET A WEEK FOR ONLY $274 For this post, I wanted to try something different. Instead of having these go to waste, I wanted to see if any of my readers could use one or more of these accommodations certificate. The issue with these certificates are that inventory changes rapidly. If something good comes up, you have to act quickly in order to get it. Therefore, it could be difficult to do since I have to be available to search and my reader needs to be available to confirm. However, I thought that we can give this a shot and see if one or more of my readers can score a awesome resort for only $274 for the week. I have been searching with these accommodations certificates myself and have seen some actual ski weeks in Breckenridge or Vail and high quality resorts in Cancun, Playa del Carmen and Cabo San Lucas. THE RULES Here is how it will work. 1. Review the chart below of available locations and the available time period. The availability will generally be March or April, 2018 2. Post in the comment section your desired location and your desired week. 3. I will monitor these comments and try to search for the requested destinations and resorts and post availability. 4. If I find something, I will reply to your comment and you should get notified. 5. You will then need to email me at [email protected]. 6. I will request readers cover the exchange fee of $274 but I will provide the guest certificate (I get free guest certificates for being an Interval Platinum Member). This is an experiment and hope that my readers find this useful and hope that at least one, two or three readers can get a great week for only $274. If this is successful, I hope to be able to offer additional weeks or offers in the future! Also, please indicate in the comments whether you like this offer or want to see more of these offers in the future! Current Available March DestinationsCurrent Available April DestinationsAs I mentioned in this recent post, I just purchased a second Hyatt timeshare at the Hyatt Beach House. In that post, I went through some details on what I own and why I made those choices. As I mentioned in that post, the Hyatt timeshare that I purchased ended up being the second one that I tried to purchase since Hyatt exercised its right of first refusal. What is a Right of First Refusal? For those of you who don't know, a right of first refusal gives the timeshare company the right to purchase your timeshare before you can sell it to a third party. There are various reasons on why most timeshare include a right of first refusal but the one most generally used by salesmen are that it keeps resale prices up since anything that will potentially be sold for a significant discount will not pass the right of first refusal and the timeshare company will purchase it back. There is some "truth" to that statement but I think that the general reason that most timeshares have the right of first refusal is so that the timeshare companies can essentially control the resale market. I can dig into this more in other posts but for this post, I wanted to explain what I learned during my process. My Attempted Purchase My strategy is to always make a low ball offer for any timeshare. You may lose some but you can end up purchasing one for a tremendous discount from "retail" pricing. The first Hyatt timeshare that I attempted to purchase was listed on Discount Timeshares. I found a low priced week that equated into 2000 Hyatt Residence Club points and contacted them to make an offer. I ended up making a low ball offer of $50.00 for this particular timeshare and after some back and forth, the seller agreed on this price. The going rate for a similar week on eBay was somewhere around $2,000-$4,000 so I thought I got a great deal. In a separate post, I will put together a complete guide to purchasing a timeshare on the resale market. As part of the process, the seller or its broker, must submit paperwork to Hyatt which details the terms and conditions of the purchase and the price for the week. Hyatt Resale / Transfer Procedures: Once Hyatt receives this paperwork, they have 30 days (15 for the Grand Aspen and Kaanapali) to inform you of their decision. Here are the specific transfer instruction provided by Hyatt: If you decide to sell your interval on your own or through a resale company, please follow these three easy steps:

The Paperwork: For this particular purchase, while the purchase price was $50.00, I was obligated to pay for the transfer fee and the closing costs. The total out of pocket cost for me was about $1,200. When Discount Timeshares submitted paperwork to Hyatt, they indicated that the purchase price was $50.00. This was accurate but as described below could have been structured in a more favorable way to benefit both the buyer and seller. After around 30 days, I was informed that Hyatt DID exercise their right of first refusal and Hyatt succeeded in buying this timeshare out from under me for a purchase price of $50. Hyatt will likely now include this week in their new Portfolio Program. The seller of the timeshare probably did not care either way as he or she was successful in selling the timeshare and getting out of the annual obligation to pay for the maintenance fees. For me though, it was disappointing as $50.00 or $1,200 (when including the fees) for this week was a very good price. Once this occurred, I began my search for an alternative week. As I mentioned in my other post, upon trying to make additional offers for similar timeshares, the representative from Discount Timeshares refused to remit my low offer to a seller despite being obligated to remit ALL offers. Since Discount Timeshares receives a commission for their sales based on the purchase price, I believe that they refused to do so in an effort to increase their own commissions despite it not being in the best interest of the seller who can make their own decision on whether the offered price was satisfactory or whether they should hold out for better offers. As a result of this experience with Discount Timeshares, I would NOT recommend them for future purchases. What I Learned in this Process: For Hyatt resales, my understanding is that they have some formula or metrics in which they determine what weeks / resorts to repurchase. They will not disclose these items. For me, when I attempted to purchase an alternative Hyatt week (which I succeeded), my strategy was to attempt to increase the submitted purchase price as high as possible while still having a low purchase price. For my second attempt, my offer of $2,000 was significantly higher than the original $50.00 attempted purchase but unlike my first offer, I had the seller be responsible for the transfer fee ($650) and the closing costs ($500). Additionally, as part of the offer, I indicated that I would pay for maintenance fees that had not been paid for the current year ($1250) and would be responsible for one additional year of maintenance fees ($1250). Therefore, when they submitted the purchase price for this week, they indicated that the purchase price was approximately $4500 instead of the $2000 that I paid since I indicated that I would pay the current year and future year maintenance fees. The reason to structure this in this manner was if Hyatt exercised their right of first refusal for this week, they would have to pay the seller $4500 as this was technically my offer even though it was somewhat disguised through transfer fees, closing costs, reimbursement of maintenance fees (past and future). Therefore, to compare my first attempted purchase to the second attempted purchase, my original offer price was $50 versus about $850 - definitely higher but not transparent as offering a set amount and having the buyer be responsible for various fees. Conclusion: From this experience, if you need to submit a purchase price where a timeshare company has a right of first refusal, I would try to have the purchase price be as high as possible by having the seller be responsible for all the various ancillary fees (transfer fees, closing costs, recording fees, existing maintenance fees, etc.). By presenting the purchase price as high of possible by including the fees and by indicating the obligation to pay maintenance fees in advance, you can present a legitimate purchase price to the timeshare company at a price point where there is less risk to them exercising the right of first refusal. In most resale transactions, the timeshare company probably does not have to pay itself any transfer fee and probably has little to no expenses for closing costs. If the buyer is responsible for these fees, they cannot include it in the purchase price. The obligation to reimburse the seller or the obligation to submit the maintenance fees for the current or future years will be the buyers responsibility in almost all cases but you can include them in the purchase price submission so that the timeshare company would be obligated to remit them to the seller if they exercised their right of first refusal. By structuring a purchase price in this fashion, there is less risk of the timeshare company from exercising their right of first refusal and this structure can even benefit the seller as if the timeshare company actually exercises their right of first refusal, they would receive more funds than if the right of first refusal was not exercised. Overall, I think that this can be a win-win strategy for a buyer and seller and decreases the odds of the timeshare company from exercising their right of first refusal. What do you think of this strategy? Have you lost any timeshare purchases to a right of first refusal? Leave your comments below!

Message from The Timeshare Guru: Here is another post from The Fit Well Traveler. This provides some good information on the various considerations that you should take into account if you are purchasing a vacation home. A big thank you to the Fit Well Traveler for this information! Please support The Fit Well Traveler and take a look at his site!

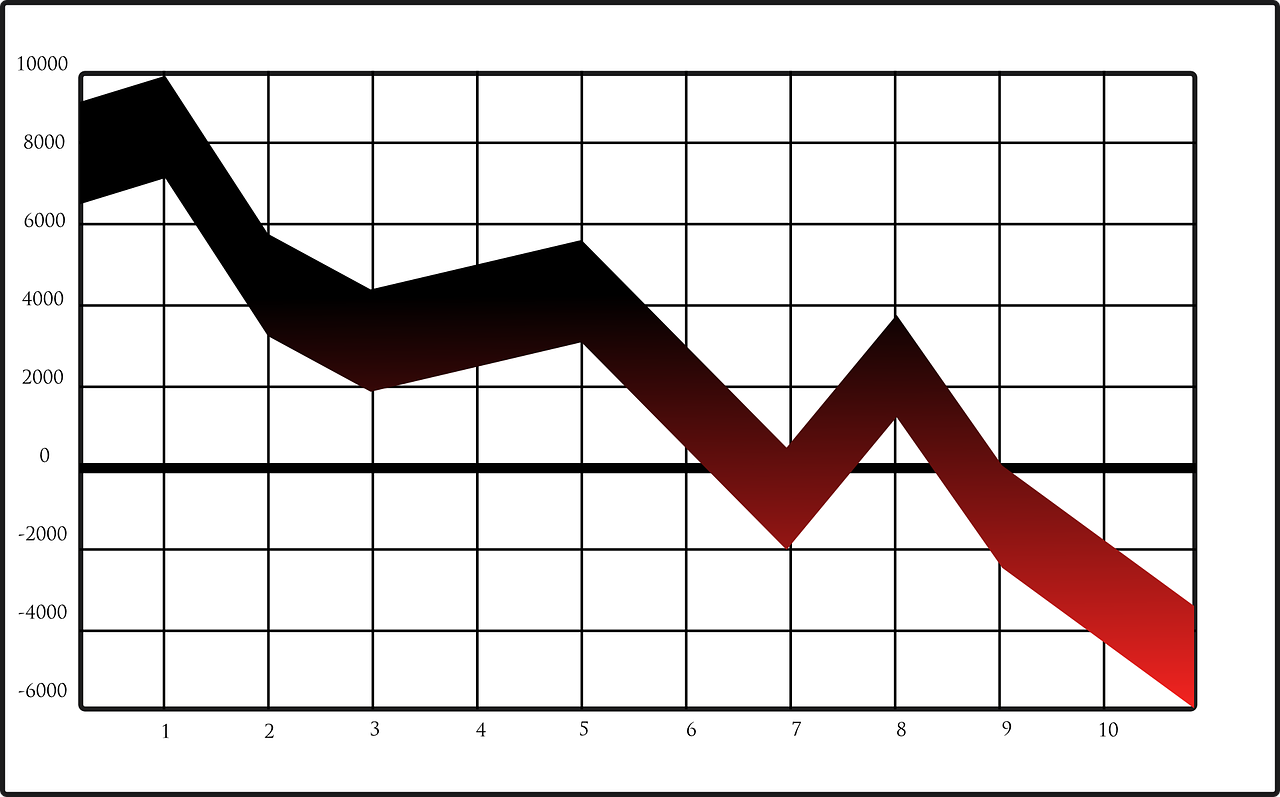

Looking for the perfect vacation home? You’re not alone. Vacation home sales are on the rise, according to the National Association of Realtors. In 2013, buyers purchased more than 700,000 vacation homes. From family vacation spots to investment properties, it’s important to ensure that you spend your money wisely. There are several questions you can ask yourself to keep yourself on track for finding--and purchasing--the ideal dream home. Question #1: Can I afford this? The cost of a vacation home is about more than a price tag; it’s about the value of your time and experiences. If you purchase a vacation home, will your vacation budget mean you have to spend the next several vacations only at this location? If so, is that something you want, or would you prefer to travel to more diverse places? Next, estimate the amount of time you’ll spend in your second home, and compare that to some of your past vacation expenses. When you tally up the cost of rentals, food, travel and activities, does purchasing a vacation home make economical sense? Many financial planners agree that ideal housing costs, for one or two homes, should stay below about one-third of your annual income. Question #2: Will I enjoy spending time here? Take the time to really understand what it will be like to spend time in the area around your potential home. Learn what the city has to offer, and think carefully about whether or not it’s a place where you’d enjoy spending most of your vacation time. Are you looking for quiet, country town to relax on the weekends or a busy, bustling beach to spend the summers? Exploring multiple environments can help you determine the kind of consistent vacation experience you want to commit to. Consider driving out to areas around the house, too. Are there mountains nearby? Are there bigger cities that might offer more activities? Spending time in your vacation home isn’t just about your immediate surroundings; it can also be about your opportunities for more travel and broader experiences. Question #3: Can this be an income property? It’s a vacation home; by its very definition, you won’t be living there all year long, so do you plan to use it as a rental property while you’re away? A good vacation home can be a place for you to unwind when you need, and bring in cash when you don’t. If planned right, the profits of renting can offset the costs of buying. If you think of this vacation home as long-term investment, renting can help you create equity and potentially pay the property off. Look online and ask local realtors how much other rentals in the area go for so you can incorporate those numbers into your budget. Question #4: How long will it take to get there? Vacation homes can be a life saver--a getaway from stress, a place to indulge in your favorite hobbies and an atmosphere that reinvigorates your drive for work and life. However, if it takes a long time or is a hassle to get there, you might find yourself utilizing your private oasis less and less. What’s the point of purchasing a place to escape to if the act of escaping is just too complicated? Think about the amount of travel time and expenses you’re willing to go through each time you head to your vacation home. Does this home fall within a 3 or 4 hour drive, or will you need to hop on a plane? The convenience of travel will likely play a big role in your choice of vacation homes. Owning a vacation home isn’t just a potential investment, it’s also a lifestyle. Finding a balance between purchasing a vacation home you love and a way to make an investment can be a huge boost in your quality of life--if theproperty is easy to manage. Do your research before you buy to really get the most out of the joy and excitement of owning a second home. As I have stated multiple times, one of my favorite strategies for maximizing timeshare ownership is trading through Interval International. While RCI does have some great resorts, I find that Interval International has more top tier resorts since they are affiliated with most of the major brands of timeshares (Hyatt, Marriott, Four Seasons, Westin, etc.). I have touched on this before but an easy and effective way to find great resorts is to search using the resort codes. In Interval International, each resort has a three digit code. You can search by "Destination", by "Resort Name" or "Search All Destinations". Many times, I will just search All Destinations and click through the various destinations that interest me and see if there are any top tier resorts available for my desired time period. This is a strategy but can take some time to sift through all the resorts. In this post, I wanted to give you the various codes for the top tier resorts by affiliation. You can copy the following list of codes and paste them in the search box and check off the "Resort Name or Code". By doing this, you will only see some of the best resorts in Interval International. Marriott Resorts: SRK, MHI, MGA, MG1, MG3, MG5, MHO, MWF, MCU, MFL, MQB, MNY, MSQ, MPP, MGQ, MAO, MSU, MBF, MBY, MBP, MWO, MBF, MCV, MEM, MMI, MCP, MDS, MPD, MFV, MFC, MGC, MC1, MGO, MGV, MGR, MHH, MHZ, MZ2, HPS, MHG, MIP, MKW, MKI, MKO, MK1, MGK, MLE, MKB, MMC, MSE, MMB, MMO, MM1, MMS, MVL, MV2, MOU, NCV, MPB, MOW, MVO, MPU, MP1, MUZ, MRP, MSP, MRD, MR2, MSK, MDO, MVB, MEV, MSW, MSN, MSF, MML, MVF, MVD, MWO, MAW, MA1, MHB, MH2, RMX, SYA, MS1 Hyatt Resorts: HBK, HCC, HMS, HYI, HYP, HYA, HYB, HSH, HWP, HSL, HNS, HKB, HYS, HYK, HYN, HRP, TYL, GBJ Vistana / Starwood Resorts: WDL, KAA, KAN, WKV, WLR, WLX, WMH, WNA, WPV, WRF, WSJ, STW, SDI, VTA, VT1, SRM, VIT, VIO, SVV, VIS, HRA, LFP, BPW Four Seasons Resorts: FSA, FS1, SCT, SC4 Combined List of Marriott, Hyatt, Vistana / Starwood and Four Seasons: SRK, MHI, MGA, MG1, MG3, MG5, MHO, MWF, MCU, MFL, MQB, MNY, MSQ, MPP, MGQ, MAO, MSU, MBF, MBY, MBP, MWO, MBF, MCV, MEM, MMI, MCP, MDS, MPD, MFV, MFC, MGC, MC1, MGO, MGV, MGR, MHH, MHZ, MZ2, HPS, MHG, MIP, MKW, MKI, MKO, MK1, MGK, MLE, MKB, MMC, MSE, MMB, MMO, MM1, MMS, MVL, MV2, MOU, NCV, MPB, MOW, MVO, MPU, MP1, MUZ, MRP, MSP, MRD, MR2, MSK, MDO, MVB, MEV, MSW, MSN, MSF, MML, MVF, MVD, MWO, MAW, MA1, MHB, MH2, RMX, SYA, MS1, HBK, HCC, HMS, HYI, HYP, HYA, HYB, HSH, HWP, HSL, HNS, HKB, HYS, HYK, HYN, HRP, TYL, GBJ, WDL, KAA, KAN, WKV, WLR, WLX, WMH, WNA, WPV, WRF, WSJ, STW, SDI, VTA, VT1, SRM, VIT, VIO, SVV, VIS, HRA, LFP, BPW, FSA, FS1, SCT, SC4 Conclusion: This is a fantastic way to get a list of the "best" resorts in Interval International. There are definitely other "great" resorts that are independent or affiliated with some of the smaller timeshare brands but this is a great list to start. I'll compile some other lists with these other resorts shortly. Do you have any other resorts that should be listed? Please post below! The Frequent Miler is one of the few blogs that I read daily. The information that The Frequent Miler puts out is very good and I have received some excellent deals thanks to his contributions. Here is a recent post about a Wyndham Timeshare Presentation. It is a good and entertaining read and I definitely recommend The Frequent Miler blog! It seemed like they experienced the standard timeshare pitch. What are your thoughts? I do not spend a ton of time discussing the world of hotel points and frequent flyer points but they are absolutely key to achieving a successful timeshare strategy. As I explained here, it is an absolute must to have hotel points in order to secure accommodations while you have a pending timeshare request. While timeshares definitely have a bad reputation, hotel points and frequent flyer miles are continually changing and becoming less and less valuable. Many of these hotel companies forget that loyalty goes both ways and continually make non-consumer friendly choices in revising their award charts. Over the years, I have witnessed almost every single hotel brand make non-consumer friendly changes. Today, Marriott announced their changes to their award charts. It is a horrendous change where 1,082 properties are moving up a category and 247 properties are moving down. Here is the list of the various changes that are being implemented.

As you can see, there are some significant changes that are occurring. I have not been shy about discussing the various issues with timeshares but every time that award charts change or even disappear, timeshares tend to look better and better from a consumer standpoint.

What do you think of these changes? |

Archives

April 2020

Categories

All

Archives

April 2020

|

RSS Feed

RSS Feed