|

I have done a couple of previous posts on purchasing timeshares on eBay and explained whether auctions offering timeshares for $1.00 are legitimate. You can read about them here and here.

The general consensus is that they are legitimate offers for timeshares but there are details that you need to read to make sure that all fees are disclosed and there are no surprises that could occur where there are outstanding loans, past due maintenance fees or other non-disclosed fees associated with the purchase. In writing those posts, I realized that I am consistently giving the message that timeshares are worthless. While I do believe that a vast amount of timeshares are essentially worthless in terms of resale value, there are actually a lot of timeshares that retain and even arguably appreciate in value. Appreciation in timeshares is almost a complete fallacy but there are definitely times where you may purchase a week inexpensively and end up selling it for a profit. These types of weeks do exist but you need to know what to look for or get lucky. My Lucky Week As you may know, I own week 47 at the Hyatt Beach House in Key West, Florida, I have never been to that resort and will likely never go. When I purchased my first week in 2008, I paid $6500 for that week which was allocated 1300 points. Compared to prices today, I paid an exorbitant amount but still don't regret it as I have received a lot of value throughout the years. Recently, Hyatt redid it exchange chart and week 47, instead of being allocated 1300 points, was reallocated 2000 points. This provided me an almost immediate 50% in value for my week although I still am not sure whether I would be able to recoup my initial investment. You can read about that here. However, this reallocation definitely increased the value of this week. Other Examples: As I have shown in other examples, eBay is a good source to see how much timeshares are worth. For this, instead of looking for $1.00 timeshares, I thought I would see how much the most expensive timeshares have sold for in the recent few weeks. Here is the list of some recently sold auctions. I think these prices will surprise some of you. As you can see in the attached, most of the timeshares listed above sold for $8,000+ dollars. While of few of them had only one bidder, many of them had multiple bids which indicates that there were multiple people willing to pay these prices. eBay is not a perfect market but I tend to view eBay as a very good indicator of the true market value of items. As you see, there are many different brands of timeshares listed above that commanded such prices. There are Hiltons, Marriotts, Disney, Westins, and even Welk resorts (a timeshare only brand). Conclusion: Most timeshares are worth a fraction of the developer pricing so buying resales is essential if you want maximize ownership. The economics of timeshare ownership buying from the developer "may" still make sense but the math gets very fuzzy and few people will actually be able to recoup the initial investment. However, timeshares can still have value and as you can see from the above, they can have some real value associated with them. Not all timeshares are equal so do you research on what you want and what the going market price is for such week or system. What did you pay for your timeshare? Can you sell it for what you paid? Timeshare Purchase: Follow up to Post on whether eBay timeshare purchases of $1.00 are legitimate1/24/2019

In a previous post, I gave a broad overview of whether timeshare sales and subsequent purchases of timeshares selling for $1.00 on eBay were legitimate. You can read that post here.

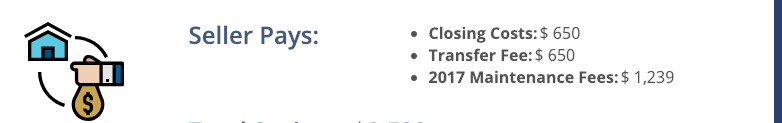

Essentially, my conclusion and position is that these auctions are legitimate, you definitely can purchase a timeshare for $1.00 BUT there may be other factors that need to be assessed where the actual winning bid could be $1,000's of dollars. I stand by that post but a lot of comments were given that I wish you would have given some examples of actual purchases and what to look for when purchasing them. As a result of those comments, in this post, I will go through some examples of eBay sales to show you what you need to look out for when making these purchases. Before we get started, I have done some other posts about determining what you timeshare is worth. One solid method that I actually use is eBay. In case you didn't know, you can actually search "completed listings" and "sold listings". There is a distinct difference between the two. Completed listings have ended but may not have sold and sold listings actually sold. You can see the exact price which they sold for. Here is the post on that topic. For the following examples, I have searched "sold listings" to see the actual selling price. Additionally, before I go through the actual examples, I wanted to again point out an important item that you should consider. My view is that timeshares are great but I would only recommend buying "name brand" timeshares such as Marriott, Hilton, Wyndham, Hyatt, Westin, Sheraton, etc. These timeshare brands have certain standards to adhere to, have regular brand recognition and have thousands of hotel counterparts which essentially markets the timeshares. Therefore, while not all of these name brand timeshares will have any value, the chances of being able to resale them for at least a $1.00 is much higher than a single destination timeshare. Example 1: Hyatt Wild Oak Ranch in San Antonio, Texas As you can see in the attached photo, a seller was selling an odd year, week 10 timeshare at the Hyatt Residence Club in San Antonio. The green price indicates that it sold for the whopping price of $0.01. If the price was grey, it would indicate that it was a completed but unsold auction. Buying a Hyatt for one penny is quite the bargain. Generally, the "gotcha" could occur for the various closing costs, transfer fees, past due maintenance fees or outstanding loans. Some, but not all of auctions, will list out the various fees and who will be responsible. Make sure that the auction clearly states the fees and responsible party. For this auction, the SELLER will pay the closing costs of $650 and the required transfer fee of $650. Additionally, as you can see below, since this auction ended in December of 2018, it is likely that the maintenance fees were not paid for 2017 and the SELLER will actually pay those as well. Once you read the description, you can also see that the ongoing maintenance fees are $1239 every year of use.

For years in which you do not have use which would be every even year, you still need to pay a fee which they do disclose of approximately $150-$180.

CONCLUSION:

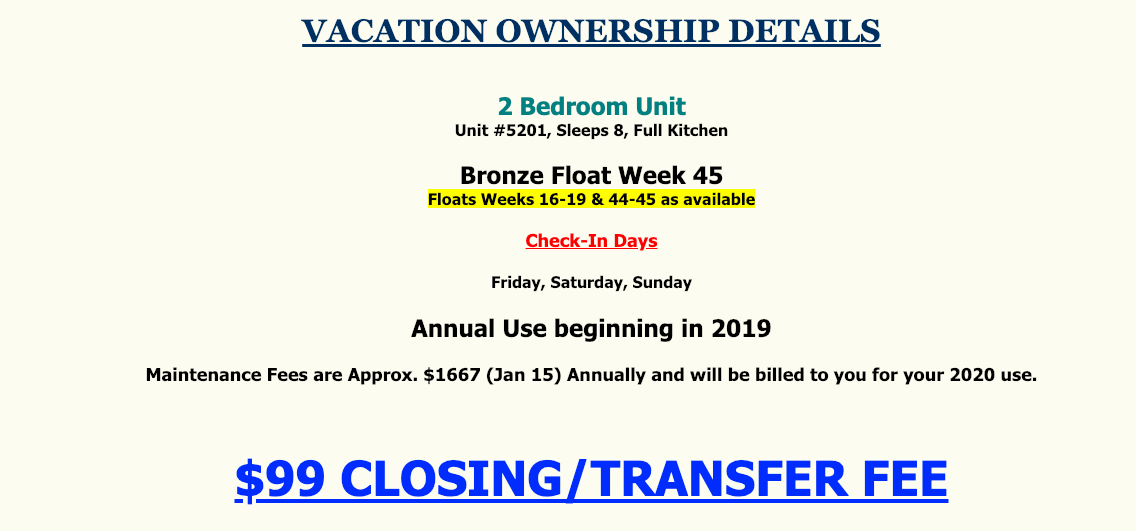

For this particular auction, it does not appear that there are any "gotchas" and the Buyer potentially purchased this particular timeshare for $0.01. The more difficult hurtle for the buyer will to pass Hyatt's Right of First Refusal. Hyatt has the right, but not the obligation to purchase the timeshare before the third party and I would be surprised if they wouldn't do so in this situation as they will likely be able to sell this unit through the developer for $10,000+ dollars. That is why it pays to buy resale! Example 2: Marriott Summit Watch in Park City Utah If you read this blog, you know that I am a big fan of Park City, Utah and a fan of the Marriott Summit Watch. Looking through these eBay sold results, I came across this one. It appears that 2 bedroom week sold at the Marriott Summit Watch sold for $1.00. Here are the details of the week:

Maintenance fees for this "floating" week are $1667 per year which the Seller has indicated has been paid for 2019. The closing costs are $99.

Looking through the other details of this auction, there are no further fees disclosed. Assuming that the facts put forth in the auction are accurate, this week likely sold for $1.00 PLUS $99 in closing costs. A pretty good bargain but the buyer will still need to get past Marriott's Right of First Refusal. The details of this auction are fairly straightforward and it looks like the buyer did purchase the timeshare for $1.00 with the obligation to pay $99 for the closing costs. They are also now obligated to pay the maintenance fees each and every year of $1667 which is definitely on the high side of fees. But, their initial up front cost was very nominal. However, upon looking closer at the Marriott timeshare, I would argue that this purchase is actually an awful deal for $1.00 plus $99.00. The Marriott maintenance fee of $1667 is quite expensive especially if you actually wanted to use the Marriott Summit Watch unit during those floating weeks. Those floating weeks actually occur during mud season which is during November and April, the least desirable timeframe for a mountain destination. I routinely see Interval International Getaways offering those types of weeks for approximately $400 per week even at the Marriott Summit Watch. If you actually wanted to use the "floating" week that you purchased, you would essentially be paying 4x what I can rent that same week for if not more. Additionally, Interval International offers Accommodations Certificates which allows you to get certain weeks for an exchange fee of $239. I routinely see those types of weeks offered at the Marriott Summit Watch and other high quality timeshares during these off-seasons. Overall, I think that purchasing the timeshare for $1.00 plus $99.00 of closing costs is a good deal but ONLY if you trade that Marriott for other weeks. Also, since you are essentially purchasing an extremely low demand week, you may not be able to trade it as freely as other properties to obtain the more desirable week. The reason that I like Hyatt properties is that each week, even legacy weeks, convert into points and you can use those points for exchanges. From interval's perspective, a point is a point regardless of the underlying week. Marriott's legacy program is different in that you trade a week for a week (or 3 studio weeks for a 2 bedroom week or 1 bedroom + a studio week for a 2 bedroom week) and when you do that, they assign a TDI or travel demand index to that week which could prevent you from getting a high demand week in exchange for your low demand week. Conclusion: Overall, buying a timeshare off eBay is great way to save tons off the the initial developer pricing. The original sellers of both of the timeshares listed above likely paid $10,000 - $25,000 for those weeks so buying them for $1.00 is a fantastic deal as a comparison. The real gotcha that you need to be aware of with these types of purchases is to ensure that there are no loans, past due maintenance fees, or other fees associated with these purchases. This is why an Estoppel Certificate from the developer is absolutely necessary. Here is a post I did on that topic. Assuming that the buyers can overcome the right of first refusal from Hyatt, that buyer got a great deal PROVIDED that they use the timeshare and understand how to maximize their use. I would argue that the Marriott timeshare is worthless and not even worth the $100.00. As you can see, there are many nuances to look into when purchasing a timeshare. Despite the low fees being offered on eBay, you need to understand what you are buying and how to use it properly to maximize tis value. Also, at some point of time in the future, you may be the one trying to sell the $1.00 timeshare that you purchased for $1.00. It is not always easy to find a buyer so you need to take that into consideration when you purchase that timeshare and make sure you understand exactly how they work and what you can trade. Have you bought a timeshare off eBay? What was your experience?

In case you did not read my recent post concerning my 3 week trip to Hawaii (read about it here), while I did use a timeshare for one week of the trip, I failed to obtain a timeshare for the other two weeks and used A LOT of points in order to stay at the Andaz Maui.

I have written about the Andaz Maui before as it is a fantastic resort and a very worthwhile redemption for your Hyatt Points especially if you have Globalist / top tier status with Hyatt. As you can see, I spent 315,000 World of Hyatt points for those stays and spent 22,500 United Mileage Plus frequent flyer miles per each family member for one way flights to Maui and 22,500 American Airlines miles per each family member for one way flights from Maui. In total, I spent: 315,000 World of Hyatt Points 90,000 United Mileage Plus frequent flyer miles 90,000 American Advantage Miles The total amount of miles spent for this trip was 495,000. Doing the math, this is simply a ton of miles. While I did receive a $28,000 worth of hotel stays and probably $6,000 worth of airfare for this, it is simply a lot of points. Accumulating Points / Frequent Flyer Miles While we were at the Andaz Maui, I spoke to various people about their trip and inevitably a discussion would ensure about points. A lot of people were staying at the hotel on points and a decent amount were not. One question that kept coming up is how I accumulate my points / miles. The easiest answer is generally credit cards. Credit card bonus have increased dramatically over the past few years as competition has significantly heated up in order to motivate credit card issuers to be at the top of your wallet. Credit cards get paid by the merchants every time you swipe the card and get paid for those who keep balances (NEVER KEEP A BALANCE!!!). The credit card issuers want you to use your card for every purchase. Over the years, I have taken advantage of a lot of credit card sign up bonuses. It is generally the easiest and quickest way to accumulate a lot of miles. However, before you start applying for various cards, you need to have a strategy. Credit Card Application Strategy In this post, I took the position that the lucrative credit card sign up bonuses are on their way out and timeshares could potentially be the next frontier on cheap / luxurious travel. The reason why I take this position was that in the past, you could simply apply for a credit card, get the bonus, cancel the card and reapply. It was a GREAT way to accumulate points. It wasn't too longer for credit card issuers to catch on this strategy and began making adjustments to their offers and limiting how many times you could get the bonus. Before we get into the specific rules on various credit card issues, before you begin applying for cards, you need to know where you stand in terms of a credit score. I use CreditKarma which is a great FREE tool to receive your credit score. Take a look at your credit score so you know where you stand. 760 and above should put you in a good place to get almost any card you desire. The other tool that I recommend is the Experian app. Here is the link for IOS. Experian also provides you with a score but also allows you to view your credit report and most importantly, what accounts you have opened and the when you opened them. This is important for the rules outlined below. Important Rules Chase Bank The reason that you need to know the amount of credit cards you have opened is because of a fairly new rule termed 5/24. This is Chase's rule where you will be automatically denied for any new application if you have opened up 5 new credit card accounts with ANY bank within the past 24 months / 2 years. When you apply for a Chase card, they will review your account and if you have more than 5 accounts opened, you will get denied regardless of your credit score, whether you a Chase Private Client Customer or whether you have millions of dollars in the bank with them. It is a hard rule. American Express The other important rule is from American Express. Instead of a 5/24 rule, they have a lifetime rule. If you have received the bonus offer for a particular credit card in the past, you are prohibited from receiving it again for your "lifetime". While I do not have any data points, a "lifetime" for American Express used to be considered 7 years but I do not know whether that is still accurate. Fortunately, American Express has rolled out a new tool so that when you apply for a credit card, if you are not eligible for the bonus offer, they will inform you BEFORE they run your credit. Citibank Citibank has also implemented their own rules for their Thank You card. Basically, if you have received any sign up offer for their Premier Card, Thank You Reward Card or Prestige card within 24 months of opening OR closing an account, you are not eligible for the bonus. With Citibank, not only do you need to be aware of the opening date, but if you received a bonus offer 3 years ago, closed the account and attempted to reapply, you would be denied the bonus since you closed the account within 2 years. The best strategy is to open an account, have it for 2 years, apply for a different variant of the card and close the previous card after you receive the new card. If you mess this up and close the card before you reapply, you will get denied the bonus. Other Banks There are other credit card issuers that all have similar rules. Barclays and Bank of America are others who have some type of similar restrictions. However, the vast amount of great credit card offers are generally offered by Chase, AMEX and Citibank. In order to try to keep this post readable, I am not listing the rules for Barclays and Bank of America. Application Strategy Once you are aware of your score, how many accounts you have opened in the past 2 years and understand the restrictions in place, you should have a strategy in place to go forward and apply. Since Chase has the most restrictive policy, I would generally start applying for Chase cards. This way you can avoid the automatic denial for having more than 5 cards. However, depending on how many you cards apply for, you will almost certainly be denied further cards for 5 years so you need to make the determination on how many to apply for as new offers constantly appear and you may be denied a stellar bonus if you have 5 or may applications. Married? An interested strategy that often seems overlooked at times is that if you are married, there are 2 people eligible for the bonus offer. It is not one per household but rather one per person. The best strategy for good offers is to apply for each spouse. You can accumulate double the amount of points. The other potential / questionable strategy that you can use is one spouse applies for the card and once approved, you can refer your spouse to apply for the same cards with additional bonus points. A simple but effective strategy to get even more points. Personal and Business Cards The credit card issuers make a lot of money off personal cards but they also want your business spend. There are personal and business versions of various cards. if you have a legitimate business with its own employer identification number, most business cards will not report to your personal credit report but if it is Chase, they will still review your report to determine if you have surpassed the 5/24. However, for future cards, the business card application will not count towards the 5/24 since it does not show up on your personal credit report. If you do not have an EIN, you can still apply for a business card as a sole proprietor and use your social security number. You need to have a bonafide business but selling on eBay or doing some side gigs definitely qualifies. Business cards are a great way to add to your points / miles stash. My Strategy I have been doing the credit card application game for a while now which is why I have some many points accumulated. As a result, I am limited to the amount of American Express cards available to me and generally always have about 5 cards opened in the past 2 years which limits my ability to get new offers. However, if I was to begin with a clean slate, here is what I would do. I would start by applying for Chase cards, both personal and business, and apply for up to 5 cards. I would then move on to American Express and Citibank. Some links provided are my referral links. I would greatly appreciate you using those links to help support the blog! Chase Personal Cards: The Chase Sapphire Preferred is a great card that generally offers 50,000 Ultimate Reward Points. This is a solid card to start. The new Chase World of Hyatt card is a great card. While it was just offering 60,000 World of Hyatt points, it is now been reduced to 50,000. You may way to wait on this one. World of Hyatt points are great and this card gives you one free night in a category 1-4 hotel each year. This easily pays for the annual fee. The Chase Southwest cards just came out with a great offer where you can get a companion pass after a $4,000 spend. There is a lot of buzz about this offer. A better strategy is to open a Chase Southwest Business Card where the introductory offer is 60,000 Rapid Reward Points and another personal card (in flight offers are currently 50,000 Rapid Reward Points) which would get you the 110,000 Rapid Rewards Points to obtain the companion pass for this year (2019) and NEXT YEAR (2020). However, I think that the companion pass offer is decent and had I not applied for the Priority card before the offer was extended, I would have taken advantage of it. The Chase Sapphire Reserve is a good card but Chase restricts the bonus to either the Sapphire Reserve or the Sapphire Preferred. Either one is a good card but the Sapphire Reserve use to be offered with 100,000 Ultimate Reward Points and now just offers 50,000. Chase Business Cards: The Chase Business Southwest cards offers 60,000 Rapid Reward Points and is a great addition to a personal card if you want a 2 year companion pass. TheChase Ink Preferred is a stellar card and offers 80,000 Ultimate Reward Points. This is a must get card for 80,000 Ultimate Reward Points. Chase Ink Business Cash card is actually a great card. Even though it states that it is a cash back card, if you have another card that earns Ultimate Rewards points, you actually get Ultimate Reward Points instead of cash and while it can be redeemed for cash, you are much better using it for travel and particularly transferring those points to Chase partners. American Express American Express use to be my favorite card issuer but after a few denials for bonuses that was assured of receiving from multiple representatives and supervisors, I don't generally use them for much spend. However, they do have some great bonus offers. The American Express Platinum Card is expensive but comes with various perks. Offers range from 25,000 - 100,000. 75,000 American Express Rewards Points or higher would be worth it for at least the first year. The American Express Gold Card just went through some changes and can be a decent deal if you use the perks that come with it. A big plus is the 4x points on dining. The American Express Everyday Card is not a great card but does not have an annual fee. It is one of the only cards that earns American Express Reward points without having a fee. The reason you want to have this card in your wallet is if you cancel some of the other American Express cards that have high annual fees, you will forfeit you points earned unless you transfer them out to another program or have another Amex reward point earning card. By having this no annual fee card, you can keep you Amex reward points even after you cancel other cards. It is great to have and could be useful for some spending. American Express Business The American Express Business Platinum card is another good card and while the fee is expensive, it could be worthwhile. Bonus offers vary for this card but it now currently 75,000. The American Express Delta Skymiles Business Card has been offering some great signup offers between 50,000 and 75,000. Also, this card does come with one free companion airfare certificate which can easily make up for the $195 annual fee if used. Citibank Personal The Citi Premier Card is a good card that I keep in my wallet. 3x points on travel and gas makes it worthwhile. 50,000 sign up bonus is decent as the highest I have seen is 60,000. The Citi Prestige Card is also a good card but it just got revamped. The fee went up and the perks went down. I do not recommend this card at the moment but if a worthwhile sign up offer comes along, it could be beneficial. There are no available applications at the moment. Citibank Business The Citibank Aadvantage Business card currently offers 75,000 Aadvantage miles. I think that this one is worthwhile. Credit Score: A lot of people will read this and be extremely worried that your credit score will be obliterated after applying for the amount of these cards. In actuality, you credit score will likely immediately decline but after a few months will actually go up. Your credit score depends on a number of factors but the two most important are paying on time and utilization. Utilization refers to the amount of credit available and how much you use. If you have a $1000 credit limit and use $900 during a month, you are utilizating 90% of your credit which will cause your score to materially decline. If you have a $10,000 credit limit and use $900 during a month, you are using 9% of your credit which should positively impact you. Essentially, having a lot of credit available to you through multiple credit cards but only using a small percentage will actually help your score. Between my wife and I, we have about 30 credit cards and both of us have an over 800+ credit score. Conclusion: This post became a lot longer than anticipated as there is a lot of information to cover on this topic. While I attempted to be concise, there is a lot of knowledge to pass on in order to apply for credit cards with a good strategy. As you can see, the bonus offers of 50,000 to 100,000 per cards can be extremely worthwhile especially if both spouses apply for personal and business cards. It is not uncommon that you can easily accumulate 1,000,000 bonus points by simply applying for a combination of personal and business cards. In some follow up posts, I will go into some more details on how I spend on my various credit cards and some additional beneficial ways to accumulate miles cheaply and easily. The goal of the blog is to explain timeshares but if you want to truly maximize timeshare ownership, you should also have good strategies to obtain credit card points, hotel points and frequent flyer miles. Besides getting free flights to various destinations, many timeshare strategies involve using hotel points. Make sure to comment below!

I have done a similar post on this type of timeshare strategy before but with new readers and a new example of why this could be a very smart and economically prudent strategy, I thought I would go into some additional details.

As I mentioned in my past article, I spent three weeks in Hawaii over Christmas break. It was a great holiday vacation. Almost immediately after I returned, I had an additional ski trip planned for Beaver Creek, Colorado. Of course I used American AAdvantage miles for this trip as well as I flew in Eagle / Vail airport which makes it a very easy drive to Beaver Creek. I won't go into the savings for flights but flights into Eagle / Vail can be very expensive so it is generally a very good use of frequent flyer miles to fly into EGE. While I normally exchange my Hyatt Residence Club points for other timeshare properties, for this particular ski trip, I actually used Hyatt’s internal trading options to secure a four night stay at the Hyatt Mountain Lodge in Beaver Creek. 4 night stays are the sweet spot in Hyatt Residence Club points redemption as it is a lot less points to stay 4 nights instead of a 3 over a weekend. While a 4 night stay does not include a Saturday night, these 4 nights stays can be a very good use of Hyatt Residence Club points. Take a look at this post on more details on the 4 night stay sweet spots. In a separate post, I’ll do a review of this property but for this post, I’ll outline the economics of this stay and you can see why owning a timeshare can actually be economically advantageous. I ended up needing two rooms for this vacation so I booked one room for myself using Hyatt Residence Club points and another room for my family members using cash. While I would have booked an extra room using points, an additional room was not available using points. I used 280 Hyatt Residence Club points for a four night stay in a studio unit. The Studio unit was actually quite large and will post some photos of this unit and a review in a later post. As discussed elsewhere, my points cost me $0.65 per point so this 4 night stay cost me $182 (in points) plus an exchange fee of $39 for a total cost of $221 or $55 per night. This stay is in the beginning of January – peak ski season. For my family members who did not have access to timeshare points, they booked a cash reservation for $337 PER NIGHT plus taxes, resort fees and fees for a total cost of over $1600. Basically, my family members paid over 6 times the amount that I spent using Hyatt Residence Club points. Also, for those of you wondering, even though the cash reservation was in my name and I am a Globalist, I did have to pay a resort fee for the cash room since Hyatt Residence Club properties do not offer almost any perks for World of Hyatt members. Additionally, to further show you the value of a timeshare relating to this particular vacation, the total cost of their 4-night stay was $300 in excess of my annual maintenance fee of $1300. Essentially, if they had a Hyatt timeshare, instead of paying cash for 4 nights, they could have paid $1300 for maintenance fees and stayed 28 nights (if they are available) in a studio unit during ski season. Quite a remarkable difference. Here is the math in case you are interested: 2000 points per week for $1300 maintenance fee / 280 points needed for a 4-night midweek stay = 7 vacations of 4 nights each or 28 total nights. If you just elected to use your 2000 points for 7 vacations of 4 nights a piece, you would be paying about $46 per night for luxurious accommodations during peak ski season where room rates are easily $300+ per night if not significantly more. Conclusion: Timeshares may not work for every type of travel or travel style but if you enjoy skiing, many top tier, name brand hotel and timeshare brands have very luxurious ski-in/ski-out properties at popular mountain resorts. Hyatt has a few properties that can offer tremendous value and as you can see from this example, it may only take one trip to more than make up for the maintenance fees for the year and still end up saving you money. This example does not include my initial cost to buy the timeshare but if done right, they can be had for a reasonable up-front cost which will ultimately decrease each year in which you use it. As discussed here, my up front cost has been fairly reasonable and still believe that even if you factor in the initial cost, the savings are material. Did you book a timeshare for ski season this year? Where are you going? Make sure to comment below.

Last Christmas, in this post, I explained my “timeshare fail” where I stayed at the Andaz Maui resort using points instead of obtaining a timeshare for Christmas week.

Despite not getting a timeshare last year, we had planned on going back to Maui again for Christmas. The Andaz Maui was a great resort and while I hoped to get timeshare instead, I used my same strategy that I used last year and booked using points while waiting for a timeshare to match. Despite my efforts, I again failed to obtain the desired timeshare for Christmas week but was able to get a timeshare for the week before Christmas. Christmas week is notoriously difficult so if you want to or must travel during Christmas, you always need a “Plan B” as getting a good timeshare will be difficult. DON’T BUY A TIMESHARE EXPECTING TO TRAVEL OVER CHRISTMAS. DISAPPOINTMENT IS LIKELY. While I failed to obtain a desired timeshare for Christmas week, I was able to successfully plan a three-week vacation in Hawaii over Christmas break staying at extremely nice properties. While vacations like this typically cost at least $25,000, I was able to secure this trip for my family of four for approximately $1200 plus a decent amount of miles and points. Here’s how I did it. Before I get into the details on this trip planning, for any new readers, I wanted to direct you to review this post on my month-long trip to Costa Rica. In that post, I explained how I use multiple strategies, travel tools, multiple different points, credit card perks, and other “travel hacks” to create an incredibly affordable month-long vacation. This post is not that different but wanted to show my readers yet another successful trip that was planned using these strategies and resulting in a truly 5-star vacation for less most people spend on a long weekend. Flights: While flights to Hawaii have been relatively inexpensive over the past year with some great deals (check out some of these), flights over the Christmas time period are always extremely expensive. Fortunately, by planning far in advance, I was able to secure flights using frequent flyer miles on both the outgoing and return. The key was diversification. Diversification in points is extremely important. I’ll do a deeper dive into this concept in later posts but by having points spread throughout multiple programs and having transferrable points (Citi Thank You Points, Chase Ultimate Reward Points and American Express Membership Rewards Points), you have more options available to you. For these flights, I could not locate 4 round trip tickets for the date and times desired at the lowest cost pricing. However, I did find 4 one-way tickets to Maui on United and did find 4 one-way tickets from Maui back home on American Airlines. I ended up booking one-way tickets using miles in order to further reduce out of pocket expenses. These tickets cost 22,500 each way for each passenger. For the flights between Kauai and Maui, I booked them using United miles which was approximately 7,000 miles per ticket instead of paying about $140 per ticket. Not the best use of miles but decent. Week 1: Kauai As I explained in this post, I originally secured a timeshare property for the week before Christmas at the Marriott Ocean Club in Kaanapali Beach. The reviews of that property looked great and generally have a very high regard for Marriott Vacation Club properties. Despite being a Hyatt owner, I stay predominantly with Marriott properties since my Hyatt points trade favorable for Marriott’s. You can review some of these strategies here. While I was looking forward to that stay, about a month before the trip, a 2-bedroom unit became available at the Marriott Waiohai Beach Club property in Kauai. The last time I was in Kauai was about ten years ago and I actually toured the property at that time. I remember it being a very high-class property located directly on Poipu beach which is a top beach on the island. Due to the fond memories and additional space for a 2 bedroom unit, I switched timeshares. Fortunately, I used e-plus for my Interval International Exchange (read about it here) and was able to exchange my week into the Marriott Waiohai Beach Club. Despite the extra fee, I always add E-Plus as it has saved me multiple times by allowing me to switch resorts, times or vacation spots. I originally had a 1-bedroom unit in Maui but was very happy to have secured a 2 bedroom unit. Having the additional space for a family of four is essential since we all have beds and ample space to spread out. I will be doing a review of that property shortly with pictures so stay tuned. Overall, the property was fantastic but had higher expectations for the finish out of the units. While decently appointed and while having a nice ocean view, it appears that the units are getting close to their end of life and need of a significant refresh. In order to secure a 2-bedroom unit, I needed to use 1300 Hyatt Residence Club Points. Based on my current maintenance fees of approximately $1300 per week for which I receive 2,000 points, the cost per this reservation was $835 ($1300 / 2000 = $0.65 per point - $0.65 * 1300 = $835). In addition to the exchange fee of $219 and the E-Plus fee of $59, the total cost for this week was approximately $1123. This is not exactly cheap but considering that going rates for this week at this property in a 2-bedroom unit was approximately $900 per night, the price per week looks like a tremendous bargain. Take a look at this post for further information on the economics of timeshare ownership. Week 2 – 3: Maui: After having failed to obtain a timeshare during Christmas last year, I thought that I would have success this year. As explained in my original post, I put in my request a full year in advance and waited patiently for a match. I also consistently looked for available inventory as some units can come available via bulk deposits or simply by luck. As discussed here, as I did in the years past and as I try to do for each and every timeshare trip, I booked a hotel using points which would be cancelled in the event that my timeshare came through. While I definitely wanted a timeshare for Christmas week, the Andaz Maui is a truly spectacular property and would not mind using points for this stay. While I had some opportunities to secure a timeshare for Christmas week, they were not the top resorts that I generally target (Westin, Hyatt, Marriott, etc.) and elected to use my points for the Andaz Maui. The Andaz Maui does play a lot of games with their inventory for point redemptions so if you want Christmas week, you need to book as soon as it is available – generally in November the year before. I booked this year’s trip last year while I was at the property last year. In case you’re interested, last year, I wrote this post about how my stay at the Andaz Maui broke my loyalty to Hyatt. This was somewhat true and despite not making a tremendous effort to hit Globalist tier, a few beneficial promotions and the World of Hyatt card made it possible to hit Globalist again. We’ll see if I achieve it for 2020. I’ll give you additional details on how to achieve Globalist in a few creative ways in a later post. Having Globalist for this stay is extremely worthwhile and arguably some of the best use of Hyatt points. In this post, I explained the various perks received. I was easily receiving about $270 per day in real perks at the Andaz Maui (breakfast, parking, waived resort fees). For this stay, I was finally able to use a suite upgrade and stayed in a suite for 7 nights. The going rate for a standard room was over $1600 per night and the going rate for the suite was in excess of $2500. Outrageous! While we were originally planning on staying 9 nights, a fortuitous weather event occured through our stop over city and a travel waiver was issued for our day of travel. While we could have easily gone to the airport and take our chances, I elected to call American and see if they could re-accomodate us for other flights. While there were some real chances that our travel plans could have been significantly interrupted, if timing works and things align with hotel/timeshares, I tend to always reschedule our flights when these weather events occur. Getting stuck in an airport with young kids or having to stay at a less than ideal airport hotel is a poor way to end the trip and would rather “wait it out” on the beach for a few extra days. As I mentioned, the cost for a standard room at the Andaz Maui was going for $1600 which is simply too expensive for me. Rooms were not available using points which was a disappointment but there were points at the Hyatt Regency at Kaanapali Beach. I had been wanting to check out the other Hyatt hotel on the island and was curious to see the Hyatt Residence Club next door and the Marriott Ocean Club (where we were originally scheduled to be) so this made a good option. The Hyatt Regency on Maui was 20,000 points per night as opposed to the Andaz Maui which costs 25,000. The general perk of most Hyatt Regency’s is that they have a club lounge which offer food and snacks throughout the day. I have been to a few stellar lounges and you could easily eat there all day long for free. I had high hopes for this Hyatt Regency but ended up being extremely disappointed. A full review on this property will also be forthcoming. While we were upgraded to an ocean front room with a spectacular view, the rooms are in dire need of refurbishment. I was not impressed and neither was my family. We checked out the club lounge the next morning for breakfast and it was in stark contrast to the unbelievable spread at the Andaz. They provided a fairly limited continental breakfast with no eggs and some frozen waffles. After breakfast, I immediately began checking on using points to get back to the Andaz. If you have a choice between properties, don’t even think twice and stay at the Andaz. One of the “perks” of achieving Globalist is to receive a dedicated concierge to assist with travel plans. I reached out to her for assistance in getting us back to the Andaz for the last 2 nights. After a few e-mails, she simply said that there was no availability and could not help. This was troubling as the Andaz had plenty of rooms available and plenty of standard rooms with a slightly elevated view. As I mentioned, they play games with their inventory so that only a select few rooms are available for award nights despite having plenty of standard rooms available for cash bookings. The only difference is the view which is arguably different than the room types allocated for award nights. After several more e-mails, she reached out the hotel directly and they were able to open up a room using points. The concierge handled the adjustments and contacting both hotels. Overall, the concierge perk has not been that worthwhile for me as there are only a select few times that I need assistance in getting something accomplished. I was frustrated that this request was not simply handled but rather required multiple e-mails and arguments to get it done. At the end, it happened as desired but it was not as smooth as process as I would have expected considering that these agents are supposed to be at Globalist’s beckon call to assist with their travel plans. We checked back into the Andaz Maui for an additional 2 nights, all using points. In the end, we stayed 11 nights at the Andaz Maui and 2 nights at the Hyatt Regency. The total amount of points used was 315,000 Hyatt points – a very large number and while we had an absolute spectacular time, I can say with certainty that I still would have preferred a timeshare. I am not saying this simply because I am “The Timeshare Guru”, but rather because I value space and value the convenience of being able to cook some meals in the hotel. The Andaz Maui is absolutely fantastic but drinks are expensive ($19 cocktails and $10 beers) and the food is extremely expensive. Saving a few bucks on having a few meals would have been nice and not having to share a bed with small kids is a nice convenience and becoming more and more necessary. In another post, I’ll explain how to obtain points quickly through credit card sign-ups and spend. If you do it strategically and intelligently, you can rack up a lot of points quickly and book a similar “expensive” vacation for cheap. Despite my desire for a timeshare, spending 315,000 Hyatt points for the Andaz Maui was a fabulous use of points. If I was paying cash for this stay, here are the total potential out of pocket spend: 7 nights in a Suite: ($2500 per night): $17,500 4 nights in a standard room ($1600 per night): $6,400 11 nights of complimentary breakfast ($180 per day): $1,980 11 nights of waived parking ($45 per day): $495 11 nights of waived resort fees ($45 per day): $495 2 nights at Hyatt Regency ($450 per night): $900 2 nights of waived parking ($32 per day: $64 2 nights of waived resort fees ($32 per day): $64 Total cash value of the Andaz Maui portion of the vacation (11 nights): $26,870 Total cash value of the Hyatt Regency portion of the vacation (2 nights): $1,028 Total Points Used: 315,000 Value per point: 8.9 cents – not too shabby! Conclusion: My family and I had another spectacular vacation using timeshares, frequent flyer miles and hotel points for a fraction of the retail cost. It was truly a vacation that would be out of our price range to mimic if we were paying cash. While my timeshare strategy failed, my plan B worked flawlessly in that we were able to enjoy the Andaz Maui for yet another Christmas. Timeshares are great but they do not work for all travel plans so the ideal strategy is to have multiple travel tools at your disposal. Diversification is key, not only in points and programs but also having multiple avenues for finding reasonable accommodations. Getting a $28,000 three week vacation in Hawaii over Christmas for about $1200 out of pocket seems ridiculous but I did it and you can to with various strategies. What did you do Christmas week? Any stellar redemptions / exchanges? Make sure to comment below. |

Archives

April 2020

Categories

All

Archives

April 2020

|

RSS Feed

RSS Feed