|

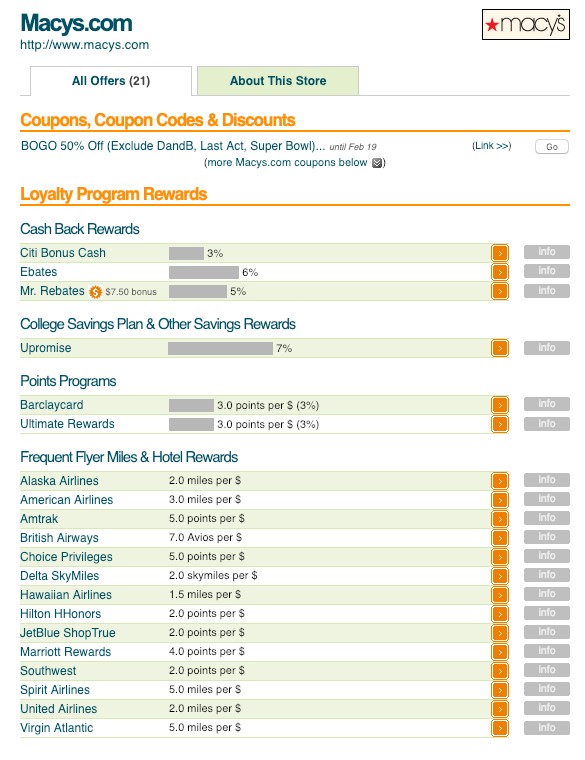

Timeshares can be a great way to travel but as I have stated many times before, you also need to have points. Points can come in many flavors but I am talking about credit card transferable points, hotel points and frequent flyer miles. In my previous post found here, I explained a fairly simple strategy on how to obtain tons of credit card, hotel and frequent flyer points by applying for credit cards. It is one of the easiest ways to amass tons of points which can be a great tool in connection with your timeshare travels. Between my wife and I, we have about 30+ credit cards and both maintain a 800+ credit score. The key is to pay off the bills each month and not maintain any balances. Believe it or not, having a lot of credit cards means having a lot of credit so when you use credit cards, your utilization percent will be lower which will actually increase your score. However, there are many people out there that simply do not want to manage that many credit cards or have the desire to constantly apply, cancel and re-apply for cards. It is definitely a time consuming hobby so I understand that it is not for everything. However, there are still some great way to get tons of points through various activities that can easily be done. Here are some of my favorites. Shopping Many of us online shop on mostly a daily basis. The key to amassing a lot of points through this activity is to go through various online portals. Some provide cash back and some provide points. There are tons of these portals that are run by almost all hotels and airline partners as well as Chase Bank, Discover and a few others. The key idea is that when you start a shopping trip, you need to start through one of these online portals. Once you click their link, it will bring you to the shop of your choice and through cookies, will track you purchases and award you miles. Many times, this can boost your earning ratio by A LOT as they have various offers that sometimes can reward you anywhere from 1x to 20x per dollar spent. Each shopping portal has different earning rates which can be time consuming to figure out the best place to start. The goal is to maximize every dollar spent. My favorite starting place to find which portal offers the best value is www.evreward.com It is extremely simple to use and you simple type in the name of the store and it provides you a listing of all available portals and their earning ratio. For example, if I wanted to shop at Macys.com, I simply type in Macy's to their tool bar and here are the results.

As you can see, there are tons of portal options and you can earn anywhere between 1.5 points per $ to 7 points per $. It pays to use this tool. You can also see that there are some cash back options which can be valuable too. It just depends on what goal you desire: cash or points.

Also, the earning ratio's provided above are just for shopping through the portal. Any points or cash back that you earn from your credit card will be in addition. Therefore, it also pays to use the right credit card for the purchases. Dining Another one of my favorite tools is signing up through various dining programs. Most hotels and airlines also having dining programs. Basically, you register with the dining portal, provide one or more credit cards to register and if and when you dine with a particular restaurant that is a member, you can earn a lot of additional points. Instead of re-creating the wheel, The Points Guy, has done a good job outlining these programs. One thing to take notice of with these programs is that you can only register one credit card per program. You cannot earn multiple points through different programs with the same credit card. Therefore, for this program, it probably makes sense to pick one dining partner to try to maximize your points. Again, these points are in addition to any points that you earn with your credit cards. For example, the Citi Prestige card now offers 5x points for dining so you can easily increase your earning potential by registering that card and dining out at those partner restaurants. Office Supply Stores This tactic is one of my absolute favorites. While this requires slightly more work, the payback is absolutely fantastic. Chase Bank originally offering the Ink Plus credit card which offers 5x points on office supply purchases. They have since discontinued that card but continue to offer the Chase Ink Business Cash Card. While the card is advertised as a cash back card, it essentially earns Chase Ultimate Reward Points which can be redeemed for $0.01 per points or, if you have another ultimate rewards earning card (Chase Sapphire Preferred, Chase Sapphire Reserve, etc.), these points become transferable and you can use the Chase Ink Business Cash Card to earn ultimate reward points and transfer them to their travel partners. Here, the simply strategy is to maximize your spend at office supply stores to get 5x points. While most people will not be spending $1,000's of dollars per year on office supply stores, the "trick" here is that most office supply stores (Staples, Office Depot, Office Max) also sell gift cards to various stores. You can easily buy gift cards to Amazon, Delta, Southwest, Whole Foods, Home Depot, Lowes, etc. You can obtain 5x points for those purchases and then spend those gift cards at those merchants. The other fairly easy win with this strategy is to buy Visa or Mastercard gift cards. These will normally come with an activation fee but even with such fee, getting 5x points is almost always a win especially if you maximize those points. Also, all of these stores regularly offer promotions on Visa and Mastercard purchases which either waive the activation fee or even give you a discount off the price of the Visa gift cards. You can essentially earn free money and get 5x points for the purchase. Once you have the Visa or Mastercard gift cards, you can use them just like any other Visa or Mastercard. They can be a little difficult to keep track of as some retailers will deny the purchase if there is not enough funds on the card, many retailers will simply approve the purchase for whatever was on the card and you can use another card to pay the balance. This is generally the case at Costco, Whole Foods and most supermarkets. Promotions While no one likes spam, the points issuers have creative a very lucrative currency that is sold to credit cards, retailers, and other third parties in order to attract customers and regularly send out e-mails advertising these offers. As a result, there are always tons of promotions that are ongoing which attempts to encourage certain behavior and it can actually be worthwhile to sign up for their promotional e-mails. It can be tough to weed through the various programs so I tend to rely on blogs to help direct me to great deals. Here are a few of my favorites and definitely encourage you to read and sign up for their updates. They have a lot of great information that has saved me $1,000's over the years. https://frequentmiler.boardingarea.com https://onemileatatime.com https://upgradedpoints.com Crazy Opportunities Every now and again crazy promotions come out where you simply need to take advantage of what they are offering. In case you are interested, one of the most interesting stories is concerning pudding and miles. This is a great story and the point issuers definitely learned from this experience. Read about it here. Here are my favorite two promotions that I took part of that was very lucrative. Lasik: While I definitely am a candidate for Lasik, they had a promotion in the past where if you get screened for it, they would give you 25,000 Delta Skymiles (enough for a domestic round trip or more). There was no purchase involved and simply required an appointment and about 30 minutes of my time. This was a great simple win. Bosley: Bosley is one of the most preeminent hair transplant systems. Unfortunately, I am also a candidate for Bosley and they also offered 25,000 Delta Skymiles for an appointment. Again, 30 minutes of my time, I became 25,000 Delta Skymiles richer. A simple win. These types of crazy opportunities come up fairly regularly so it pays to review those emails from the airlines, hotels and credit cards. Fairly often, they provide you with some great offers which are easy to do and can earn you tons of points. Conclusion Points are a great way to travel for "free" but are an essential tool to use with timeshares. My strategy has been and will continue to be to use points as backups when trying to get a timeshare so that you can book flights without worrying about whether your timeshare will come through. Here is an overview of that strategy. Points have become a very lucrative industry for the issuers but also are can be very lucrative for the traveler. Despite constant devaluations of their programs, it is an essential tool to maintain to be able to travel for significantly less than retail. Credit cards are a simple way to amass tons of points but that avenue is dying quickly as credit cards issuers get stricter on enforcing their bonus offers. Take a look at my take on that here. What other strategies to you use to get points? Make sure to leave your comments below! |

Archives

April 2020

Categories

All

Archives

April 2020

|

RSS Feed

RSS Feed