|

Southwest is one of the best airlines out there thanks to its extremely customer friendly policies. Southwest still offers 2 free bags for any type of fare as well as having 100% availability for redemption of its Southwest Rapid Rewards points.

I have discussed why Southwest is great for timeshare planning here. Instead of rehashing the entire post, this is merely to inform my readers that the new scheduled has opened up as of today for travel up to January 7, 2018. This is an important schedule update since you can now book travel for Thanksgiving, Christmas and New Years. Booking with Southwest Rapid Reward Points is a fantastic option since they are fully refundable. If you have points, book now and continue to monitor the flights as Southwest will refund your points if the airfare cost goes down. My advice is to book now and look for accommodations later. There is little risk in doing so if you are booking with points. I have spoken about various vacation packages that many timeshare developers offer in exchange for agreeing to sit through a timeshare presentation. I was recently targeted for a 3 Days / 2 Nights vacation package with Hilton Grand Vacations for a trip to New York City. This offer expires May 31, 2017.

The package being offered is for an upfront fee of $249 plus tax (total) in exchange for the following:

Interestingly, the offer indicates 5,000 bonus points but the fine print indicates that guests will receive 15,000 bonus points. Guests will receive 15,000 Hilton Honors Bonus Points (valued at $100), a $100 Spend a Night on Us certificate, and a $100 Elevated Rewards card. If interested, I would definitely call and see if you can get the higher bonus points. 15,000 bonus points is not a ton for use at a Hilton but is definitely a good amount. As with all of these types of offers, there are various restrictions. This include income requirements and state of residence requirements. Additionally, if married, both spouses must attend. Additionally, you cannot participate in this offer if you have participated in a sales presentation at the New York City property within the last year or at any of the Hilton Grand Vacation properties within the last 6 months. This particular offer indicates that accommodations will be offered in a standard hotel room at a Hilton Honors portfolio hotel. The fine print does not say whether this will be a Hilton Garden Inn or a Waldorf Astoria. I am guessing that it will be at a lower quality property but two nights in New York City will almost always cost more than $249 per night. Per the details, the prices of the deeded weeks range from $8,490 to $377,300. As I argue in many other posts, timeshares are great provided that the initial purchase price is reasonable. Purchases on the secondary market will be exponentially less than purchases from the developer. In most situations, you will save thousands by buying on the secondary market and is generally the recommended strategy. Buying directly from the developer could be necessary in very limited situations such as if it is a new resort or you actually want to go to a specific resort year after year for the same week. Buying resale will generally be 70--90% off the developer prices with many timeshares being sold for $1.00. These timeshare offers are generally a fantastic deal but they do require 2 hours of your time to sit through a presentation. These can be easy going or can be very difficult. If you are thinking about taking advantage of this offer but not attending the timeshare presentation - JUST DON'T. Per the fine print: You must attend a two hour timeshare sales presentation in order to participate in this promotion. If you do not meet the qualifications of this promotion or attend presentation, the difference between the special package price and the currently published nightly rate for the applicable resort at that time, plus premium costs and taxes, may be charged to your credit card. Basically, they will charge you the going rate for the entire package which will be much more than the $249 fee. In other posts, I will discuss some general strategies for handling these timeshare presentations but I generally find that these can be very informative. Each timeshare system is complicated so these types of presentations and offers can be worthwhile to learn about the systems and get some great mini-vacations for cheap. I would never recommend buying during these offers despite their likely strategy of offering "deals only good for today" or other types of "limited perks" for purchasing today. You can buy a timeshare anytime you want - GUARANTEED, at prices for a fraction of their going rates. The offer link below seems to allow anyone to book so if you are interested, go for it. Unfortunately, the link does not provide a phone number or show the available dates. It seems as though you need to purchase the offer and then a specialist will call you to confirm everything and book your accommodations. Will you be doing this offer? Please leave comments below if you are and where they are offering to put you up.

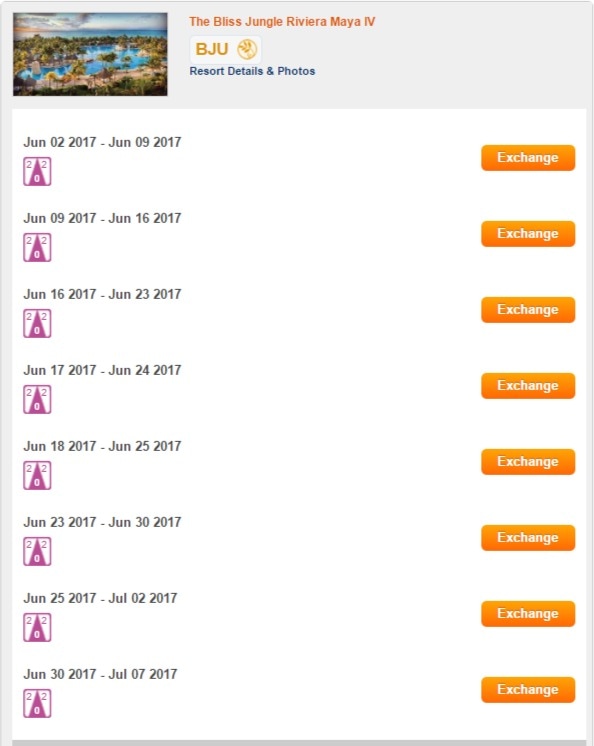

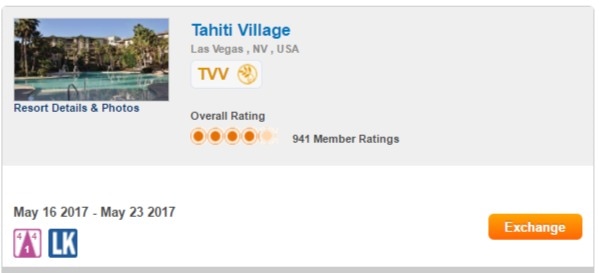

Fairly frequently, Interval International will run various promotions where you can receive discounted getaway weeks, discounted membership fees, and various other promotional items including a free Resort Accomodations Certificate.

Resort Accomodations Certificates allow you to reserve a week vacation as various resorts and destinations. I posted some information concerning these Resort Accomodations Certificate here. Resort Accomodations Certificate can be somewhat difficult to use but there have been some fantastic weeks that pop up every now and again. Until May 26, 2017, Interval International is running a promotion where you can receive one Resort Accomodations Certificate for each exchange transaction. Basically, if you own a timeshare and exchange your points and/or week through Interval International, you will be given one Resort Accomodations Certificate per transaction. Each certificate will require a redemption fee of between $249 to $449 based on the size of the unit and various taxes. These certificates will be valid for one year after issuance. I still have a Resort Accomodations Certificates in my account which is valid through the beginning of July. Doing a quick search, here a couple of weeks that I can see that can be a great value. As you can see, there are some decent weeks available. Since the new Resort Accomodations Certificate is valid for one year from issuance, I would imagine that you should be able to get great use out of these certificates. But, is this a great deal? If you were going to make an exchange, doing so now in order to get a Resort Accommodations Certificate can be a good deal. It is also possible to make an exchange just to get the Resort Accommodations Certificate and opt-in to getting E-Plus which will allow you to make 3 trades for free. By doing this, you can get a Resort Accommodations Certificate and still be able to exchange your week for future travel. You lose some flexibility with this strategy since you cannot put in an ongoing request but it could be worthwhile. Also, in case you were thinking that using one of your E-plus retrades would trigger the promotion, it won't. Unfortunately, Interval International explicitly states this in the terms. In my opinion, I wouldn't just make a trade for this promotion but if a good week becomes available, getting a Resort Accomodations Certificate is not a bad deal as there are been some truly fantastic weeks that become available with these Resort Accomodations Certificate. I have recently seen 2 bedrooms at Westin Naana (Vistana's newest Maui resort), various Hyatt units, Marriott weeks, prime ski weeks, etc. - all for a total cost of $249-$449 for the week - approximately $35-$65 per night. The fine print indicates that this may be targeted but I think it is is fairly widespread. Did you get this offer? Have you used a Resort Accomodations Certificate before? World of Hyatt Points vs. Timeshare Ownership: A Comparison on Cost of Booking using both Systems5/13/2017

As I mentioned in other posts, I am an avid collector of points - hotel points, credit card points, frequent flyer miles, etc. I know them all and use them extensively to travel.

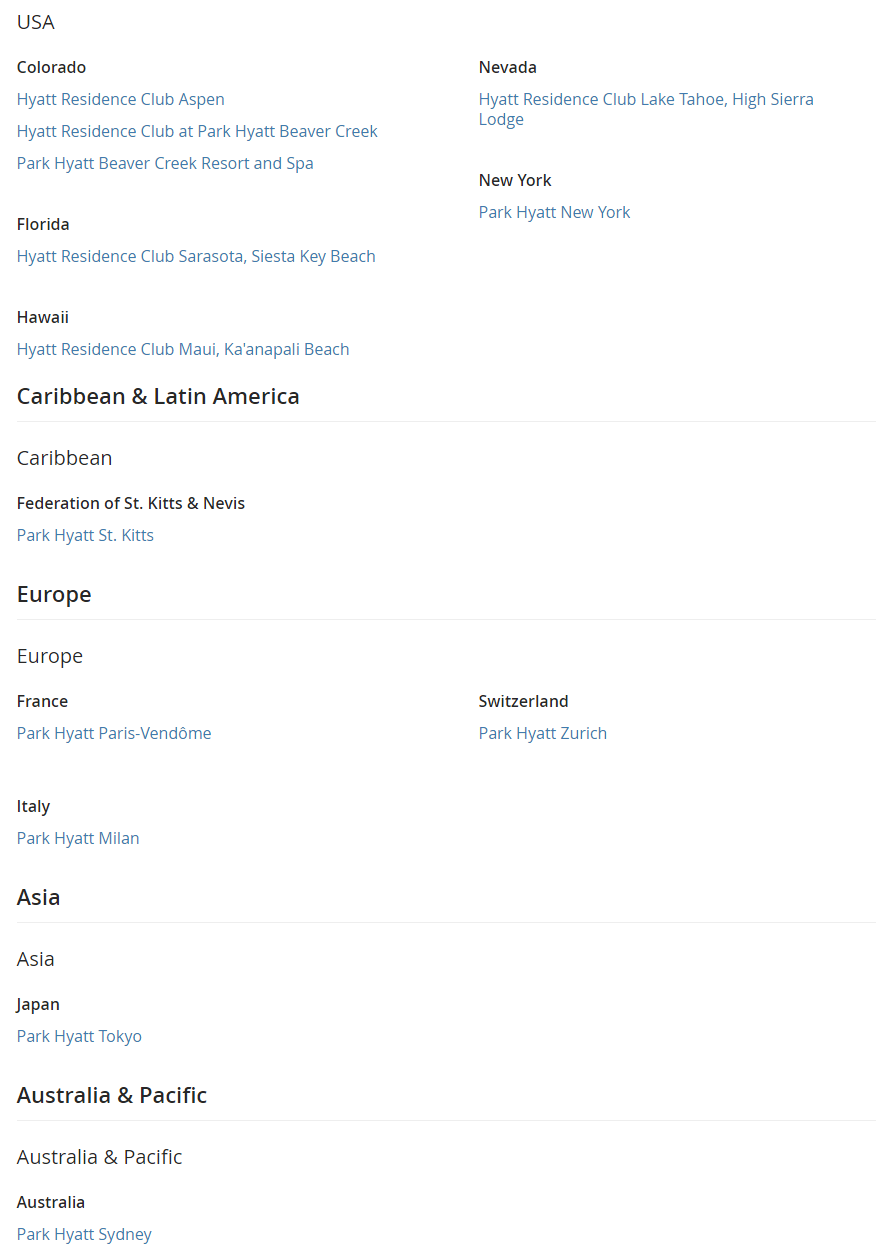

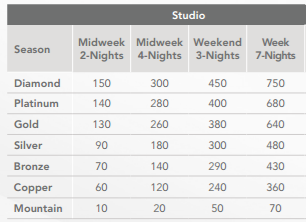

I also obviously own a timeshare and use it in conjunction with my points. One way that I pick destinations is to look at the various hotel programs and look at the highest tier properties. By doing so, I can guarantee that these are luxurious accommodations and generally a fantastic use of my points. As I start my planning for the next big trip, I wanted to see how I can maximize the value of my Hyatt points so I started the search seeing their top end properties which is a Category 7 under Hyatt's system. Hyatt is one of the best hotel loyalty programs as it only costs 30,000 points per night at highest tier Hyatt properties. This is much lower than many of the other major chains. Here is the list of all Category 7 hotels. As you can see in the above chart, I was surprised to see that there are five Hyatt Residence Club properties that are categorized as a Category 7 hotel (there are 17 Hyatt Residence Club properties in total). Curiously, I wanted to see whether using my Hyatt timeshare points would be more valuable than using my World of Hyatt points to book a one week trip. Hyatt points can be very valuable and there are some great ways to get a lot of Hyatt points. In this analysis, I wanted to see the true cost of getting a one week vacation in one of these properties by using timeshare points versus using World of Hyatt points. Since these are category 7 properties, it takes 30,000 World of Hyatt points per night for a studio unit. Therefore, it will cost 210,000 World of Hyatt points for a week stay in a studio unit. A one bedroom or two bedroom would cost more. In an effort to compare apples to apples, we will assume that we can reserve a studio unit using both programs as availability using World of Hyatt points and Hyatt Residence Club points can be difficult. OBTAINING WORLD OF HYATT POINTS: There are many ways to get World of Hyatt points. You can stay in Hyatt hotels, use the Hyatt credit card or use various credit cards associated with Chase Ultimate Rewards. One of the best ways that I have found to get Hyatt points is through the Chase Ultimate Rewards program and in particular, using their business card (Chase Ink Bold or Ink Plus) to get 5x points on various spending categories including office supplies, utilities and telecom charges. If you exclusively purchase items in the 5x categories, you would need to spend approximately $42,000 on your credit card to generate 210,000 Chase Ultimate Reward Points which can be transferred to Hyatt on a 1:1 basis. For the purpose of this post, lets assume that for a cost of $6.95, you can receive 1,034.75 points. This figure was chosen for a reason as this is generally the cost of Visa or Mastercard gift cards in $200 increments. Based on the assumption of using $6.95 to "purchase" 1,034.74 Chase Ultimate Reward points, it would cost you $1,459.50 to obtain these points requiring a purchase of approximately 210 $200.00 increment gift cards. The math is as follows: 210,000 divided by 5 = 42,000 42,000 divided by 200 = 210 210 times 6.95 = $1,459.50 Alternatively, if you could purchase higher denomination gift cards (i.e. $500) (not very available anymore), the math would be as follows: 210,000 divided by 5 = 42,000 42,000 divided by 500 = 84 84 times 6.95 = $583.80 Therefore, it will require you to spend $42,000 on a card that generates 5x points in order to earn enough points for a one week stay at these properties. The cost to spend $42,000 can vary but based on some typical methods, I would argue that it would cost somewhere between $583.80 to $1,459.50 plus a decent amount of time to make these purchases. This "cost"will vary widely so don't hold me to this as a true cost. It is meant as a fairly realistic example in the points world but this figure will highly depend on your individual spending habits. Additionally, some lucrative sign-up offers can lower this cost significantly but even with a 100,000 sign up bonus, you still need an additional 110,000 points. Alternatively, the same example can be used if you stay at Hyatt hotels. Hyatt gives you 5 world of hyatt points per dollar spent with Hyatt. You would need to spend approximately $42,000 in order to get the required 210,000 - a little less if you have any status with Hyatt since they give you an extra 10%, 20% or 30% based on your status. HYATT RESIDENCE CLUB POINTS: I am a Hyatt Residence Club owner and own a week at the Hyatt Beach Club in Key West. I have never been to this destination and likely will never attend. I purchased this week specifically for Hyatt Residence Club points. For this analysis, I am completely ignoring the upfront purchase fee. I have argued in other posts why it is smart to do so but there are many ways to get a timeshare for little to no cost including Hyatt properties. For my specific week, I pay an annual fee of $1,207.46 in exchange for 2,000 Hyatt Residence Club Points. My week was previous allocated 1,300 Hyatt Residence Club Points but the chart was recently readjusted that resulted in a tremendous increase in points for my week. This is a rare occurrence but worked out in my favor. Since we are comparing Studio units to Studio units, here is the chart for the Hyatt Residence Club for exchanging into a studio. As you can see there are seven seasons associated with the Hyatt Residence Club. For purposes of this example, let assume that I want a prime week such as Christmas week - something that I would do with my Hyatt World of Hyatt points. As you can see, lesser demand seasons would require lower amounts of points. As a comparison, World of Hyatt points do not change per season - it always requires 30,000 per night for the five Hyatt Residence Club properties indicated above. In order to get a prime week, this would require 750 Hyatt Residence Club points. As indicated above, I pay $1,207.46 in annual maintenance fees in exchange for 2,000 points. Therefore, my cost per point is approximately $.0.60 cents per point. Here is the math: $1,207.46 divided by 2,000 = $0.60 For purposes of evaluation, lets assume that my week was still worth 1,300 Hyatt Residence Club Points. In this example, my cost per point is approximately $.93 cents per point. Here is the math: $1,207.46 divided by 1,300 = $0.93 In order to reserve one week in a studio unit at one of the 5 Hyatt Residence Club properties using Hyatt Residence Club Points would cost me $450 using $.60 per point or $697.50 using $0.93 per point. Here is the math: 750 times $0.60 = $450 750 times $0.93 = $697.50. For full disclosure, the Hyatt Residence Club charges a reservation fee of $41.00 per reservation so the total upfront fee is $491.00 or $738.50, depending on the specific value. FINAL COMPARISON: Depending on how you earn World of Hyatt Points, I would argue that it would cost somewhere between $583.80 to $1,459.50 to earn 210,000 World of Hyatt Points in order to stay one week in a Category 7 property if you assume that you could entire spend would be in a credit card category that earns 5x. If you earn less than 5x, the cost will be much higher. As an aside, I am ignoring the resort fees for this analysis since Hyatt waives resort fees on award night stays. Hyatt does not charge resort fees on Hyatt Residence Club owners who book using Hyatt Residence Club points. As a comparison, by owning a Hyatt timeshare, my total upfront fee is approximately $491.00 or $738.50. This figure will vary depending on the maintenance fees associated with the particular unit and the allocated amount of points. Therefore, at the low end, using Hyatt Residence Club Points to reserve a week in a studio unit at a category 7 Hyatt Residence Club property has an approximate cost of $491.00 for the entire week. At the low end, using World of Hyatt points to reserve a week in a studio unit at a category 7 Hyatt Residence Club property has an approximate cost of $583.80 for the entire week but this "cost" can vary depending on your spending habits. If you spend $42,000 for business or personal at a 5x category, this "cost" is probably zero but not many people generate that type of spend. CONCLUSION: I am sure that there are many areas which readers can dissect in this post that can allow you to make arguments in either direction - for or against the various items in the analysis. The point of this post is that I wanted to show readers that owning a Hyatt timeshare and reserving with Hyatt Residence Club points can get you into top tier properties and is not very expensive based on the monetary outlay. I argue that it is not very expensive even when comparing it to using World of Hyatt points since there is likely some cost associated with generating the required amount of points. Additionally, I receive my Hyatt timeshare points each and every year. There is no effort to generating credit card spent or obtaining additional points. I simple pay my annual maintenance fee and receive these points. This can be much easier than continually accumulating world of hyatt points through Hyatt stays, credit cards or other means. I did not go through an analysis based on cash bookings but most of these properties would cost over $400 per night which is simply too expensive for me. That is why is love the points world! What do you think of this analysis? Is this accurate? How would you do an analysis on the cost to acquire World of Hyatt points? Make sure to subscribe below! Thanks to the Doctor of Credit for allowing me to post a guest post on his blog found here. As a result of his generosity, there are a few new readers to The Timeshare Guru. As a result of this new readership, I thought I would take this opportunity to give a very basic overview of timeshares.

Timeshares are complicated so I thought I can break down the basics so that readers can have a better understanding of various options involved in actually owning or using a timeshare. Types of Timeshares: There are actually a few different types of timeshares. Most people are familiar with the most basic model which is where you purchase a one week interval at a resort. This "weekly model" allows you to use that specific week each year or sometimes, every other year if you own a bi-annual week. Another type of timeshare ownership is a "points model". Instead of owning a specific week, you purchase an annual allocation of points which can then be redeemed for stays are various resorts within that particular program. You typically purchase enough points to use for a week stay at various resorts. Yet another model is a "hybrid model'. In a hybrid model, you typically purchase a week a at a particular resort and you have the option to use that particular week or alternatively, give up that week and get a certain amount of allocated points. You then use those points to make reservations in other resorts. Units: Timeshares generally come in various size units. Timeshares come in studios, one bedrooms, two bedrooms, three bedrooms and occasionally four bedrooms. Studios are similar to hotels but generally can be slightly larger. Most timeshares larger than a studio will come with a full kitchen and living room. Seasons: Unlike the standard four seasons, timeshares come in various different seasons. Each program breaks down the 52 weeks of the year into many different seasons with as many as 6-8 seasons with various names depending on the program such as Platinum, Diamond, Bronze, Mountain, etc. The general premise is that high demand weeks in high demand locations will be categorized in the highest seasons. Internal Exchanges: While the older system of timeshares generally obligated you to buy a week and use that specific week year after year, the new version of timeshares attempts to give the purchaser a lot more flexibility. Timeshares now offer the ability to exchange their week and/or points into other resorts within the same system. For example, if you own a Hilton timeshare, you can exchange your week into another week at another Hilton timeshare. This goes for almost all timeshares that are affiliated with larger brands (Marriott, Hyatt, Hilton, Wyndham, Four Seasons, Vistana, etc.) External Exchanges: In addition to being able to exchange for other properties within the same brand, almost all timeshares offer the ability to use a third party exchange company to exchange your week and/or points into other timeshares. Timeshare brands are generally associated with either RCI or Interval International. For example, Marriott trades through Interval International and Hilton trades through RCI. A Hilton owner can never trade into a Marriott and a Marriott owner can never trade into a Hilton. RCI: RCI is one of the major exchange companies. It was the original exchange company and is the largest based on the amount of resorts affiliated with RCI. RCI was purchased by Wyndham International a few years back but still operates independently. Interval International: Interval International is the other major exchange company. Interval International has been a major player in the timeshare market and recently purchased many of the large brand timeshares including Hyatt, Vistana (Starwood brands)and Aqua-Aston. Purchasing a Timeshare: The main option in purchasing a timeshare is buying from the developer or buying resale. Buying from the developer occurs when you attend a timeshare presentation or purchase directly with the timeshare brand. Resale occurs when you buy directly from a current owner or on the secondary market with major outlets being Redweek, Ebay or other real estate brokerage firms that specialize in timeshares. Developer Purchases: When you purchase from the developer, they tend to offer various perks including hotel points, extra or bonus vacation weeks, resort credits or some other perk for purchasing. Purchasing from a developer is vastly more expensive then purchasing on the resale market. Resale Purchases: Purchasing resale can provide some truly phenomenal cost savings as opposing to buying from the developer. However, there are few items that you need to be aware of before you move forward with a resale purchase. The developer may provide some type of "penalties" for buying resale. This can be prohibitions on internal trades or prohibition against converting your week into hotel points. Also, you need to make sure that there are no debts or other encumbrances on the resale week. If you do not thoroughly research the timeshare week, you could end up assuming debt that you didn't realize existed. Initial Purchase Price: In order to purchase a timeshare, it will require an upfront fee for purchase. The fees will vary widely depending on the size of unit, season, whether you purchase resale or from the developer and whether it is annual or bi-annual usage. The fees can be as little as $0.00 (NOT A TYPO) or hundreds of thousands of dollars (AGAIN - NOT A TYPO). Maintenance Fees: In addition to the initial purchase price, the owner will be required to pay maintenance fees on the unit. Maintenance fees are essentially all the pass through costs of the resort broken down by unit and week. Maintenance fees include property taxes, management fees, capital expenditures, reserve accounts, staffing, housekeeping, etc. Maintenance fees can vary widely but tend to range from $500-$2500. These fees occur each and every year, regardless of whether you use the timeshare. As an aside, timeshares have developed this awful reputation due to this fact concerning maintenance fees and their recurrence and not being adequately disclosed during purchase. Exchange Fees: In addition to the purchase price and maintenance fees, you will generally have to pay an exchange fee. Exchange fees can be levied on internal reservations, external reservations, guest certificates, cancellation fees, etc. There are no shortage of fees associated with timeshare usage. Converting Timeshares to Hotel Points: Timeshares that are associated with major hotel brands generally offer timeshare owners the ability to convert their week into hotel points. This "perk" is one of those that generally will be taken away if you purchase resale but can vary according to the timeshare brand. Converting into hotel points generally does not convert at a favorable rate but it can be a useful option in some limited situations. Renting Timeshare Weeks: RCI and Internal International both offer options to rent weeks for cash instead of exchanging your week and/or points. These are called Interval Getaways or RCI Extra Vacations. The rates for these weeks can be as low as $200 per week and can offer a tremendous amount of value. One secret is that you do not even need to own a timeshare in order to rent these weeks. Reselling Timeshares: Timeshares are easy to purchase but can be very difficult to sell. This is generally a surprise to most owners since they were likely induced to purchase thinking that the timeshare, a deeded property, would appreciate in value. Timeshares almost never increase in value and can be difficult to sell since there is more inventory than demand. The poor reputations of timeshares do not help the resale market either. if you are new to this website, I am sure that you have many preconceived notions on timeshares and have a lot of skepticism on timeshares. While I am definitely a fan of timeshares, I am not here shilling purchases of timeshares as the intent of this blog is to educate timeshare owners and show you how you can maximize ownership, maximize the systems, grab cheap weeks without owning a timeshare and get a tremendous amount of value out of the systems if you own. I encourage you to look around the site at some various posts that go into some more detail on timeshares and some various deals that can be offered through these programs. As the site grows, I anticipate adding more details on some of the other major programs but I am hoping that readers can help direct me for content that they find useful. Please reach out with any questions and I hope that I can help you see how timeshares can actually be a wonderful way to vacation with very little cost! TTG The Timeshare Guru Every pair of shoes doesn’t fit or suit every person, and neither does every timeshare. The trick is to figure out what you really want, what you really need, what you can afford, and how to get the most out of your timeshare. That’s why you read this blog, right? A timeshare located right by Disneyland might be perfect when your kids are eight and ten years old, but what if you have 17 and 18-year-olds? What if you’re 58, and wondering if you would use a timeshare in retirement? What if you’re single? Each timeshare company has its own personality, style and price point. How often would you use your timeshare—one week a year, three weeks a year, or perhaps a week every other year? Would you like friends to enjoy the timeshare week with you, perhaps traveling to different countries and exploring them together? Is a studio just fine for you, or do you need a couple of bedrooms to accommodate everyone? Model units are great for showing you the decor, but look around the timeshare property. How are the grounds, pools, buildings and amenities maintained? Look at the people you see there. Do you feel that you fit in with them? Does the free owners’ breakfast have the kind of food you want to eat? Take a good look at the list of locations where your timeshare company has timeshares. Is there a place that you want to keep returning to? Is there a program that lets you exchange to a sister resort within the company for a reasonable fee? How much effort do you have to put into owning a timeshare—writing a check or paying the maintenance fee online? Are the maintenance fees paid monthly, annually, or every other year? What suits your style of budgeting—would you rather make an automatic monthly payment, or are you happy to save up and pay once a year? Do you have to call or email to make reservations, or can you do it online? What works best for you? When you buy a timeshare, pay attention to seasons. Seasons in timeshares are not like spring and winter—they’re all about how desirable it is to be at that particular location at any given week of the year. So if you want to go to Florida in February, it’s going to cost more than if you buy a timeshare for a week in August, when it’s hot and there are not as many people traveling there. Do you need to work around your family’s availability, such as when your spouse can take time off, or when the kids are out of school? Make sure your timeshare will be available when you are. Timeshares are like a home away from home where you walk in, enjoy the place, and leave. No maintenance, no fuss. You can find a place that you want to go to, is affordable, and just feels right—and enjoy! |

Archives

April 2020

Categories

All

Archives

April 2020

|

RSS Feed

RSS Feed