|

I have done a couple of previous posts on purchasing timeshares on eBay and explained whether auctions offering timeshares for $1.00 are legitimate. You can read about them here and here.

The general consensus is that they are legitimate offers for timeshares but there are details that you need to read to make sure that all fees are disclosed and there are no surprises that could occur where there are outstanding loans, past due maintenance fees or other non-disclosed fees associated with the purchase. In writing those posts, I realized that I am consistently giving the message that timeshares are worthless. While I do believe that a vast amount of timeshares are essentially worthless in terms of resale value, there are actually a lot of timeshares that retain and even arguably appreciate in value. Appreciation in timeshares is almost a complete fallacy but there are definitely times where you may purchase a week inexpensively and end up selling it for a profit. These types of weeks do exist but you need to know what to look for or get lucky. My Lucky Week As you may know, I own week 47 at the Hyatt Beach House in Key West, Florida, I have never been to that resort and will likely never go. When I purchased my first week in 2008, I paid $6500 for that week which was allocated 1300 points. Compared to prices today, I paid an exorbitant amount but still don't regret it as I have received a lot of value throughout the years. Recently, Hyatt redid it exchange chart and week 47, instead of being allocated 1300 points, was reallocated 2000 points. This provided me an almost immediate 50% in value for my week although I still am not sure whether I would be able to recoup my initial investment. You can read about that here. However, this reallocation definitely increased the value of this week. Other Examples: As I have shown in other examples, eBay is a good source to see how much timeshares are worth. For this, instead of looking for $1.00 timeshares, I thought I would see how much the most expensive timeshares have sold for in the recent few weeks. Here is the list of some recently sold auctions. I think these prices will surprise some of you. As you can see in the attached, most of the timeshares listed above sold for $8,000+ dollars. While of few of them had only one bidder, many of them had multiple bids which indicates that there were multiple people willing to pay these prices. eBay is not a perfect market but I tend to view eBay as a very good indicator of the true market value of items. As you see, there are many different brands of timeshares listed above that commanded such prices. There are Hiltons, Marriotts, Disney, Westins, and even Welk resorts (a timeshare only brand). Conclusion: Most timeshares are worth a fraction of the developer pricing so buying resales is essential if you want maximize ownership. The economics of timeshare ownership buying from the developer "may" still make sense but the math gets very fuzzy and few people will actually be able to recoup the initial investment. However, timeshares can still have value and as you can see from the above, they can have some real value associated with them. Not all timeshares are equal so do you research on what you want and what the going market price is for such week or system. What did you pay for your timeshare? Can you sell it for what you paid? Timeshare Purchase: Follow up to Post on whether eBay timeshare purchases of $1.00 are legitimate1/24/2019

In a previous post, I gave a broad overview of whether timeshare sales and subsequent purchases of timeshares selling for $1.00 on eBay were legitimate. You can read that post here.

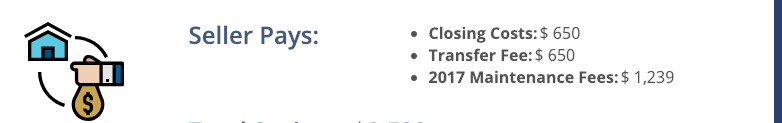

Essentially, my conclusion and position is that these auctions are legitimate, you definitely can purchase a timeshare for $1.00 BUT there may be other factors that need to be assessed where the actual winning bid could be $1,000's of dollars. I stand by that post but a lot of comments were given that I wish you would have given some examples of actual purchases and what to look for when purchasing them. As a result of those comments, in this post, I will go through some examples of eBay sales to show you what you need to look out for when making these purchases. Before we get started, I have done some other posts about determining what you timeshare is worth. One solid method that I actually use is eBay. In case you didn't know, you can actually search "completed listings" and "sold listings". There is a distinct difference between the two. Completed listings have ended but may not have sold and sold listings actually sold. You can see the exact price which they sold for. Here is the post on that topic. For the following examples, I have searched "sold listings" to see the actual selling price. Additionally, before I go through the actual examples, I wanted to again point out an important item that you should consider. My view is that timeshares are great but I would only recommend buying "name brand" timeshares such as Marriott, Hilton, Wyndham, Hyatt, Westin, Sheraton, etc. These timeshare brands have certain standards to adhere to, have regular brand recognition and have thousands of hotel counterparts which essentially markets the timeshares. Therefore, while not all of these name brand timeshares will have any value, the chances of being able to resale them for at least a $1.00 is much higher than a single destination timeshare. Example 1: Hyatt Wild Oak Ranch in San Antonio, Texas As you can see in the attached photo, a seller was selling an odd year, week 10 timeshare at the Hyatt Residence Club in San Antonio. The green price indicates that it sold for the whopping price of $0.01. If the price was grey, it would indicate that it was a completed but unsold auction. Buying a Hyatt for one penny is quite the bargain. Generally, the "gotcha" could occur for the various closing costs, transfer fees, past due maintenance fees or outstanding loans. Some, but not all of auctions, will list out the various fees and who will be responsible. Make sure that the auction clearly states the fees and responsible party. For this auction, the SELLER will pay the closing costs of $650 and the required transfer fee of $650. Additionally, as you can see below, since this auction ended in December of 2018, it is likely that the maintenance fees were not paid for 2017 and the SELLER will actually pay those as well. Once you read the description, you can also see that the ongoing maintenance fees are $1239 every year of use.

For years in which you do not have use which would be every even year, you still need to pay a fee which they do disclose of approximately $150-$180.

CONCLUSION:

For this particular auction, it does not appear that there are any "gotchas" and the Buyer potentially purchased this particular timeshare for $0.01. The more difficult hurtle for the buyer will to pass Hyatt's Right of First Refusal. Hyatt has the right, but not the obligation to purchase the timeshare before the third party and I would be surprised if they wouldn't do so in this situation as they will likely be able to sell this unit through the developer for $10,000+ dollars. That is why it pays to buy resale! Example 2: Marriott Summit Watch in Park City Utah If you read this blog, you know that I am a big fan of Park City, Utah and a fan of the Marriott Summit Watch. Looking through these eBay sold results, I came across this one. It appears that 2 bedroom week sold at the Marriott Summit Watch sold for $1.00. Here are the details of the week:

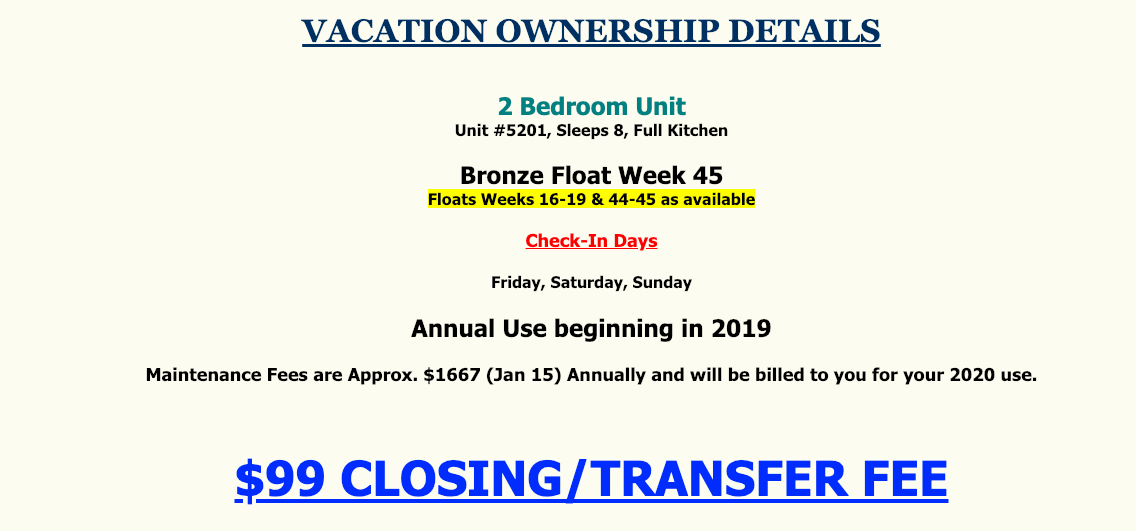

Maintenance fees for this "floating" week are $1667 per year which the Seller has indicated has been paid for 2019. The closing costs are $99.

Looking through the other details of this auction, there are no further fees disclosed. Assuming that the facts put forth in the auction are accurate, this week likely sold for $1.00 PLUS $99 in closing costs. A pretty good bargain but the buyer will still need to get past Marriott's Right of First Refusal. The details of this auction are fairly straightforward and it looks like the buyer did purchase the timeshare for $1.00 with the obligation to pay $99 for the closing costs. They are also now obligated to pay the maintenance fees each and every year of $1667 which is definitely on the high side of fees. But, their initial up front cost was very nominal. However, upon looking closer at the Marriott timeshare, I would argue that this purchase is actually an awful deal for $1.00 plus $99.00. The Marriott maintenance fee of $1667 is quite expensive especially if you actually wanted to use the Marriott Summit Watch unit during those floating weeks. Those floating weeks actually occur during mud season which is during November and April, the least desirable timeframe for a mountain destination. I routinely see Interval International Getaways offering those types of weeks for approximately $400 per week even at the Marriott Summit Watch. If you actually wanted to use the "floating" week that you purchased, you would essentially be paying 4x what I can rent that same week for if not more. Additionally, Interval International offers Accommodations Certificates which allows you to get certain weeks for an exchange fee of $239. I routinely see those types of weeks offered at the Marriott Summit Watch and other high quality timeshares during these off-seasons. Overall, I think that purchasing the timeshare for $1.00 plus $99.00 of closing costs is a good deal but ONLY if you trade that Marriott for other weeks. Also, since you are essentially purchasing an extremely low demand week, you may not be able to trade it as freely as other properties to obtain the more desirable week. The reason that I like Hyatt properties is that each week, even legacy weeks, convert into points and you can use those points for exchanges. From interval's perspective, a point is a point regardless of the underlying week. Marriott's legacy program is different in that you trade a week for a week (or 3 studio weeks for a 2 bedroom week or 1 bedroom + a studio week for a 2 bedroom week) and when you do that, they assign a TDI or travel demand index to that week which could prevent you from getting a high demand week in exchange for your low demand week. Conclusion: Overall, buying a timeshare off eBay is great way to save tons off the the initial developer pricing. The original sellers of both of the timeshares listed above likely paid $10,000 - $25,000 for those weeks so buying them for $1.00 is a fantastic deal as a comparison. The real gotcha that you need to be aware of with these types of purchases is to ensure that there are no loans, past due maintenance fees, or other fees associated with these purchases. This is why an Estoppel Certificate from the developer is absolutely necessary. Here is a post I did on that topic. Assuming that the buyers can overcome the right of first refusal from Hyatt, that buyer got a great deal PROVIDED that they use the timeshare and understand how to maximize their use. I would argue that the Marriott timeshare is worthless and not even worth the $100.00. As you can see, there are many nuances to look into when purchasing a timeshare. Despite the low fees being offered on eBay, you need to understand what you are buying and how to use it properly to maximize tis value. Also, at some point of time in the future, you may be the one trying to sell the $1.00 timeshare that you purchased for $1.00. It is not always easy to find a buyer so you need to take that into consideration when you purchase that timeshare and make sure you understand exactly how they work and what you can trade. Have you bought a timeshare off eBay? What was your experience? Purchasing a timeshare on the resale market can be difficult solely because there are so many timeshares to purchase. Picking out the right timeshare for the right price is not an easy endeavor. As I state many times before, all timeshares are not equal. There are some great timeshares and their are some truly awful ones. There are many places to purchase timeshares but one of my favorite places is actually eBay. eBay is a legitimate marketplace to buy and sell just about anything and timeshares are no exception. I actually recommend using eBay to determine what your timeshares is potentially worth. Are eBay Purchases Legitimate? eBay has a vast amount of timeshares being offered with many with a list price of $1.00, (yes One Dollar), or even one cent ($.01). The question is whether these are legitimate purchases. The answer is that they are generally legitimate but you NEED to read the fine print. While the auction for the timeshare may be for that low price, the eBay description might have various other details that will cause the "purchase price" to skyrocket way beyond the winning price. For example, the timeshare purchase could require the buyer to pay many years of maintenance fees, pay off loans, closing costs, future maintenance fees and so on. The actual price for the timeshare may be thousands of dollars even if you ended up winning the auction for a $1.00. Here is a screen shot showing some recent listings of timeshares on eBay. As you can see, all these offered timeshares having selling prices for $1.00

Legitimate Purchases

Some of these timeshares are legitimately selling for a $1.00 and DO NOT have any "catches". Unfortunately, despite what you may think, the resale value of some timeshares is almost completely worthless and selling for $1.00 may actually be the fair market value for these items. As discussed many times, sometimes timeshares simply do not have any resale market despite their initial purchase price. There are NO buyers for these timeshares which is why a vast majority of them sell for $1.00 or are at least offered for $1.00. There are even plenty of timeshares where people will PAY YOU money to take them. Why Purchase a Timeshare? While many timeshares are essentially worthless, there are plenty of others that will retain some value or at a minimum, be able to sell them when you are done using them. The timeshares from the main timeshare brands (Hyatt, Marriott, Hilton, Starwood / Vistana, etc.) all tend to retain some value where you should be able to sell them or give them away without too much effort. The key is to purchase them at the "right" price, use them and understand how to maximize their value! The problem is that there are a lot of smaller / independent timeshares where there simply isn't a resale market or enough buyers to create one. There are not too many buyers looking to purchase one week at one location anymore. While all of the timeshares can usually be exchanged, these smaller / independent ones do not trade that well. These types of timeshares give timeshares a very bad name as many owners are disgruntled about having these items where they don't use them, can't get rid of them for any price and they continue to have to pay maintenance fees. Recommendation: While buying a timeshare for $1.00 can look like a good deal, a lot of these "deals" are not really deals at all as once you take them over, at some time in the future, you may be the one trying to sell it for $1.00. There are always some diamonds in the rough and there could be some fantastic timeshares out there selling for $1.00 but my recommendation would be to always stay with the big name timeshare brands. The big name timeshares will not hold their value but they usually will retain some value which will make them worthwhile to somebody, someday. They have more brand awareness so it will be easier to try to find someone to buy them. Conclusion: eBay is a great place to find and purchase timeshares. However, you need to carefully review the description to fully understand what you are getting. You also need to fully review the timeshare that you are purchasing and make sure that you understand how it works, how it trades and how you will use it. If you purchase something and you don't use it, you can get yourself stuck with a ongoing bill that is tough to get rid of. Have you purchased a $1.00 timeshare and if so, what has your experience been? Timeshare Presentations and First Time Purchasers: Timeshare presentations have become a finely tuned science. NO ONE ever goes into a timeshare presentation wanting to buy a timeshare. They have refined their sales process where they know exactly how many people will buy a timeshare based on the number of presentations. I obviously advocate owning a timeshare as I think that they can be a great travel tool to travel well, affordably and comfortably. However, timeshare ownership ONLY makes sense if the upfront cost is reasonable, maintenance fees are reasonable considering the amount of potential weeks you can receive, and you purchase with a reputable high quality brand (Hilton, Hyatt, Marriott, Four Seasons, Wyndham, etc.) that give you a reasonable opportunity to sell your timeshare if you no longer want to and cannot use it. Timeshare ownership also will ONLY make sense if you understand the systems and how to use them to maximize their value. If you purchase a timeshare and use it for one week of travel during the year, it will rarely if ever make sense (with the potential exception of ski weeks). The key is to obtain more value from your week and transform that into multiple weeks of vacation. Then, the numbers make more sense and timeshare ownership can be very worthwhile. The vast number of first time timeshare purchasers end up purchasing from the developer through these timeshare presentations. They have responses to every question you can throw at them and their pitch makes a lot of sense. Even the main players like Hyatt and Marriott have fine tuned their presentations so it is no longer a high pressure environment but now they have transformed these pitches into a fear of losing out (FOMO). Buy now before you lose the opportunity or before the price goes up! It is effective but it is not the best way to purchase a timeshare. Resale Purchases: What the timeshare salespeople rarely disclose is the economic value of the timeshare. They sell timeshares for a lot of money and as soon as you purchase from the developer, the economic value of the timeshare just plummeted. Timeshares are sort of like cars. The moment you drive it off the lot, it loses value. Some timeshares literally can lose 99% of its value after purchase and some can almost lose 100%. When you purchase some timeshares, there is literally no resale market for them so it is difficult if not impossible to sell. Even though you may have purchased it for $10,000 - $20,000, the value can be almost $0.00. These facts continue to perpetuate the ideas that timeshares are scams and not worth purchasing. I agree that some timeshares are never worth purchasing even if they are selling for one dollar or someone is paying for you to own them. However, there are plenty of other timeshares that are re-sellable and will retain "some" value. Again, if you stick with the main timeshare brands, you will likely have a much better experience. In my opinion, buying a timeshare on the resale market is the most economical and can actually make timeshare ownership beneficial and can make tremendous economic sense. Rescission: As I mentioned, most timeshare owners purchase their first timeshare through a timeshare presentation. The pitch made economic sense and the ability to travel around the world was intriguing. Many times, immediately after signing the purchase documents, these buyers will race to google and attempt to confirm that they received a great deal (as likely stated by the salespeople) and find glorious stories of many happy owners traveling around the world. What they normally find is a bunch of information discussing how timeshares are awful investments, many disgruntle owners and sometimes, they even find their week that they just purchased selling for pennies on the dollar. Unfortunately, this is common and people should do research on timeshares BEFORE going to these presentations. If you understand some of these simple facts concerning timeshares, you can go into these presentations with more information and ask tough questions concerning the program and their broad statements concerning usage. For those people who made a purchase and immediately have buyers remorse, all is not lost. Almost all timeshare purchase contracts have the right of rescission. The right of rescission gives the purchaser a set number of days to cancel the contract with no fees and receive their money back. It will essentially be like the agreement never occurred. The time period for rescission varies from state to state but is generally around 3 to 15 days. The Rescission Process The terms of the rescission process will normally be buried in the fine print of the contract. They do not make it easy but you actually will need to read the fine print, find the rescission clause and FOLLOW THE STEPS PERFECTLY! Unfortunately, it is never as easy as simply going back to the developer and requesting a refund. Even if you go back the next day, the sales people will tell you to read the contract and will likely not be much help. The general process is that you need to send a written letter to the specific address in the contract with details of the specific timeshare that you purchased including the contract number with a clear and concise statement that you would like to cancel the contract pursuant to the right of rescission found in the contract. I would specify the exact clause as stated in the contract. The letter should be signed by all people who signed the contract so if both spouses signed, both spouses should sign the rescission letter. I would also include a copy of the timeshare agreement. MAKE SURE TO SEND IT WITHIN THE REQUIRED TIMEFRAME AND MAKE SURE TO USE TRACKABLE MAIL WITH A SIGNATURE! SEND IT VIA TRACKABLE MAIL WITH SIGNATURE, VIA REGULAR POSTAL SERVICE AND VIA CERTIFIED MAIL! MAKE SURE YOU HAVE PROOF THAT YOU SENT IT TO THE RIGHT ADDRESS WITHIN THE REQUIRED AMOUNT OF TIME! It is extremely important to make sure that you abide by the rescission dates. If you miss it by one day, don't expect them to cancel it. The salespeople were likely very friendly and easy going during the sale. Expect the exact opposite in their assistance in cancelling their sale. Conclusion Despite their reputation, timeshares are not that bad provided that you understand what you are buying and how to maximize use. The vast majority of timeshare owners do not understand everything when they first buy and get roped into a purchase by smooth talking salespeople. Too often, buyers only realize the mistake after the purchase and only do research on timeshares once they are owners. The goal of the blog is to educate people BEFORE a purchase or help you maximize ownership after the purchase. As I stated, most timeshare owners purchased a timeshare directly from the developer for their first timeshare purchase. They likely overpaid but hopefully they get enjoyment from it. If you purchased a timeshare from the developer and you missed the rescission period, don't dwell on it. Try to understand the program and use strategies to maximize its use and have great vacations. Use this information to make a different decision for your next purchase. Buying resale for a fraction of the price of the developer pricing makes a lot of sense and can make timeshare ownership very beneficial. The general idea is to rescind if you are within the applicable time period and search for another timeshare on the resale market. You will always be able to find a timeshare to purchase so do not worry about FOMO! (Fear of Missing Out!) Have you rescinded a timeshare purchase before? Share you story below!

As promised, here is the third part of a multiple part series on how to purchase a timeshare on the resale market.

Part 1, dealing with finding the specific timeshare, is found here. Part 2, dealing with contracting is found here. For Part III, the final part, I wanted to go through some various due diligence items that you need to be aware of. While you should definitely do due diligence on the particular timeshare that you are purchasing before contracting, once you have an executed contract, you need to make sure that you know exactly what you are buying before you close. Otherwise, you can end up with something that you didn't realize or worse, undisclosed debt. Estoppel Certificate I have discussed this item before but will do so again in order to have a complete guide. An estoppel certificate is a letter drafted by the timeshare company or timeshare manager, in response to a buyers request, which states the specifics of the timeshare. The specifics should include the particular week that you are purchasing and if it is a points based program or hybrid program, the amount of points allocated for that week. It should also state the current amount of maintenance fees for that particular timeshare and a statement that all past due maintenance fees, special assessments or other dues have been paid in full. It will also state whether there is a mortgage with the timeshare that would need to be paid off before any transfer. As you can see, the estoppel certificate includes some extremely important items. While the seller may state certain things, the estoppel certificate is the authoritative document that confirms what you are buying. Read it carefully and make sure that there are no surprises. Right of First Refusal Again, I have written about the right of first refusal before but here is some brief information on the subject again. The right of first refusal provides that the original timeshare company must be provided the opportunity to purchase the timeshare at the proposed price that the seller is offering the timeshare before a sale can be completed. The timeshare company can either elect to exercise its rights and purchase the timeshare from the seller for the same terms and price or waive its right and the buyer and seller can proceed with the transaction. The timeshare companies claim that the right of first refusal is generally included in order to maintain a floor for secondary prices. This is partially true but I think that the real reason is for the timeshare companies to control the secondary market. As I wrote about above, there are certain strategies that you should use before you submit the right of first refusal. I lost a couple of good timeshares when the timeshare company exercised their right and purchased the timeshare for almost nothing likely selling it immediately for a tremendous amount more. Escrow An escrow account is generally an account held by an independent third party where the buyer will deposit the purchase price. Only when the escrow agent receives all the documents and confirms that everything has been executed and filled out properly, will the escrow agent release funds to the Seller. The escrow agent will also handle disbursements to any broker or other third party that may get paid out of the sales proceeds. An escrow account is meant to protect both the buyer and seller. It is suppose to be an independent party so neither the buyer or seller will be able to manipulate any of the funds. It also highly protects the buyer so that the funds deposited will only be released upon confirming that everything is in order and the actual deed for the timeshare is filed. Timeshares are notorious for having a lot of fraud and scams so an escrow agent is a very good idea. A very good strategy to use is to use a credit card to deposit the funds in the escrow account. Most companies or sellers will allow you to use a credit card to purchase the timeshare. This does a couple of important things. (1) You can get credit card points! I am a huge fan of credit card points and any chance I get to obtain them, I do, If you are lucky, it may post as a travel expense which is generally a bonus category in most of the lucrative credit cards (Chase Sapphire Reserve, Citi Premier, Chase Ink Business, etc.) (2) It gives you another layer of protection. If anything occurs with the purchase, you have your credit card protections to back you up. If you are mainly going to use a credit card for protection purposes, I highly recommend using American Express. American Express is notoriously customer friendly, vendor adverse, and anytime I have ever had an issue with a vendor and filed a claim, it has been ruled in my favor. Deed A timeshare is considered real property so in order to fully document everything, there needs to be an actual deed completed and notarized that is filed with the county where the timeshare is located. There are many different types of deeds but the ones that you will potentially run into with timeshare purchases are quitclaim deeds or special warranty deeds. A quitclaim deed is the least protective deed. The seller is essentially transferring whatever interest the seller has in the particular timeshare. The seller is not providing any type of warranty that they own anything or that others may have any interest in the particular timeshare. A special warranty deed is much better than a quit claim deed in that the seller is representing and warranting that the Seller owns the particular interest being transferred and they are unaware of any other issues or claims that have occurred during the time that they owned it. The best type of deed is the general warranty deed which provides the same protections as the special warranty deed but the seller warrants that there are no claims relating to the time period before the seller acquired the interest. Points based timeshares may be slightly different depending on how it is structured but still likely require some public record filing. Most of the points based timeshares are structured as a Land Trust where the timeshare company sells interests in the Land Trust which is given to you as points. The owners of the Land Trust still need to be disclosed in the public records through deeds. Hybrid systems, where you own a week and you can convert that week into points, will require an actual deed. Account Transfers Once the deed is transferred to your name, you are technically the owner the timeshare. However, the timeshare company will need a copy of the filed deed in order to change the name of their account and begin to give you access to using the week and/or points. Timing can differ based on the timeshare company but for me, with Hyatt, it took about 2 weeks after the deed was recorded for an account to be set up in my name where I could actually book weeks and use my points. I would say that this a reasonable amount of time for most timeshare companies to handle the transfer process. Closing Services Buying and selling a timeshare can be a complicated process. There are legal agreements to complete, multiple parties to contact and filings in the public records. Despite being familiar with the process, I have always used a closing company to purchase the timeshare. They make the entire process much easier and know exactly what to do. There are various timeshare closing companies out there so you need to do you homework. I have used Greatway Services through my purchase with Sumday Vacations. If you end up purchasing a timeshare through a company, they will usually handle the closing or have some affiliate do so. This should generally be fine but make sure you understand the fees before agreeing to anything. Here is a link to some reviews and comments on various timeshare related companies. This is a good place to start looking for reputable companies to assist with any timeshare purchase. Also, when you negotiate the purchase agreement, you should be very clear on who is responsible for the closing costs. They can run in the thousands of dollars so make sure to negotiate this point up front! Conclusion Purchasing a timeshare is almost identical to purchasing a house. While the contracts and documents will be slightly different, it is a real estate transaction and it can get complicated fast. Purchasing a timeshare on the resale market can save you an absolute bundle. Prices will differ depending on the timeshare that you are purchasing, but I would venture to say that the resale prices are somewhere around 50-99% of the original purchase price. Buying resale is a great way to get a timeshare for a low initial fee. If you purchase low enough and you understand what timeshare you want and what strategies you will use to maximize its use, you can really get some great vacations for very little money. If you are considering a timeshare purchase, I highly recommend sticking with a name brand timeshare. They tend to exchange the best, be the most desirable properties and have some secondary market value so you can sell it down the road, maybe not for a profit, but at least you can transfer it to someone else and get out of paying the maintenance fees. In addition, if you are purchasing a timeshare, I would highly recommend using a closing company. They are simply well versed in timeshare transfers and will save you hours of frustration and could potentially save you from purchasing something you didn't expect. Please make sure to add anything that I may missed in these resale purchase guides! Please also add any companies that you have used successfully! I hope you find these guides useful. I'll compile these into one complete guide after comments are done to make sure that everything is included!

As promised, here is the second part of a multiple part series on how to purchase a timeshare on the resale market.

Part 1, dealing with finding the specific timeshare, is found here. Contracting In this post, I wanted to go through the contracting process. It is very important that all terms and conditions of the transaction are put down in writing and signed by both the buyer and seller. Once you locate the particular timeshare that you want and both the buyer and seller have agreed upon the price, you should move to the contract stage. In my particular timeshare purchase, upon agreeing on the price, the Seller asked me for the following information: 1. Legal Names(s) FULL MIDDLE NAMES REQUIRED FOR HAWAII 2. Are you taking title as single person, husband/wife, married as sole owner or joint tenancy. 3. Mailing address 4. Your county of residence 5. Daytime phone number 6. Home phone number 7. SEPARATE e-mail address for EACH INDIVIDUAL TO BE LISTED ON OWNERSHIP 8. Are you a current owner?_____________ Member # __________ 9. Copies of photo ids for each individual to be listed on ownership 10. Recent or current bankruptcy or foreclosure? _______ 11. If title is to be taken in a Trust, LLC, or Corporation you must provide a copy of the established documents. Requested Information The information above was requested in order to properly fill out the Purchase Agreement. It is good practice for the Buyer to provide this information for the Seller as the Seller will generally complete the Purchase Agreement for you to sign. As you can see, there are personal details that will be required to complete the timeshare purchase so there has to be some level of trust or confidence in the Seller. It is generally recommended to deal with a reputable company for a timeshare purchase. There are too many scams out there concerning timeshares and financial transactions is general so be careful and do your research before providing this information or transferring funds. Do some research on the Seller before doing anything. As previously discussed, I used Sumday Vacations and had a good experience but there are many reputable companies out there. Purchase Individually or through an Entity? One important item to consider before the contracting stage is the way that you will hold title to your timeshare. This can be done individually, as husband and wife or through a legal entity. The legal entity can be in multiple forms but generally a limited liability company (LLC) or a Trust can be a good way to hold title. This is NOT legal advice but the benefits of holding title in a legal entity is that you are able to transfer ownership of that legal entity without having to inform the timeshare company / developer. For example, if I bought my timeshare through a legal entity, ABC LLC, and I then wanted to transfer it to my children, I can do so by selling or transferring the LLC. You would have to inform the developer of a potential name change on the account but this should generally avoid any transfer fees that the timeshare developer likely charges for transfer. Also, the other potential benefit to holding title in a legal entity is to have multiple people associated with the entity. For example, if you are a family of four, you can have all 4 family members as owners of the legal entity and therefore, can make reservations of its behalf. If the parents own a timeshare and wanted to allow your children to use it without you being there, this would generally require a guest certificate which generally costs money. If all family members are owners of the timeshare through the legal entity, guest certificates will be avoided. The other consideration is liability. One of the downsides to timeshare ownership is that the timeshare will always have maintenance fees associated with it. Those never end and generally will continue to increase year after year. In the event that you cannot afford to pay those and you go into default, the developer will go after the legal entity and not you personally. While this is technically true, the individual(s) associated with the legal entity will likely be dragged into any legal action but it does provide an additional barrier between you and the timeshare company / developer. Although I am not positive, it is also possible that if the legal entity defaulted and an action instituted against it for non-payment, when you lose or default (extremely likely), the developer will not be able to report the individual to the credit bureaus where it would significantly hurt your credit score. I'll have to do a more detailed post of defaulting on timeshare fees but generally, it is NOT RECOMMENDED AT ALL, regardless of how you own it. The timeshare agreement is generally rock solid and the timeshare company / developer will likely institute proceedings to foreclose on the timeshare and it will be time consuming, costly and distracting. Overall, purchasing through an entity can be a smart decision. There are some upfront costs and ongoing filing requirements but it can save you headaches down the road when you want to transfer it and save you some fees depending on how you intend to use it. Contract Once you decide on how you want to hold title to your timeshare, you will need to execute a Purchase Agreement. I have attached a template of one that I have used in the past. The above is a decent agreement that you can use. It is not the best but the key is to get the material terms on paper. As you can see, the above contracts makes mention of a Florida statute so if the timeshare is located in another jurisdiction, that should either be removed or replaced with the applicable statute of the jurisdiction where the timeshare is located. Maintenance Fees Make sure that the agreement specifies the amount of maintenance fees per year and if there are any maintenance fees that are past due. You should also mention who will be responsible for what during the contract phase. As previously discussed, when I purchased my timeshare in Key West, while we were in the contracting phase, Hurricane Irma came through and caused significant damage to the resort as well as the entire area. If a special assessment was done during this time, it was important to spell out who would be responsible for it. Conclusion In Part III of this series, I will go through some more details on the process following the executed contract. Once the contract is completed, there are additional items to complete including making a deposit or depositing the purchase price in escrow, documentation requesting an estoppel certificate, going through the right of first refusal (if applicable) and getting a deed. In that part of the series, I will also discuss the pros and cons of using a closing company to assist in that process. Overall, once you have located the particular timeshare that you want and agreed upon a price with a seller, the above contract can be used to negotiate the specific terms of the transfer. This should explain if there are closing costs and if so, who will be responsible for it, who should be responsible for maintenance fees either currently due or which could be due during the transfer process, who is responsible for any special assessments which either occur or which are assessed during the transfer as well as whether an entity or you individually will hold title to the timeshare. Many people do purchase timeshares without the assistance of attorneys but it could be a good use of time of money to hire an attorney to review some of the documentation before committing to signing a Purchase Agreement. Purchasing a timeshare is almost the same as purchasing a home as the documentation is almost the same. Stay tuned for Part III! Make sure to comment below with any thoughts or comments?

It been a long time of promises but here is part one of promised guide on buying a resale timeshare. In this post, I will give you some good spots to begin your search for a timeshare purchase on the resale market.

Finding the Timeshare The key to maximizing timeshare ownership is to purchase the right timeshare for the right price. If the initial upfront price makes sense, the maintenance fees are reasonable and you fully understand the internally trading aspects of a timeshare as well as as the trading aspects of the affiliated exchange company (RCI or Interval International), timeshare ownership can actually be fantastic. As I continually try to show my readers, I get tremendous value out of my timeshares and have been able to take luxurious trips to expensive destinations for a fraction of the cost of nightly hotel rentals. Once you fully review the various programs and know what particular program that you want to purchase, you can start the search process for the particular timeshare. A good spot for the overview of some of the major program are here. As I state over and over, the timeshare programs are extremely complicated so you need to know what you want to buy before actually buying it and how you are going to use it. If you generally take 3 night trips, many programs will be a very bad fit for you as a lot of timeshares / exchanges only allow 7 day usage so you would have to let 4 days go to waste. Some programs allow for as little as one night usage so you need to do your homework and find the right fit for your vacation style. For example, if you want a Marriott property, you need to know whether you want Marriott Destination Club Points (point program) or a week at a specific resort in the legacy program. You need to understand the differences between them and the restrictions. Points are more flexible and allow for 1 night usage whereas the legacy program generally only allows you 7 night exchanges. However, points are much more expensive and can be difficult to find on the resale market. If you know what program you want to purchase and have a good timeshare strategy going into the purchase. (read about various timeshare strategies here), you can start looking for the desired timeshare. One thing to note as you begin your searches. The timeshare resale prices vary considerably. It is very hard to determine the actual fair market cost for a timeshare since there are so many resales and each one can be different even if associated with the same major company. Just because someone is offering a timeshare at a particular price does not mean that it is the correct price to purchase it at. eBay Believe it or not, a fantastic source for finding timeshares is eBay. eBay is the ultimate marketplace for almost everything and they have a constant mix of all types of timeshares being offered. As with everything on eBay, inventory fluctuates so I would constantly look at eBay and see what people are offering and the prices. However, just remember that anyone can offer anything at any price so just because someone is offering a timeshare at a particular price does not mean that it will sell or that is actually worth that amount. Take a look at this post for details on how to see the actual selling prices which is key to understanding the real value. When you start your search on eBay, you will come across various various types of sellers. Some will be individuals but a lot of them will be companies specializing in timeshare resales. Generally, you can locate the timeshare companies website based on the user name they use on eBay or in the details of the post. If you find a timeshare that interests you from a timeshare company on eBay, I would recommend finding the company online and seeing if they are offering the same or similar timeshare on their own website. Sometimes prices can differ from eBay prices to direct prices in a significant way. Additionally, it is generally better to work directly with a timeshare company for resale purchases since the timeshare purchase generally takes 3-6 months and eBay is not the ideal platform for these types of purchases that take time to close and finalize as disputes and resolutions need to occur within a set amount of time following the purchase and if there are any difficulties, it usually will occur outside of this window set by eBay. Timeshare Users Group (TUG) If you want to buy a timeshare, you need to find TUG. TUG is one of the first timeshare focused forums. The amount of information on the site is staggering and the participants on the forum are very helpful and friendly. In addition to being a great resource, they also have a Timeshare Marketplace. The Timeshare Marketplace is a great spot to see asking prices, see various inventory and get a good feel for the market for timeshare resales. Many timeshares listed through the Timeshare Marketplace are from individual owners. Therefore, there can be more direct communication and more negotiation. However, when you purchase directly through an individual owner, you need to make sure to use a good closing company to assist in getting the paperwork done right. Timeshares are real property purchases and there will be deeds and recordings in the public records so it has to be done right in order for it to be valid and to make sure that there are no unwelcome surprises down the road. TUG is free to join but they do have a paid membership option which gives you access to posting timeshare sales in their marketplace as well as reviewing their timeshare reviews. It is $15 per year. Sum Day Vacations Sum Day Vacations is a timeshare reseller based in Branson, Missouri. They are active on eBay and they have all of their inventory listed directly on their site. They also have the prices listed on the site so you can see the various asking prices. Sum Day Vacations does have a good reputation on TUG and I personally used them for my recent Hyatt Residence Club purchase. While there were some snags along the way, I thought that they handled the transaction well and in the end, got me the timeshare that I wanted at the price point that I wanted. Here is an overview of that purchase. One thing to consider is that Sum Day Vacations does have the prices listed on the website but do note that you are free to make an offer for any timeshare at any price. When I found the timeshare that I wanted, I made them a lower offer than what was listed on the website and it was approved. Redweek Redweek is another popular website that offers timeshare resales, rentals and information. Redweek does have a fairly active site with multiple timeshare resales BUT they are a subscription based website. In order to review the details of the resale postings, you need to be a member. Registering as a member will only cost you $18.99 for 12 months. I personally am not a big fan of having to pay to get access to information or purchase something that I may or may not want. There are so many other sources for timeshare resales that it is difficult for me to recommend signing up as a member. I would say that the vast majority of the time, anyone advertising their timeshare on Redweek will also advertise it on multiple other forums and sites. Unlike Redweek, TUG is free to review the ads and contact the sellers so it could be a better option at first. If there is something listed on Redweek and you cannot find it other sources, it could be worth the $18.99 to evaluate that option. Conclusion: I was going to put together an entire guide to resale purchases in one post but once I got started, I realized that it was going to be way to lengthy for anyone to read it in one sitting. As a result, this is part one of series of posts that I will do concerning timeshare resale purchases. In the next post, I will explain the contract process once you have found the timeshare that you want to purchase. The sources listed above are just some of many. I have personally found the timeshares that I purchased through eBay and then found the actual company website and dealt directly. I have had good luck with my purchases but as you probably know or have heard, the timeshare industry is rampant with fraud and scams. Make sure you know who you are dealing with before purchasing or entering into a transaction. Stay tuned for Part II on timeshare resales! What other websites or sources have you used to find timeshare resales? Make sure to comment below to help others! Navigating a timeshare purchase on the resale market can be tricky. Prices are not very transparent and there are plenty of timeshare sellers but there are definitely some that you should stay away from due to potential scams or lower quality expertise that may leave you with a purchase or bills that you didn't expect. I keep promising a full timeshare resale guide and it is in the works but time has been difficult to obtain for the past few weeks but it will be here soon. If you have read this blog before, you know that I recently purchased a second Hyatt Residence Club timeshare week. I purchased a resale week since I predominately use my Hyatt Residence Club points for transferring to Interval International. I went through the various ins and outs of my purchase but a reader sent me a question inquiring about the potential restrictions on resale purchases. If you have been to a timeshare presentation before, the salespeople tend to avoid any questions concerning resale and attempt to change the topic when these items come up. The price discrepancy between buying from the developer and buying resale is massive with potential savings of greater than 90% off developer pricing when buying resale. Timeshare developers know this so they do a couple of things to persuade people to avoid purchasing resale. Unknown Bills When you purchase a resale timeshare, there could be past due maintenance fees, a loan associated with the week or pending special assessments. If you do know adequately inquire with the timeshare developer or main timeshare program, you could get stuck purchasing a week with a hefty amount of debt. This is why you NEED to obtain an estoppel certificate. You can read about it here. Restrictions The other major item that timeshare developers due to resale owners is create additional restrictions on the use of the timeshare. Vistana (Starwood brands) has some of the worst timeshare resale restrictions. If you purchase resale on the vast majority of their timeshare properties, you CANNOT trade internally with other Vistana timeshares. There are a few timeshares properties that DO come with this ability but this is a significant restriction that you need to be aware of before purchasing a Vistana timeshare on the resale market. Here is an overview of that program which details some of these items. Hyatt Resale Restrictions To finally get to the point of this post, I wanted to explain the resale restrictions that the Hyatt Residence Club implements to encourage you to purchase directly from the developer. For owners who purchase directly from the Hyatt Residence Club, you can exchange your week into World of Hyatt points where you can use those World of Hyatt points at various hotel properties throughout the world. Here are some details on how that aspect of the program works. If you purchase resale, YOU DO NOT GET THAT ABILITY. The Hyatt Residence Club blocks resale owners from participating in that program and you cannot exchange your Hyatt Residence Club week or points into World of Hyatt points. You can only use your points to exchange internally to other Hyatt Residence Club properties or exchange through Interval International. Additional Resale Restrictions on the Hyatt Residence Club The inability to exchange into World of Hyatt points was the single restriction that the Hyatt Residence Club implemented for resale purchase for a long time. Resale owners still had the ability to exchange into other Hyatt properties at the same rates as developer sold weeks and had the same reservation Windows as developer sold weeks. Essentially, the only difference between a resale owner and a developer owner was the inability to exchange into World of Hyatt points. All other aspects of the program worked exactly the same. The New Hyatt Portfolio Program As you may know, Hyatt has recently rolled out a new program called the Hyatt Portfolio program. The program is different in that instead of owning a week which has a set amount of points allocated to that week, you purchase points. The more points you purchase equates into various different levels of ownership which provides better reservation windows or points banking capabilities. The details of the new program are here. The issue with the new program is that the points, while being able to be resold, are subject to a right of first refusal (like the legacy weeks). However, I have been told but I have not confirmed this, that the points are subject to a set repurchase amount by Hyatt. In that case, Hyatt would be able to repurchase these points at a set price (likely a tremendous discount to the original purchase price) which would prevent the ability for a secondary market to develop since Hyatt would likely just scoop up the cheap points and resell them for top dollars. Conclusion In a long winded answer, the only restriction on purchasing a legacy Hyatt Residence Club timeshare week on the resale market is the inability to exchange into World of Hyatt points. Thats it! Everything else is exactly the same. In my opinion, saving thousands of dollars makes this restriction completely bearable and in all honesty, the exchange rate for converting into World of Hyatt points is generally poor where even if I could exchange my weeks into World of Hyatt points, I WOULD NEVER DO SO. The issue with many timeshares is that the rules change and evolve so there is always the risk that new restrictions can be implemented on resale purchases. All timeshares track this item so they will always know where you purchased it and how much you paid. Existing timeshare owners are the easiest demographic to market the purchase of additional timeshare weeks or points so the big timeshare companies generally do not want to impose harsh restrictions on resale owners but they do want to impose some meaningful restrictions which can allow them to market owners the ability to purchase additional weeks directly from the developer and remarkably remove these "restriction". There have been plenty of timeshare presentations where I have been given the opportunity to remove my resale designation IF I purchase another week directly from the developer. I have not been persuaded to do so as the inability to convert to World of Hyatt points is not significant enough for me to want to spend tens of thousands of more dollars for a developer week. What do you think of this restriction? Would this prevent you from buying a timeshare on the resale market? In my previous post, I explained what specific timeshares that I own and disclosed that I recently completed a resale purchase of a second timeshare at Hyatt Beach House in Key West, Florida. I now own two weeks at the Hyatt Beach House. It seems strange to say that considering that I have never been to the Hyatt Beach House, have no tremendous desire to go, and did not actually target the Hyatt Beach House to purchase. As explained in my previous post on my personal timeshare strategy, I bought a second timeshare because we travel a lot and I get tremendous value out of my original Hyatt timeshare week. Since Hyatt's legacy program (they have switched to an all points systems called the Hyatt Portfolio program) is a hybrid system where you can use your week or exchange into points, I found that using points to exchange through Interval International can provide enormous value. As a result, I did want another Hyatt week but my only worry was the amount of points associated with that week and the amount of annual maintenance fees. With the legacy program being phased out, I wanted to get another legacy week before they became scarce. The new Hyatt Portfolio Program has some perks but the offered price is extremely expensive. Since it is now a points system, resales point purchases will likely be very rare to find, especially at discounted prices. With this is mind, I do think that it is a great time to purchase a legacy Hyatt week. Out of coincidence, I ended up with another Hyatt Beach House week. So far, my strategy has panned out and have some great trips already planned for 2019 and even 2020 with a bunch of requests pending. While I am working on a complete guide to purchase a resale timeshare (I know that it is way overdue), I thought that I would provide you with the time table of what transpired with my purchase of my Hyatt week. As discussed, I ended up purchasing this unit through Sumday Vacations who used Greatway Services for their closings. Time Table: 8/17/17: Payment was received 8/24/17: Title information received 8/31/17: Documents were signed 9/18/17: Closing documents for GreatWay sent 9/25/17: Closing documents for GreatWay signed 10/12/17: Received Power of Attorney for GreatWay 10/19/17: Right of First Refusal sent to Hyatt 11/9/17: Right of First Refusal decision from Hyatt, (ROFR did not apply) 11/22/17 Deed was sent to the County for Recording 12/20/17: Received recorded deed 12/22/17: Deed sent to Hyatt for the transfer of ownership. Mid January: Access to Hyatt Residence Club website with the ability to make reservations. My Thoughts: As you can see from the times listed above, it took over 4 months for the purchase and transfer to go through. This was a long time. I have purchased resale timeshares before and this was longer than normal. However, in Sumday Vacation's defense, part of this delay was due to me. During the purchase transaction, Hurricane Irma came through Florida and almost had a direct hit on Key West, directly where my new potential timeshare was located. Obviously, I was concerned with going through the purchase if (i) the resort was not going to actually be there and (ii) if the resort got extremely damaged which would result in either a special assessment (one time charge for extraordinary damage) or a significant increase in maintenance fees. I was prepared to go through with the purchase ONLY if the previous owner would be responsible for any special assessments that were issued while they still owned the timeshare. I inquired about this issue and it took some various communications with the parties to determine how this would be handled. Essentially, it was agreed that any assessments before January 1, 2018 would be the previous owners responsibility and anything thereafter would be mine. I was definitely concerned about this but did reach out to the Hyatt Residence Club directly and the resort. While the resort did close for a month or so, the damage was fairly minimal and they did not anticipate any major renovations. With that confirmation, I went forward with the purchase understanding the potential risks. Conclusion: The time table for this particular timeshare resale purchase was longer than normal but I would expect that a typical timeshare resale purchase should take about 60 days. For Hyatt purchases, they have the Right of First Refusal which takes approximately 30 days and the other documents and processes should only take a few weeks. How long have your timeshare purchases taken? |

Archives

April 2020

Categories

All

Archives

April 2020

|

RSS Feed

RSS Feed