|

In case you did not read my recent post concerning my 3 week trip to Hawaii (read about it here), while I did use a timeshare for one week of the trip, I failed to obtain a timeshare for the other two weeks and used A LOT of points in order to stay at the Andaz Maui.

I have written about the Andaz Maui before as it is a fantastic resort and a very worthwhile redemption for your Hyatt Points especially if you have Globalist / top tier status with Hyatt. As you can see, I spent 315,000 World of Hyatt points for those stays and spent 22,500 United Mileage Plus frequent flyer miles per each family member for one way flights to Maui and 22,500 American Airlines miles per each family member for one way flights from Maui. In total, I spent: 315,000 World of Hyatt Points 90,000 United Mileage Plus frequent flyer miles 90,000 American Advantage Miles The total amount of miles spent for this trip was 495,000. Doing the math, this is simply a ton of miles. While I did receive a $28,000 worth of hotel stays and probably $6,000 worth of airfare for this, it is simply a lot of points. Accumulating Points / Frequent Flyer Miles While we were at the Andaz Maui, I spoke to various people about their trip and inevitably a discussion would ensure about points. A lot of people were staying at the hotel on points and a decent amount were not. One question that kept coming up is how I accumulate my points / miles. The easiest answer is generally credit cards. Credit card bonus have increased dramatically over the past few years as competition has significantly heated up in order to motivate credit card issuers to be at the top of your wallet. Credit cards get paid by the merchants every time you swipe the card and get paid for those who keep balances (NEVER KEEP A BALANCE!!!). The credit card issuers want you to use your card for every purchase. Over the years, I have taken advantage of a lot of credit card sign up bonuses. It is generally the easiest and quickest way to accumulate a lot of miles. However, before you start applying for various cards, you need to have a strategy. Credit Card Application Strategy In this post, I took the position that the lucrative credit card sign up bonuses are on their way out and timeshares could potentially be the next frontier on cheap / luxurious travel. The reason why I take this position was that in the past, you could simply apply for a credit card, get the bonus, cancel the card and reapply. It was a GREAT way to accumulate points. It wasn't too longer for credit card issuers to catch on this strategy and began making adjustments to their offers and limiting how many times you could get the bonus. Before we get into the specific rules on various credit card issues, before you begin applying for cards, you need to know where you stand in terms of a credit score. I use CreditKarma which is a great FREE tool to receive your credit score. Take a look at your credit score so you know where you stand. 760 and above should put you in a good place to get almost any card you desire. The other tool that I recommend is the Experian app. Here is the link for IOS. Experian also provides you with a score but also allows you to view your credit report and most importantly, what accounts you have opened and the when you opened them. This is important for the rules outlined below. Important Rules Chase Bank The reason that you need to know the amount of credit cards you have opened is because of a fairly new rule termed 5/24. This is Chase's rule where you will be automatically denied for any new application if you have opened up 5 new credit card accounts with ANY bank within the past 24 months / 2 years. When you apply for a Chase card, they will review your account and if you have more than 5 accounts opened, you will get denied regardless of your credit score, whether you a Chase Private Client Customer or whether you have millions of dollars in the bank with them. It is a hard rule. American Express The other important rule is from American Express. Instead of a 5/24 rule, they have a lifetime rule. If you have received the bonus offer for a particular credit card in the past, you are prohibited from receiving it again for your "lifetime". While I do not have any data points, a "lifetime" for American Express used to be considered 7 years but I do not know whether that is still accurate. Fortunately, American Express has rolled out a new tool so that when you apply for a credit card, if you are not eligible for the bonus offer, they will inform you BEFORE they run your credit. Citibank Citibank has also implemented their own rules for their Thank You card. Basically, if you have received any sign up offer for their Premier Card, Thank You Reward Card or Prestige card within 24 months of opening OR closing an account, you are not eligible for the bonus. With Citibank, not only do you need to be aware of the opening date, but if you received a bonus offer 3 years ago, closed the account and attempted to reapply, you would be denied the bonus since you closed the account within 2 years. The best strategy is to open an account, have it for 2 years, apply for a different variant of the card and close the previous card after you receive the new card. If you mess this up and close the card before you reapply, you will get denied the bonus. Other Banks There are other credit card issuers that all have similar rules. Barclays and Bank of America are others who have some type of similar restrictions. However, the vast amount of great credit card offers are generally offered by Chase, AMEX and Citibank. In order to try to keep this post readable, I am not listing the rules for Barclays and Bank of America. Application Strategy Once you are aware of your score, how many accounts you have opened in the past 2 years and understand the restrictions in place, you should have a strategy in place to go forward and apply. Since Chase has the most restrictive policy, I would generally start applying for Chase cards. This way you can avoid the automatic denial for having more than 5 cards. However, depending on how many you cards apply for, you will almost certainly be denied further cards for 5 years so you need to make the determination on how many to apply for as new offers constantly appear and you may be denied a stellar bonus if you have 5 or may applications. Married? An interested strategy that often seems overlooked at times is that if you are married, there are 2 people eligible for the bonus offer. It is not one per household but rather one per person. The best strategy for good offers is to apply for each spouse. You can accumulate double the amount of points. The other potential / questionable strategy that you can use is one spouse applies for the card and once approved, you can refer your spouse to apply for the same cards with additional bonus points. A simple but effective strategy to get even more points. Personal and Business Cards The credit card issuers make a lot of money off personal cards but they also want your business spend. There are personal and business versions of various cards. if you have a legitimate business with its own employer identification number, most business cards will not report to your personal credit report but if it is Chase, they will still review your report to determine if you have surpassed the 5/24. However, for future cards, the business card application will not count towards the 5/24 since it does not show up on your personal credit report. If you do not have an EIN, you can still apply for a business card as a sole proprietor and use your social security number. You need to have a bonafide business but selling on eBay or doing some side gigs definitely qualifies. Business cards are a great way to add to your points / miles stash. My Strategy I have been doing the credit card application game for a while now which is why I have some many points accumulated. As a result, I am limited to the amount of American Express cards available to me and generally always have about 5 cards opened in the past 2 years which limits my ability to get new offers. However, if I was to begin with a clean slate, here is what I would do. I would start by applying for Chase cards, both personal and business, and apply for up to 5 cards. I would then move on to American Express and Citibank. Some links provided are my referral links. I would greatly appreciate you using those links to help support the blog! Chase Personal Cards: The Chase Sapphire Preferred is a great card that generally offers 50,000 Ultimate Reward Points. This is a solid card to start. The new Chase World of Hyatt card is a great card. While it was just offering 60,000 World of Hyatt points, it is now been reduced to 50,000. You may way to wait on this one. World of Hyatt points are great and this card gives you one free night in a category 1-4 hotel each year. This easily pays for the annual fee. The Chase Southwest cards just came out with a great offer where you can get a companion pass after a $4,000 spend. There is a lot of buzz about this offer. A better strategy is to open a Chase Southwest Business Card where the introductory offer is 60,000 Rapid Reward Points and another personal card (in flight offers are currently 50,000 Rapid Reward Points) which would get you the 110,000 Rapid Rewards Points to obtain the companion pass for this year (2019) and NEXT YEAR (2020). However, I think that the companion pass offer is decent and had I not applied for the Priority card before the offer was extended, I would have taken advantage of it. The Chase Sapphire Reserve is a good card but Chase restricts the bonus to either the Sapphire Reserve or the Sapphire Preferred. Either one is a good card but the Sapphire Reserve use to be offered with 100,000 Ultimate Reward Points and now just offers 50,000. Chase Business Cards: The Chase Business Southwest cards offers 60,000 Rapid Reward Points and is a great addition to a personal card if you want a 2 year companion pass. TheChase Ink Preferred is a stellar card and offers 80,000 Ultimate Reward Points. This is a must get card for 80,000 Ultimate Reward Points. Chase Ink Business Cash card is actually a great card. Even though it states that it is a cash back card, if you have another card that earns Ultimate Rewards points, you actually get Ultimate Reward Points instead of cash and while it can be redeemed for cash, you are much better using it for travel and particularly transferring those points to Chase partners. American Express American Express use to be my favorite card issuer but after a few denials for bonuses that was assured of receiving from multiple representatives and supervisors, I don't generally use them for much spend. However, they do have some great bonus offers. The American Express Platinum Card is expensive but comes with various perks. Offers range from 25,000 - 100,000. 75,000 American Express Rewards Points or higher would be worth it for at least the first year. The American Express Gold Card just went through some changes and can be a decent deal if you use the perks that come with it. A big plus is the 4x points on dining. The American Express Everyday Card is not a great card but does not have an annual fee. It is one of the only cards that earns American Express Reward points without having a fee. The reason you want to have this card in your wallet is if you cancel some of the other American Express cards that have high annual fees, you will forfeit you points earned unless you transfer them out to another program or have another Amex reward point earning card. By having this no annual fee card, you can keep you Amex reward points even after you cancel other cards. It is great to have and could be useful for some spending. American Express Business The American Express Business Platinum card is another good card and while the fee is expensive, it could be worthwhile. Bonus offers vary for this card but it now currently 75,000. The American Express Delta Skymiles Business Card has been offering some great signup offers between 50,000 and 75,000. Also, this card does come with one free companion airfare certificate which can easily make up for the $195 annual fee if used. Citibank Personal The Citi Premier Card is a good card that I keep in my wallet. 3x points on travel and gas makes it worthwhile. 50,000 sign up bonus is decent as the highest I have seen is 60,000. The Citi Prestige Card is also a good card but it just got revamped. The fee went up and the perks went down. I do not recommend this card at the moment but if a worthwhile sign up offer comes along, it could be beneficial. There are no available applications at the moment. Citibank Business The Citibank Aadvantage Business card currently offers 75,000 Aadvantage miles. I think that this one is worthwhile. Credit Score: A lot of people will read this and be extremely worried that your credit score will be obliterated after applying for the amount of these cards. In actuality, you credit score will likely immediately decline but after a few months will actually go up. Your credit score depends on a number of factors but the two most important are paying on time and utilization. Utilization refers to the amount of credit available and how much you use. If you have a $1000 credit limit and use $900 during a month, you are utilizating 90% of your credit which will cause your score to materially decline. If you have a $10,000 credit limit and use $900 during a month, you are using 9% of your credit which should positively impact you. Essentially, having a lot of credit available to you through multiple credit cards but only using a small percentage will actually help your score. Between my wife and I, we have about 30 credit cards and both of us have an over 800+ credit score. Conclusion: This post became a lot longer than anticipated as there is a lot of information to cover on this topic. While I attempted to be concise, there is a lot of knowledge to pass on in order to apply for credit cards with a good strategy. As you can see, the bonus offers of 50,000 to 100,000 per cards can be extremely worthwhile especially if both spouses apply for personal and business cards. It is not uncommon that you can easily accumulate 1,000,000 bonus points by simply applying for a combination of personal and business cards. In some follow up posts, I will go into some more details on how I spend on my various credit cards and some additional beneficial ways to accumulate miles cheaply and easily. The goal of the blog is to explain timeshares but if you want to truly maximize timeshare ownership, you should also have good strategies to obtain credit card points, hotel points and frequent flyer miles. Besides getting free flights to various destinations, many timeshare strategies involve using hotel points. Make sure to comment below!

Timeshares are a great way to travel but they simply do not work for every trip. Additionally, the only way that I personally am able to travel as extensively as I do is through frequent flyer points and credit card points which allow me to book airfare for free or fares that are significantly discounted.

I have not gone into a lot of details of this subject but I have discussed the importance of getting miles in this post. Credit card signup bonuses are one of the best and easiest way to quickly accumulate various types of points. It is a quick and easy way to travel for free. Current Offer for the Chase Sapphire Preferred I wanted to quickly get this post out because Chase recently increased the signup bonus for one of their most popular cards, the Chase Sapphire Preferred Credit Card. There are two offers currently available - one offer for 50,000 ultimate reward points with the annual fee of $95 waived and the second new offer for 60,000 ultimate reward points with the annual fee of $95 NOT waived. Both offers also allow you to add an authorized user and once the authorized user makes one purchase, you will be given an additional 5,000 points so the offers below are really 55,000 or 65,000 ultimate reward points. Redemption Options Both are truly stellar offers as ultimate reward points are a fantastic travel currency. These ultimate reward points can be redeemed in various ways including the following:

Favorite Transfer Partners One of my favorite transfer partners is easily Hyatt as you can use 60,000 ultimate reward points to stay 4 nights at the Andaz Peninsula Papagayo which I reviewed here. Nightly room rates vary by season but if you redeem these points over Christmas break, this one credit card offer can easily save you close to $5,000 as rates at that particular hotel are going for over $1200 per night! One of my other favorite uses of ultimate reward points is actually through Flying Blue, the loyalty program of KLM / Air France. This is a lesser known partner as KLM and Air France are based in Europe but they are partnered with Delta. As a result, you can use ultimate reward points to book Delta flights with Flying Blue. One of the best sweet spots in this program is the ability to fly to Hawaii from anywhere in the United States for only 30,000 points. Therefore, you can get two round trip flights to Hawaii solely by signing up for one credit card! If you are a couple, both spouses can sign up for these cards and get double the amount! Many people are concerned with credit cards as they could impact your credit score. However, while they may be a little impact to your score at first, if you pay it off every month (which you NEED TO DO), your score can actually go up since you will have a positive credit history. Conclusion I truthfully think that both offers are fantastic as the Chase Sapphire Preferred card is a great card for everyday use. However, in an effort to make sure that this is clearly transparent, the 50,000 offer below is my referral link and the 60,000 is a public offer. My preference would be to receive the 60,000 ultimate reward points but some people prefer to save the $95 and take a lower offer. You should be aware that if you already have the Chase Sapphire Reserve card, you will be ineligible for this bonus so it is not worth applying for at this time. If you are not involved in getting free travel through credit card signup bonuses, you are missing out on tremendous offers. I have posted this before but this is definitely a good read if you want to know how credit cards can help maximize travel. Timeshares can be a great tool to receive cheap accommodations but frequently flyer miles and credit card points give you the ability to get to your destination for free which can easily save thousands of dollars but more importantly, can give you the flexibility to travel anywhere in the worth without regard to cost! What credit cards do you use?

In case you missed it, I took my family on a month long vacation to Costa Rica. Here is how I did it on the cheap.

One thing that you should take away from that post is that there are many strategies that you need to have in order to get great luxury affordable trips. Timeshares are great for many trips but they don't always work out perfectly for every trip. Credit cards can have a bad reputation to some people while to others, they have become the key to free travel. The credit card landscape is highly competitive and very lucrative for the credit card issuers so they have been actively increasing sign-up bonuses, bonus categories for spend and various perks (status, lounge entry, Global Entry credits, travel credits, etc.) that go along with these cards. In addition to maximizing my timeshare ownership, I am an avid points and miles collector and an avid credit card user. Between my wife and I, we have about 30 credit cards that are divided between personal cards and business cards. Despite the high amount of credit cards, we both have a mid-800 credit score which is superb. As I mentioned in my post on Costa Rica, I utilized various different frequent flyer miles, points and credit card perks. I will not rehash everything that I used for that trip but I did want to provide my readers with some insight on what I currently carry for my credit cards. Despite having 30+ cards, there are only a few that remain in my wallet, either for day to day use or for some other perks associated with it. Here is a list in no particular order:

The American Express Business Platinum card holds a space in my wallet for a few key reasons. The first is the access to the American Express Centurion Lounges. I have had access to various airport lounges in the past and most offer free drinks, some peanuts or pretzels and a quiet area to relax.

The American Express Centurion Lounges are completely the opposite. They offer fantastic food, free spa services, signature cocktails, and handpicked wines. These lounges are truly fantastic and with either an American Express Business Platinum or an American Express Personal Platinum, you can get free access for you and two additional people. The second reason is the somewhat new redemption option. You can redeem you Membership Rewards points for flights and receive 50% back. They have since changed this so you know only receive 35% back. Despite this change, it can be very beneficial. While many frequent flyer programs require frequent flyer availability or require a tremendous amount of miles to get to a destination, Membership Reward Points can be redeemed for 1 cent per point for flights. This value is quite bad and would have never redeemed my Membership Reward points for flights but with the 50% rebate, you now receive 2 cents per point or slightly less now with the change to a 35% rebate. This option has opened up many more opportunities for free flights since the redemption with Membership Reward points are based on the cash value of the flights which can be much more reasonable than using frequent flyer miles. Many times, with the new 35-50% rebate, you can redeem Membership Rewards for far less than the amount of frequent flyer miles needed for the same trip. Many times, I actually arrange for a layover in Dallas or some other airport that has a Centurion Lounge even if a non-stop is available. They are actually worth it! They are currently available in Dallas, Houston, Las Vegas, New York (La Guardia), Miami, Seattle and San Francisco. I anticipate that more are in the works.

As I mentioned in my review, I used the Citibank Prestige for the 4th night free benefit. The card has some additional perks but I use it predominantly for the 4th night free benefit.

Basically, if you have the Citibank Prestige card, you can make a hotel reservation for 4 or more nights, and Citibank will provide you with a statement credit equal to one night based on the average cost of the 4 night stay. This is a tremendous perk that can easily justify the $450 annual fee. I generally use this perk for 4 night hotel stays where timeshares simply do not work. There are some other reasonable perks for this card but for me, I use it simply for the 4th night free benefit.

The Chase Ink Business Preferred is a fairly new card for Chase and is offering a staggering 80,000 point sign up bonus. This 80,000 ultimate reward points can be redeemed for about $1000 in travel or if you have another one of Chase's card, the Chase Sapphire Reserve, this 80,000 points equates into $1,200 in free travel.

I got this card mostly for the sign-up bonus. Ultimate Rewards are very valuable as they are flexible in that you can transfer points to travel partners such as Southwest, United and Hyatt or redeem them for 1.25 - 1.5 cents per point, depending on what card you have. I jumped on getting this card for the 80,000 sign-up bonus. This can get you five free nights at the Andaz Peninsula Papagayo resort simply for signing-up. In case you missed it, here is my review on the resort which was absolutely terrific. If you want to support me and the site, I can generate a referral for you to apply to this card. Please send me an e-mail and I will make sure to get you a application that would be sent directly by Chase.

The Amex EveryDay card is a decent card. They have the Amex EveryDay card and the Amex EveryDay preferred card. The Amex EveryDay does not have an annual fee and earns Membership Reward points. It is the first card that earns Membership Reward points without an annual fee.

This is important since you can keep this card active without paying a fee and maintain whatever else you earned on American Express premium cards without the possibility of losing those points when cancelling a card. The American Express Business and Personal Platinum card are fantastic cards but each year when the $450 annual fee comes due, I definitely think long and hard on whether I am getting enough value out of the card to justify the fee. The other benefit to the Amex EveryDay card is that you can receive 20% more Membership Reward points for each statement period that you have 20 or more transactions. 20% isn't much but it is decent bonus. The Amex EveryDay preferred has a similar feature but earns 50% more when you have 30 or more transactions. I tend to use this card on any purchases that only earn 1 point. When I do use it, I make sure to make at least 20 purchases in the month in order to get the extra 20%. Conclusion I have tons of more cards than what I have gone through here, but many of them simply reside in my sock drawer until I go to the branded hotel, fly the particular airline or have some specific need based on the benefits of the card. I have cards that I keep simply for the free annual night, cards that get me free checked bags, or cards that get me hotel status simply by having it. Like timeshares, credit cards do have a bad reputation but as many can attest to, if you understand the systems, you can really maximize their use. As I mentioned in many other posts, timeshares can be great but if flights cost too much, you many not be able to use that timeshare week. Many times, cheap flights do not coincide with great timeshare weeks so you need to have hotel points to bridge the gap between reasonable flights and your timeshare week. Credit cards and their lucrative sign-up bonuses are a great way to quickly get tons of points so that you have various tools available to assist in traveling well and affordably. What cards do you carry? What cards should we all have / use? My family took an extended trip to Costa Rica for the month of July. While I would have highly preferred to be able to stay in timeshares for the entire trip (mostly due to space and having a full kitchen), this was not doable for a few reasons. Costa Rica is a wonderful destination but they simply do not have a ton of timeshare options. There are a few but not many high-quality timeshares which is an absolute must. We did stay at the Breeze Private Residences for one week (review is here) which was a timeshare property but I simply could not find suitable timeshares in Costa Rica for the entire month. Planning Strategy Booking a month vacation has its various challenges but doing it in a very cost-effective manner is difficult. As I mentioned in other posts, I am a huge points and miles fanatic so I have plenty of points and miles available to use. Using Citi Thank You Points For this trip, my family of four flew American Airlines to Liberia. I used Citi Thank You points for our fights. As a Citibank Prestige Credit Card holder, I was able to redeem my points for 1.6 cents per point. This option just vanished on July 23, 2017 and points are now worth less. Southwest Rapid Reward Points For our return flight, we flew Southwest Airlines. I am a huge fan of Southwest as they are the last airline that offer customer friendly policies – free bags, free cancellations, free changes, etc. Additionally, their customer service agents are generally friendly and helpful which is very noticeable when comparing it to other airlines. My wife and I both have a companion pass with Southwest so we are able to have our 2 kids fly with us for free. We were each able to score the companion pass through the option of exchanging our Marriott points to Southwest points with the available Marriott travel packages. Unfortunately, this option is now no longer available as of January 1, 2017. With the above methods, my family of four was able to get free roundtrip flights to Costa Rica. A good start. Week 1: Playas del Coco I was able to grab a fantastic deal through RCI for staying at the Breezes Private Residence Club. I paid $278.99 for the entire week in a 2-bedroom unit. This was an absolute steal as nightly rentals for this particular property were approximately $450 per night. The Breezes Private Residence Club is located in Playas del Coco and is a great area. There are tons of restaurants and activities right out the front door. I would highly recommend this destination and would definitely recommend the Breezes Private Residence Club.

Week 2: Arenal Volcano in La Fortuna

For week 2, we traveled to La Fortuna / Arenal which is located inland in the rainforest. La Fortuna / Arenal was a very cool destination with the volcano as the centerpiece. For our trip to Arenal, we stayed at the highly rated Hotel El Silencio del Campo. We chose this based on the Tripadvisor reviews which were stellar. The property generally lived up to those expectations but would say that the rooms, although spacious, needed a refresh. The décor and bedsheets were older than I would like. It was clean but definitely felt old and tired. However, breakfast was stellar, they had hot springs on the premise, fruit trees galore to pick throughout the property and had an awesome view of the volcano when the weather permitted. Citibank Prestige 4th Night Free Benefit For this stay, I again used our Citibank Prestige Credit Card in order to utilize our 4th night free benefit. If you are not familiar with this benefit, it can be extremely rewarding in that you will receive the 4th night free on any hotel booking made through the Citibank portal. This can literally save you thousands of dollars. The Citibank Prestige Credit Card has done an overall of its card and has revised some of its offers but they have kept in the 4th night free benefit and made it easier to get by expanding the ability to book online. For those of you interested, here is a link to the offer with 75,000 bonus points. A complete no-brainer to apply in my opinion.

For our stay in La Fortuna / Arenal, I paid about $200 per night for 4 nights and I will receive a $200 credit through Citibank’s 4th night free benefit. This effectively gave us 25% off our stay in Arenal which is decent considering that there are no timeshares or points based hotel chains in this area.

Week 3 and 4: Andaz Peninsula Papagayo Resort

For those of you in the miles and points world, there is a ton of buzz about the Andaz Peninsula Papagayo Resort. The reason that there is so much buzz is because it is an extremely nice resort and is only a category 4 hotel in Hyatt’s World of Hyatt program. This is significant in that the Chase Hyatt Credit Card gives you a free night stay in a category 1-4 hotel each year upon paying the annual fee of $75. Essentially, for $75, you can get a free night at the Andaz Peninsula Papagayo Resort where nightly rates are generally somewhere between $250-$1200 where the $1200 a night has been seen over Christmas. Also, since the Andaz Peninsula Papagayo Resort is a category 4 hotel, you can use 15,000 Hyatt World of Hyatt points per night which is a very good deal. The cash plus points rate of 7,500 points per night plus a payment of $100 per night is also a stellar deal. I will be posting a full review on our stay so stay tuned. Using my Chase Hyatt Free Night Certificate We ended up staying at the Andaz Peninsula Papagayo Resort for a total of 16 nights. I used my free category 4 certificate from my Chase Hyatt Credit card for the 1st night. Using Hyatt Points or Cash For the remaining 15 nights, we actually paid cash (a rarity as I almost always use points for our hotel stays!). This was not expected as I had planned on using the points plus cash option for 15 nights. If I had done this option, I would have used 112,500 Hyatt World of Hyatt Points and paid approximately $1500 for 15 nights. The cash plus points options is highly beneficial and would definitely recommend it. $100 per night for this resort is almost unheard of and I would pay that in a second. Using Hyatt's Best Rate Guarantee As I mentioned, I actually paid cash for the 15 night portion of our stay since I got a great rate with Hyatt. I was able to use Hyatt’s best rate guarantee. Hyatt’s best rate guarantee provides that they will match any rate you find on other websites and give you an extra 20% off your entire stay. I was lucky enough to find a lower rate for this time period and was successfully approved for the best rate guarantee. As a result, my nightly rate for 15 nights was approximately $156 per night. The Hyatt best rate guarantee has been revised as of July 31st where instead of giving you 20% off the matched rate, they will give you a $50 voucher for future travel. While they will still match the lower rate, they will not give you the extra 20% off. Hyatt can make you jump through various hoops to get their Best Rate Guarantee but I have been successful in using it. This revision is really bad for the way that I use the Best Rate Guarantee. I am not happy about this change as this will likely affect my hotel choices going forward. Marriott offers a 25% discount for its best rate guarantee and is much more accommodating than Hyatt but I definitely like Hyatt's properties. We'll see how this plays out before I switch my loyalties. Despite preferring timeshares for our travels, I will actually be a Globalist (top tier elite status in Hyatt) this year so we'll see how Hyatt treats me going forward. As stated, I was able to secure a rate of $156 per night. While higher than the per night cost of using the points plus cash rate of $100, I chose to pay cash instead of using 7,500 points per night. If I used points, I would be redeeming them a rate of less than 1 cent per point (0.007) which is a horrible deal. I generally get 2-3 cent per points and have received upwards of 6 cents per point for various redemptions. Therefore, I elected to pay cash. The total bill was about $3,000 for 15 nights. Higher than I would normally like to pay but still a good deal. Rates for our room (the Andaz Suite) during our stay were approximately $600 per night so we did well. Using Gift Cards for Further Discounts In an effort to get even more of a discount for our stay, I ended up purchasing Hyatt gift cards through cardcash. Cardcash is a second-hand reseller of gift cards. They buy gift cards from people who do not want gift cards for a discount and resell them to people who can use them and make a profit of the difference. Cardcash has mixed reviews and there are definitely times when gift cards arrive with zero balance or the balance disappears after purchasing. They offer a 45-day guarantee where they will refund your money if the cards value is not as described or disappears within 45 days. I have had good experiences with Cardcash but I only purchase on the day that I will be using it. I purchase it and immediately apply it to my room. This limits the chance of getting a bad card or having your balance disappear. I did receive one bad card and my order was refunded within 48 hours of purchase. For this stay, I was able to get Hyatt gift cards for a discount of 16% through Cardcash. Their discounts fluctuate but I was able to purchase $3,000 worth of Hyatt gift cards for about $2520. Using the Chase Ink Card for 5x Points One of the added benefits of using Cardcash is that purchases through Chase Ink Credit Card are coded as utilities which generate 5x Chase Ultimate Reward points. Therefore, by purchasing $2520 worth of Cardcash gift cards through my Chase Ink credit card, I received 12,600 Chase Ultimate Reward Points. Chase Ultimate Reward Points are very valuable and can transfer into multiple travel partners including Hyatt or can be redeemed for about 1.25 cents per point or for 1.5 cents per point if you have the Chase Sapphire Reserve Credit Card. Final Tally and Summary As you can see, I used multiple different strategies to get a month of vacation in Costa Rica. For our flights, these were completely free using Citibank Thank You Points and my Citibank Prestige Credit Card to redeem for American Airlines for our flight to Costa Rica and used Southwest Points for our return flights. Our kids fly free with us on Southwest since my wife and I both have the Companion Pass at the moment which we achieved by redeeming Marriott travel packages. For the first week, we used a timeshare and rented it through RCI’s Extra Getaways for a purchase price of $278.99 for the week in a 2-bedroom. No timeshare presentation required even though I did attend one ( I am The Timeshare Guru so I kind of needed to do it). For the next 4 nights, I used my Citibank Prestige Credit Card to take advantage of the 4th night free benefit. The total cost for these 4 nights was $800 minus the $200 credit for a total of $600. For the following 16 nights, I used my annual free night certificate for my Chase Hyatt Credit Card and paid cash for the remaining 15 nights. I was able to get a great rate using Hyatt’s Best Rate Guarantee. I was able to purchase discounted Hyatt gift cards for a further discount of 16% off our entire stay so the total was $2520 for 15 nights which is $168 per night which includes the resort fee and taxes. By purchasing the gift cards, I was also able to get 5x Chase Ultimate Reward Points by using my Chase Ink Credit Card for Cardcash. Therefore, even if I valued these points at only 1 cent per points, this equates to another discount of approximately $126. Here are the total numbers for accommodations for our month of travel:

Total: $3,272.99 Conclusion: The above is an actual real world example of how I utilize timeshares, frequent flyer miles, hotel points, credit card points and perks, hotel best rate guarantees and gift cards to maximize my travel. This can be complicated but it is doable. As you can see, we saved multiple thousands of dollars off of retail prices and traveled in luxurious accommodations for an entire month! I will be doing a detailed review of the Andaz Peninsula Papagayo resort in an additional post as this is definitely a property to check out (even though it is not a timeshare). The intent of this blog is to explain timeshares and how they can be a great tool for your travel arsenal. As you can see in the above, it is not the only tool that I use but they can be very useful and affordable. My goal is to show you how to incorporate timeshares in your travel plans and demystify timeshares, their costs and how they can work to your advantage. Timeshares are simply one tool among many to travel well and affordably. What are your thoughts on the above? Did I miss any strategies that I could have implemented? If you find this useful, please share this post across your social media channels! Your support is highly appreciated! World of Hyatt Points vs. Timeshare Ownership: A Comparison on Cost of Booking using both Systems5/13/2017

As I mentioned in other posts, I am an avid collector of points - hotel points, credit card points, frequent flyer miles, etc. I know them all and use them extensively to travel.

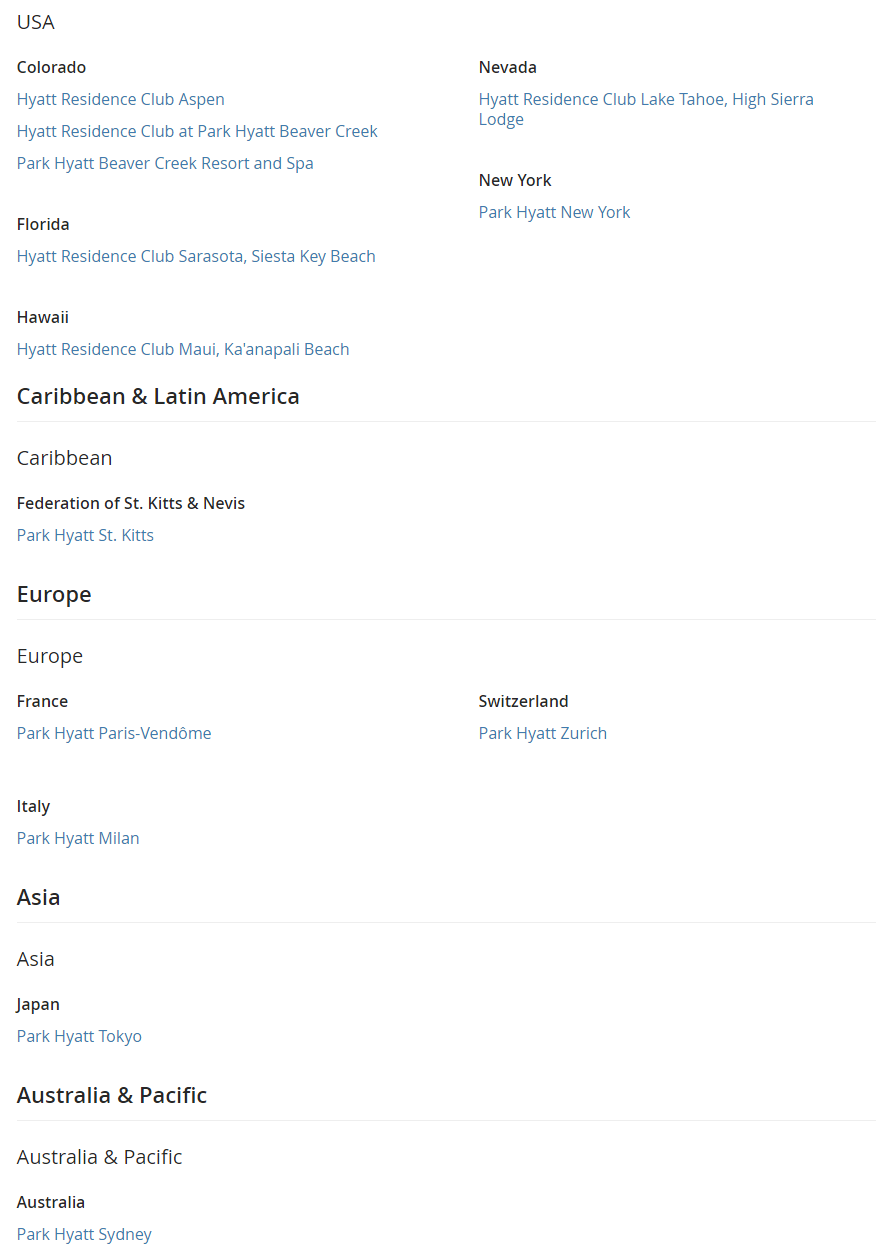

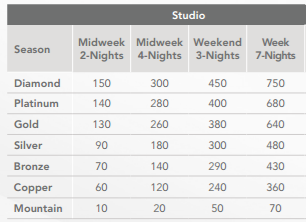

I also obviously own a timeshare and use it in conjunction with my points. One way that I pick destinations is to look at the various hotel programs and look at the highest tier properties. By doing so, I can guarantee that these are luxurious accommodations and generally a fantastic use of my points. As I start my planning for the next big trip, I wanted to see how I can maximize the value of my Hyatt points so I started the search seeing their top end properties which is a Category 7 under Hyatt's system. Hyatt is one of the best hotel loyalty programs as it only costs 30,000 points per night at highest tier Hyatt properties. This is much lower than many of the other major chains. Here is the list of all Category 7 hotels. As you can see in the above chart, I was surprised to see that there are five Hyatt Residence Club properties that are categorized as a Category 7 hotel (there are 17 Hyatt Residence Club properties in total). Curiously, I wanted to see whether using my Hyatt timeshare points would be more valuable than using my World of Hyatt points to book a one week trip. Hyatt points can be very valuable and there are some great ways to get a lot of Hyatt points. In this analysis, I wanted to see the true cost of getting a one week vacation in one of these properties by using timeshare points versus using World of Hyatt points. Since these are category 7 properties, it takes 30,000 World of Hyatt points per night for a studio unit. Therefore, it will cost 210,000 World of Hyatt points for a week stay in a studio unit. A one bedroom or two bedroom would cost more. In an effort to compare apples to apples, we will assume that we can reserve a studio unit using both programs as availability using World of Hyatt points and Hyatt Residence Club points can be difficult. OBTAINING WORLD OF HYATT POINTS: There are many ways to get World of Hyatt points. You can stay in Hyatt hotels, use the Hyatt credit card or use various credit cards associated with Chase Ultimate Rewards. One of the best ways that I have found to get Hyatt points is through the Chase Ultimate Rewards program and in particular, using their business card (Chase Ink Bold or Ink Plus) to get 5x points on various spending categories including office supplies, utilities and telecom charges. If you exclusively purchase items in the 5x categories, you would need to spend approximately $42,000 on your credit card to generate 210,000 Chase Ultimate Reward Points which can be transferred to Hyatt on a 1:1 basis. For the purpose of this post, lets assume that for a cost of $6.95, you can receive 1,034.75 points. This figure was chosen for a reason as this is generally the cost of Visa or Mastercard gift cards in $200 increments. Based on the assumption of using $6.95 to "purchase" 1,034.74 Chase Ultimate Reward points, it would cost you $1,459.50 to obtain these points requiring a purchase of approximately 210 $200.00 increment gift cards. The math is as follows: 210,000 divided by 5 = 42,000 42,000 divided by 200 = 210 210 times 6.95 = $1,459.50 Alternatively, if you could purchase higher denomination gift cards (i.e. $500) (not very available anymore), the math would be as follows: 210,000 divided by 5 = 42,000 42,000 divided by 500 = 84 84 times 6.95 = $583.80 Therefore, it will require you to spend $42,000 on a card that generates 5x points in order to earn enough points for a one week stay at these properties. The cost to spend $42,000 can vary but based on some typical methods, I would argue that it would cost somewhere between $583.80 to $1,459.50 plus a decent amount of time to make these purchases. This "cost"will vary widely so don't hold me to this as a true cost. It is meant as a fairly realistic example in the points world but this figure will highly depend on your individual spending habits. Additionally, some lucrative sign-up offers can lower this cost significantly but even with a 100,000 sign up bonus, you still need an additional 110,000 points. Alternatively, the same example can be used if you stay at Hyatt hotels. Hyatt gives you 5 world of hyatt points per dollar spent with Hyatt. You would need to spend approximately $42,000 in order to get the required 210,000 - a little less if you have any status with Hyatt since they give you an extra 10%, 20% or 30% based on your status. HYATT RESIDENCE CLUB POINTS: I am a Hyatt Residence Club owner and own a week at the Hyatt Beach Club in Key West. I have never been to this destination and likely will never attend. I purchased this week specifically for Hyatt Residence Club points. For this analysis, I am completely ignoring the upfront purchase fee. I have argued in other posts why it is smart to do so but there are many ways to get a timeshare for little to no cost including Hyatt properties. For my specific week, I pay an annual fee of $1,207.46 in exchange for 2,000 Hyatt Residence Club Points. My week was previous allocated 1,300 Hyatt Residence Club Points but the chart was recently readjusted that resulted in a tremendous increase in points for my week. This is a rare occurrence but worked out in my favor. Since we are comparing Studio units to Studio units, here is the chart for the Hyatt Residence Club for exchanging into a studio. As you can see there are seven seasons associated with the Hyatt Residence Club. For purposes of this example, let assume that I want a prime week such as Christmas week - something that I would do with my Hyatt World of Hyatt points. As you can see, lesser demand seasons would require lower amounts of points. As a comparison, World of Hyatt points do not change per season - it always requires 30,000 per night for the five Hyatt Residence Club properties indicated above. In order to get a prime week, this would require 750 Hyatt Residence Club points. As indicated above, I pay $1,207.46 in annual maintenance fees in exchange for 2,000 points. Therefore, my cost per point is approximately $.0.60 cents per point. Here is the math: $1,207.46 divided by 2,000 = $0.60 For purposes of evaluation, lets assume that my week was still worth 1,300 Hyatt Residence Club Points. In this example, my cost per point is approximately $.93 cents per point. Here is the math: $1,207.46 divided by 1,300 = $0.93 In order to reserve one week in a studio unit at one of the 5 Hyatt Residence Club properties using Hyatt Residence Club Points would cost me $450 using $.60 per point or $697.50 using $0.93 per point. Here is the math: 750 times $0.60 = $450 750 times $0.93 = $697.50. For full disclosure, the Hyatt Residence Club charges a reservation fee of $41.00 per reservation so the total upfront fee is $491.00 or $738.50, depending on the specific value. FINAL COMPARISON: Depending on how you earn World of Hyatt Points, I would argue that it would cost somewhere between $583.80 to $1,459.50 to earn 210,000 World of Hyatt Points in order to stay one week in a Category 7 property if you assume that you could entire spend would be in a credit card category that earns 5x. If you earn less than 5x, the cost will be much higher. As an aside, I am ignoring the resort fees for this analysis since Hyatt waives resort fees on award night stays. Hyatt does not charge resort fees on Hyatt Residence Club owners who book using Hyatt Residence Club points. As a comparison, by owning a Hyatt timeshare, my total upfront fee is approximately $491.00 or $738.50. This figure will vary depending on the maintenance fees associated with the particular unit and the allocated amount of points. Therefore, at the low end, using Hyatt Residence Club Points to reserve a week in a studio unit at a category 7 Hyatt Residence Club property has an approximate cost of $491.00 for the entire week. At the low end, using World of Hyatt points to reserve a week in a studio unit at a category 7 Hyatt Residence Club property has an approximate cost of $583.80 for the entire week but this "cost" can vary depending on your spending habits. If you spend $42,000 for business or personal at a 5x category, this "cost" is probably zero but not many people generate that type of spend. CONCLUSION: I am sure that there are many areas which readers can dissect in this post that can allow you to make arguments in either direction - for or against the various items in the analysis. The point of this post is that I wanted to show readers that owning a Hyatt timeshare and reserving with Hyatt Residence Club points can get you into top tier properties and is not very expensive based on the monetary outlay. I argue that it is not very expensive even when comparing it to using World of Hyatt points since there is likely some cost associated with generating the required amount of points. Additionally, I receive my Hyatt timeshare points each and every year. There is no effort to generating credit card spent or obtaining additional points. I simple pay my annual maintenance fee and receive these points. This can be much easier than continually accumulating world of hyatt points through Hyatt stays, credit cards or other means. I did not go through an analysis based on cash bookings but most of these properties would cost over $400 per night which is simply too expensive for me. That is why is love the points world! What do you think of this analysis? Is this accurate? How would you do an analysis on the cost to acquire World of Hyatt points? Make sure to subscribe below!

While it may sound counterintuitive, as a timeshare owner, hotel points can be extremely valuable. Hotel points can be an extremely valuable currency for free vacations but their use for timeshare owners is absolutely instrumental in providing certainty to a particular destination.

I use hotel points for plenty of free or quasi free vacations. Hotel points are fantastic for traveling in high demand time periods and for stays of less than 7 nights. For timeshare owners, the importance of hotel points is that they allow you to book a hotel room in your desired travel destination while trying to exchange into the desired timeshare. Once you have a confirmed hotel room in your desired location, you can confirm your airline flights and continue the search for a desired timeshare. Timeshare exchanges can be difficult and many exchanges may be filled close to date of travel which usually corresponds into ridiculously priced airline tickets. Hotels have very generous cancellation policies where they allow you to cancel your reservation as little as 24 hours prior to arrival. These flexible cancellation policies are vastly different than timeshares which generally do not allow any changes at all. The strategy the I generally use is to use my hotel points to book a hotel as far in advance as possible for the desired week and location. At the same time, I will put in my exchange request with the timeshare company (i.e. Marriott, Hyatt, Hilton, etc.) or put in a request for my desired exchange through Interval International or RCI. Once I know that I have a week at the hotel, I feel confident that I can book my non-refundable airfare or use my frequent flyer miles. Booking far in advance is necessary to ensure that flight prices are reasonable, in either cash or miles. Using this strategy, the worse case scenario is that we end up staying in the hotel for free using points. The best case scenario is that you were able to book your airfare far in advance for a good rate and your timeshare exchange comes through at the desired resort. In either case, it is really a win-win. I have stated before that the easiest way to quickly accumulate miles is through credit card sign-up bonuses. These bonuses fluctuate all the time but there are always some great opportunities. One of my favorite points currency is Chase Ultimate Reward Points. These can be transferred into many different programs including Hyatt and Marriott. Transfers to Hyatt are much more valuable since Hyatt's program has wonderful redemption options for much lower cost than Marriott. However, at certain times, Marriott has some great options and with Marriott and SPG now merged, I anticipate that there will be some wonderful opportunities going forward. Here are two current options that I recommend which provide an immediately influx of Chase Ultimate Reward Points:

Timeshares are great for getting great accomodations for relatively little cost. However, the cost to get to your destination should not be overlooked. While there are plenty of opportunties to get great timeshare weeks for absurdly low prices, getting to those destinations can be really expensive.

I am always suprised that when I speak to people while traveling, they are generally familiar with frequent flyer miles but don't focus on acquiring them since they do not travel a lot for work. This is a very common misconception. The truth is that I use to travel for work and accumulated a decent amount of miles but there are actually much, much better ways to accumulate miles that do not invovle traveling at all. This may be very basic to some people but the vast amount of miles that I collect come from sources completely unrelated to flying. The easiest and best way to collect miles is through credit card sign up bonus. Credit card companies offer tremendous bonuses in order to entice you to sign up for their credit card. There are tons of great opportunities to gain tons of miles that allow you to get free flights, free hotels, upgrades, club access, free global entry and more. For example, one of the newest cards that is being offered by Chase is called the Chase Sapphire Reserve. They are currently offering 100,000 bonus points to get the card. The details are below. This is just one example of some tremendous credit card sign up bonuses that are available. 100,000 bonus points can get you a minimum of 4 free domestic tickets (potentially even more with Southwest) or even more value through various transfer opportunities. At the very least, you can redeem them for travel worth $1500. There are better ways to redeem the points but they are essentially giving you $1500 of free travel just for getting the card. Yes, there is a $450 annual fee but they give you $300 annual credit for travel (essentially cash) and $100 for Global Entry. The perks of this particular card actually justify the annual fee. Other cards may not justify the annual fee so you need to make sure that you are getting sufficient value from these credit cards before you apply and pay annual fees. The goal of this blog is to show you how to travel in luxury for a fraction of the cost of retail purchases of vacations. Timeshares can give you access to great accomodations that are simply out of budget for most people. Despite the poor reputation, timeshares are actually a hidden gem in travel. However, as stated in many posts, the are not for everyone and can be difficult to understand the various programs and you need to plan ahead. The point of this post is that you need to accumulate frequent flyer miles in order to give you the additional flexibility to be able to use timeshares. Frequent Flyer miles can be complex as well but they are very important in order to be able to travel for free or at least get to some wonderful destinations for a fraction of the airfare prices. Flexibility is key in planning timeshare vacations. Additionally, one of the best things about using frequent flyer miles is that you can travel to exotic locations without worrying about the price of the ticket. Frequent flyer miles can give you the travel to places that are simply cost prohibitive. The combination of using timeshares and frequent flyer miles allows me to travel to wonderful destinations that would simply be unaffordable. Travel is extremely expensive these days as airfares keep going up and hotel prices become exhorbinant. There are many ways to maximize timeshare ownership but in order to be able to truly maximize timeshare ownership, you need to have the ability to get to the final destination without breaking the bank. If airfare is too expensive, the fact that you can stay a week in a caribbean destination for $500 becomes irrelevant. The ability to get free airfare for my family through accumulating frequent flyer miles is an important tool and strategy to be able to travel . In other posts, we can explore additional ways to earn miles but there are tons of opportunities to get frequent flyer miles through non-travel. Traveling is actually one of the worst ways to quickly accumulate miles! While this is not an extensive list, you can obtain frequent flyer miles through the following: 1. Credit Card Sign-Up Bonuses; 2. Credit Card use; 3. Rental Cars; 4. Hotel stays; 5. Online shopping; 6. Retail shopping; 7. Dining out; 8. Signing up for TV, Satellite, Cell phones, etc. Again, the point of this blog is to show you how to maximize timeshare ownership but it also my goal to show you how to travel in luxury on a budget. If you are unfamiliar with frequent flyer miles, now is the time to begin to learn the basics on how to acquire them and how to use them to your advantage. Timeshares and frequent flyer miles are complementary tools that can allow you to travel to awesome destinations without worrying about cost. Stay tuned for additional posts on great ways to get frequent flyer miles and great ways to redeem them!

Hotels and airlines have gone crazy with all the fees being charged. Resort fees, baggage fees, upgrade fees, extra person fees, seat assignment fees, etc. The list goes on and on.

While I hope that these fees will end and get reigned in to something more reasonable, unfortunately, we are stuck with these fees for the foreseeable future. I can go on and on about the various fees which I detest but the one fee that truly gets me agitated is luggage fees with airlines. There have been a lot of articles written about baggage fees and the airlines are having a great time charging for them. A recent article just came out that indicated that the US airlines have made over $1 BILLION in revenue from baggage fees alone. Since I detest baggage fees, I am always trying to figure out the best way to avoid them all together. Luckily, there are some fairly easy ways to avoid them. SOUTHWEST AIRLINES: I have written about Southwest Airlines in the past, and they are a fantastic airline. They provide many benefits which most, if not all, of the other major carriers do not provide. One significant benefit is that they do not charge baggage fees for the 1st or 2nd bag. This is a tremendous perk and potentially the last airline that offers free baggage for any flyer. DELTA: Delta is a fairly good carrier. They have spent a lot of money and effort in making their in-flight experience better than the other carriers. I generally like Delta even though their frequent flyer program has significantly been devalued over time. Delta does not even publish award charts for their program so they are free to charge you any amount of miles they deem for redemption of skymiles. Delta also charges baggage fees. They charge $25 for the first bag and $35 for the second bag. These are high and are very frustrating to me especially when I purchase an expensive ticket. In order to avoid these fees, I carry the Gold Delta Skymiles Card from American Express. This card does come with an annual fee of $95 but is waived the first year. For this annual fee, you will receive the first checked bag for free for up to eight passengers on the same itinerary. While a lot of other cards claim to offer free checked baggage, the Delta cards are actually the best since you can book the flights from any travel agency, you do not need to pay for the flights with the actual card and it is valid on ANY Delta flights including international itineraries. Additionally, as of today, they have increased their signup bonus to 70,000 miles for the Platinum card. This is one of the highest offers and definitely worth it for the free baggage fees and signup bonus.

AMERICAN AIRLINES:

American Airlines charges $25 for the first bag and $35 for the second bag. American also offers free baggage with their co-branded credit card. You can receive up to 4 free bags for all passengers traveling on the same itinerary. The various offerings are described below.

I currently hold the Citi AAdvantage Platinum Select Card but have been disappointed with it. The material item is that the first free checked bag is ONLY FOR DOMESTIC ITINERARIES.

A lot of my travel is done internationally so this card does not help alleviate those fees on international trips. I think that this is an issue so you need to know this before you move forward with obtaining this card. However, if you normally fly domestic, this card can help with the annoying baggage fees on American Airlines. UNITED AIRLINES: United Airlines, like most of the other carriers, charges $25 for the first bag and $35 for the second bag. Again, like the other carriers, you can obtain the first bag for free for the primary card holder and one companion.

United's MileagePlus's Explorer Card is actually one of the most restrictive cards that offer free bags. While their free baggage policy is available for both domestic and international itineraries, you MUST PURCHASE THE TICKET WITH THE CARD TO BE ELIGIBLE FOR FREE BAGGAGE.

This is a very important issue that you must purchase the ticket with the specific card to be eligible. Many cards offer additional bonus points for airline purchases so it does not always make sense to book airline flights with the United Card. However, you need to do so if you want free baggage. CONCLUSION: Obtaining credit cards can be a great way to avoid baggage fees. While all of the above cards do require an annual fee, it actually may make sense to get these cards solely for the free baggage benefit. There are plenty of other cards available that may make more sense for daily spend but the free baggage perks that these cards offer can provide a lot of value. It does not take too many trips for the annual fee to pay for itself. Additionally, the baggage fees are just annoying and frustrating so getting them for "free", even with the annual fee, makes me feel better when traveling. We can also pack what we need without trying to fit everything into a carry on bag. The Delta cards provides the most flexibility but the other cards can be useful provided that you understand the restrictions and requirements of their free baggage policy. Make sure to subscribe below for additional information and to be informed on all timeshare and travel related deals!

Nobody likes it when the time comes to pay your maintenance fees. They usually are more than last year and it always feels like a surprise even though you knew it would be arriving. In order to get the maximize value out of your maintenance fees, it is essential to use the proper credit card. All maintenance fees are generally categorized as “travel” within the credit card category and many credit cards provide bonus points for expenses relating to travel. However, most of the major timeshare companies such as Marriott, Hilton, Hyatt and Starwood each have their own branded credit cards. All of these co-branded cards give you bonus points for spending at their properties. The best secret is that the maintenance fees will generally trigger this bonus! If you use the right credit card to pay your maintenance fees, you can generally receive a free night at many hotels. Depending on the how you choose to redeem that night can essentially result in a 10-25% discount off your maintenance fees. In some circumstances, you can get even more value out of a hotel redemption. In order to show you how this is possible, I will assume that the maintenance fees are $1200 per year. Based on this amount, if I owned with Marriott, Hilton, Hyatt or Starwood and I used a specific co-branded credit card, I would receive bonus points. HILTON: The Hilton Hhonors reserve card is one of the Hilton branded hotel cards. It currently offers 2 free weekend night certificates after making $2500 in purchases within 4 months of the account opening. I have this card and used the initial bonus at the Grand Wailea in Maui. We can discuss the value of the initial bonus later but this saved me close to $1000 off hotel nights.

For these purposes, the Hilton Hhonors reserve card provides 10 HHonors Bonus Points per $1 spent on hotel stays within the Hilton Portfolio.

A $1200 spend would result in 12,000 Hilton Hhonors points. As per the following chart, 12,000 Hhonors points would get you almost to a free night in a category 2 hotel. There are approximately 76 category 2 hotels to choose from. Based on a few examples, I would say that this easily equates to about a $120 hotel room, therefore saving 10% off your maintenance fees.

MARRIOTT:

The Marriott Premier card is one of Marriott’s branded hotel cards. It is currently offering 80,000 bonus points after you spend $3,000 on purchases in the first 3 months. 80,000 bonus points is quite good as this is on the high end of recent bonuses.

For these purposes, the Marriott Premier card provides 5 Marriott bonus points per $1 spent at over 4,000 participating Marriott® locations worldwide.

A $1200 spend would result in 6,000 Marriott points. As per the chart here, 6000 bonus points would almost get you into a category 1 hotel or would definitely get you in on a pointsavers reward night for a category 1 hotel.

Assuming that you can secure a pointsavers night in a category 1 (this is not difficult), I would value the Marriott points at about $100, potentially more depending on the redemption. In this scenario, I would say that paying with a Marriott Premier card would result in about an 8% discount to your maintenance fees.

Additionally, you should be aware that card members receive an annual free night for category 1-5 hotels which can be very valuable. HYATT: The Hyatt Credit card issued by Chase is the only Hyatt branded credit card. It currently offers 2 free nights in ANY hotel worldwide after spending $2,000 in the first 3 months. The initial signup offer is fantastic since there are no restrictions on use. These two free nights can be used at very expensive hotels such as the Hyatt Ka’anapali in Maui, the Park Hyatt New York or the newest arrival, the Park Hyatt St. Kitts. Nightly rates can be close to $1000 per night so this initial signup bonus can be tremendously valuable.

For these purposes, the Hyatt credit card provides 3 points per $1 spent on purchases at all Hyatt properties.

A $1200 spent would result in 3,600 Hyatt points. 3,600 points is just shy of minimum of 5,000 points for a category 1 hotel. However, 3000 points does get you a club upgrade on a paid night which can be very valuable. Club rooms do get you access to the Regency club which offers complimentary food, beverage (sometimes alcohol) and breakfast.

Based on a few examples, I view the upgrade as potentially worth $150. If you assume that that you will obtain the additional points for a free night at a category 1, I would view this to be worth about $150, again, potentially more depending the redemption.

The Hyatt card also offers an annual free night for category 1-4 properties. This can easily be worth a few hundred dollars, again depending on its use. I personally have this card and typically use my free night for a ski trip in Park City, Utah which usually would cost $500 per night in a hotel. STARWOOD: The Starwood Preferred Guest Credit Card from American Express is the credit card for Starwood. Their current signup offer is 25,000 bonus starpoints. It has gone as high as 30,000 but this is generally their signup offer. Starpoints are very valuable currency as there are not as many ways to receive starpoints as other hotel currents.

The initial bonus offer is very valuable and could offer you 8 nights in a category 1 hotel, 6 nights in a category 2, 3 in a category 3 or 2 nights in a category 4 or 5. The award chart is found here:

The Starwood Preferred Guest Credit Card provides "you up to 5 Starpoints® for each dollar of eligible purchases at participating SPG® hotels – that's 2 Starpoints for which you may be eligible as a Card Member in addition to the 2 or 3 Starpoints for which you may be eligible as an SPG member. Get 1 Starpoint for all other purchases."

Basically, you will receive 2 Starpoints for each dollar and potentially receive an additional 2 or 3 points per dollar if you have Starwood Status. For this example, we should assume that we don’t have status. A $1200 spend would result in 2400 Starpoints. As per the chart above, 2400 starpoints is just shy of a free night in a category 1 hotel. Based on a review of their category 1 hotels, I would view the free night to be worth approximately $100. Again, this gives you an 8% discount off the maintenance fees. CHASE SAPPHIRE RESERVE: If you are involved in the credit card travel game, you have definitely heard about the Chase Sapphire Reserve card. This is a new awesome card that offers 3x points on Travel and Dining. The initial signup offer is huge and gives you 100,000 Chase Ultimate Reward Points. Chase Ultimate Reward Points are transferrable currency that allows you to transfer into frequent flyer accounts and hotel award programs. While it carries a $450 annual fee, it provides a $300 annual credit for travel related charges. A key perk to the Chase Sapphire Reserve is that the travel credit applies towards your maintenance fees! Basically, this is a very easy way to get $300 off your maintenance fees. The travel credit gets replaced in January so if you get the card now, you can save $300 now and $300 again in January. $600 easy savings! The initial bonus is easily worth $1500 but if used properly, can be worth thousands. Without too much work, this can easily be worth $3,000.

In our example, a $1200 charge for your maintenance fees would be categorized as travel and you would earn 3,600 Chase Ultimate Reward Points. This can be used for travel and redeemed for $54.00 through Chase or can be transferred into various programs including Hyatt.

I would value 3,600 Chase Ultimate Reward Points at about $75 but this is just a guestimate. The value would depend on how you use them. You could transfer them directly to Hyatt and get a club upgrade as discussed above. Chase Ultimate Reward Points are very valuable and in later posts will describe how to use these in relation to timeshare vacations. This is a stellar card and is highly recommended. The 100,000 sign up bonus is huge as it is rare for sign up bonuses to be that high. CITI PREMIER: The Citi Premier card is a solid card that earns Thankyou Reward Points. You can earn 3 points per $1 spent on Travel including Gas plus 2 points per $1 spent on Dining Out and Entertainment and 1 point per $1 spent on other purchases.

Citi’s Thankyou Reward program has gotten much better in recent years and you can now transfer points into various partners. These can provide tremendous amount of value if you redeem them properly. The Citi Premier is not offering any signup bonus so I would not apply at the moment but wait until a bonus appears.

In this example, a $1200 charge for maintenance fees would result in 3,600 Thankyou Reward Points. Redeeming these points for travel expenses would result in them being worth $45 since Citi values them a 1.25 cents when redeeming for airfare and other expenses. As discussed in other posts, you could also transfer these points to Citi’s partners that could result in better redemption rates. CONCLUSION: As stated above, if you use the proper credit card, a $1200 maintained fee would result in the following amount of points and potentially give you a material discount on your maintenance fees.

As shown, using the right credit card for your maintenance fees can essentially result in a significant discount. You should definitely make sure to use the right credit card when paying your maintenance fees.

Even if you own a timeshare not affiliated with the companies stated above, these charges still are categorized as travel and you can earn at least 3x the amount of points which can easily result in a meaningful discount. This blog is not meant to show you how to maximize frequent flyer, hotel or credit card points. There are already plenty out there to do so. However, if you travel each year, which I anticipate you must if you own a timeshare, you need to get reasonably versed in these types of program. They can be complicated but I know that they save me thousands of dollars per year in travel and you can use these tools for your advantage and to travel to some great destinations for much less or even free. More importantly, they provide me with the ability to travel to exotic locations for free. Over time, I will discuss the basic mechanics of these programs and how to use these programs, miles and points to complement timeshare ownership to allow you to travel in luxury for less. Additionally, as discussed in other posts and as I will discuss later, you always need to have a Plan B for timeshare planning. Since availability can be difficult to get in prime weeks or resorts, you need to be able to book airfare reasonably in advance to secure reasonable prices or use your frequent flyer miles. You can use hotel points to book a hotel room for the desired destination and be confident in your ability to book non-refundable airfare. We will discuss these types of strategies in other posts but it is absolutely necessary. Otherwise, if your desired week becomes available, the cost of airfare can quickly derail that vacation and you will need to start the planning all over again. |

Archives

April 2020

Categories

All

Archives

April 2020

|

RSS Feed

RSS Feed