|

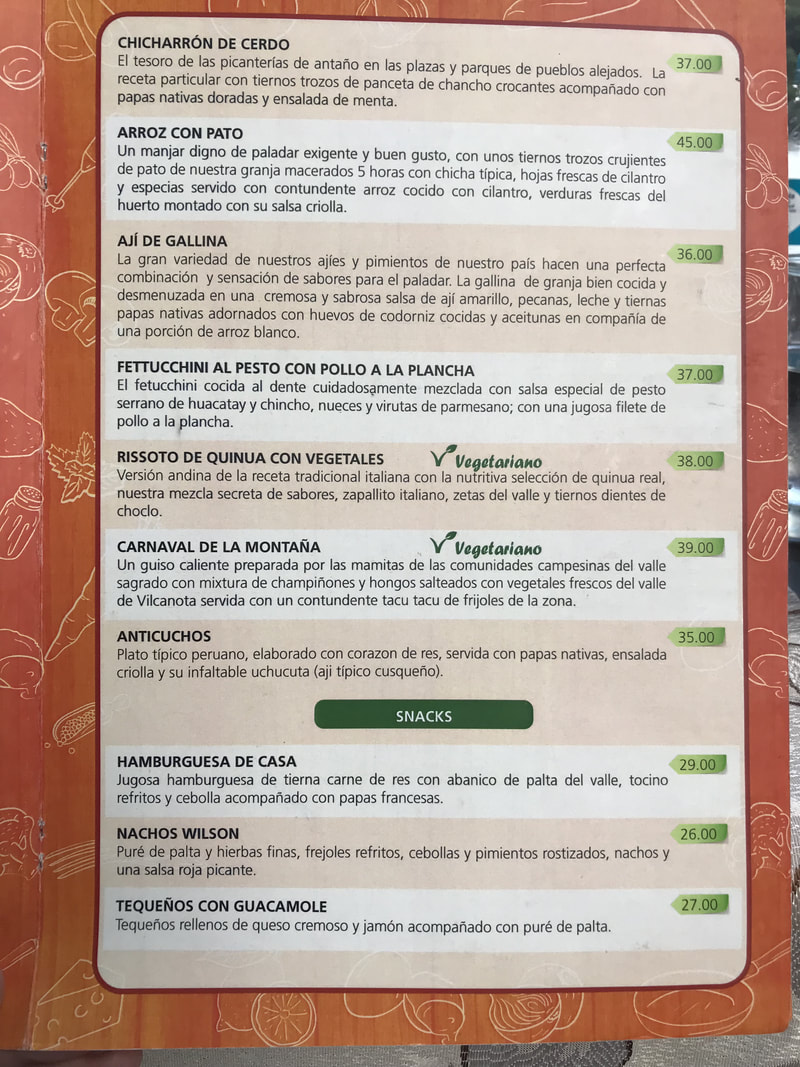

My wife and I are currently in Peru and are thoroughly enjoying the sites, culture and food. The photo above was taken by me at Macchu Picchu. Macchu Picchu was absolutely spectacular. More details to follow on this trip! It should be obvious but we love traveling and do as much as we can. The language barrier can be difficult at times but we always manage to get by. Google Translate has been around for a while and it has always helped with translating from various languages back to English. It generally has helped with translating various words or phrases and is a remarkable tool. I may be late to the game but I just discovered an absolutely amazing feature of Google Translate that I had to share with everyone. Most travelers who end up traveling in places where their native language is not spoken can generally get by but the one area that can be a challenge is ordering food. When you receive a menu in a foreign language, you try to make out bits and pieces of it in order to decide what to order. We stayed in Aqua Calientes which is the town at the base of Macchu Picchu. Here is the menu of a restaurant that we ate at.

My Spanish is not great and while I can understand bits and pieces, there are always words or phrases that I can not decipher.

I noticed that Google Translate has a camera icon and when I pressed it, it went to the camera section of my phone. When I pointed my camera at the menu above, here is what appeared. UNBELIEVABLE!! Google Translate can literally translate signage, menus or other text from almost any language back into English INSTANTANEOUSLY. When I pointed my camera at the menu, it translated the menu instantaneously. No loading or waiting or anything. The words literally changed in my camera view. I thought that this was absolutely incredible as it immediately translating the text on the page into English. As you can see, the interpretation is a bit fuzzy and it is not entirely correct but it is very close or at least close enough to understand the menu item. This is an incredible tool that should definitely be on your phone! It is completely free and has the ability to make your travels extremely easy when you are in foreign country where you do not speak their language. Although incredibly cool, I have to say that I was a little disappointed in finding this tool as struggling with the language is a challenge that I tend to enjoy. However, knowing that I can decipher any language in a blink of an eye is very reassuring to make traveling as easy as possible. Do you use Google Translate? Did you know about this incredible functionality? Leave your comments below!

While most of the material on this website is meant to discuss timeshares, there are various other tools out there that can make traveling easier and more affordable.

I was introduced to the Seated app and have been using it for a month or two now and it is absolutely wonderful! It is basically like Opentable (reservation booking app) where you can make reservations at various restaurants through an iPhone or Android app but after you eat out, you can rewarded for your meal with rewards between $10-50 based on the amount of the dine. These rewards come in the form of gift cards from your choice of Amazon, Lyft or Starbucks. Essentially, this becomes a rebate of up to 50% (sometimes even more) of your meal cost. It is a great deal and can make eating out very affordable. Currently, it available in the following cities:

When you download the app and you create an account, you can use my promo code which gives you a free $5 reward.

MY CODE IS: DAVID401 In full disclosure, there are incentives that I receive when you sign up for an account but there is no cost or obligation to use their services. If you are lucky enough to live in one of the above cities, I find this to be a tremendously beneficial app that has relationships with many of the top rated restaurants in those cities. Due to the value of these rewards, I tend to look up restaurants with this app before deciding where to eat. I have received hundreds of dollars back in the form of Amazon gift cards which I treat as just as valuable as cash! Have you heard of the Seated App? What do you think of it? Leave your comments below!

Doctor of Credit has been a very gracious supporter of The Timeshare Guru and has allowed me to post a number of articles on his site regarding timeshares.

I posted a complete guide to renting timeshares on his site which is a great resource for those looking to rent timeshares. I definitely encourage you to review the guide and to frequent the Doctor of Credit's website. His blog is the preeminent place to find bank account deals and has a lot of great travel deals as well as credit card deals. Make sure to leave comments below if you have alternative sources or other tips and tricks to rent timeshares for cheap!

My family and I like to travel a lot. We take multiple vacations throughout the year. One of the reasons that we are able to do so is due to our timeshare. We can take multiple vacations in very nice accommodations for a very reasonable amount of money when compared to hotels or even airbnb or vacation rentals.

There are various tricks and tips to travel cheap and use frequent flyer miles for flights, points for car rentals and even points for activities. Timeshares are great for numerous reasons but one key benefit is having a full kitchen. Being able to cook in your timeshare can save you tons of money.

Hotels and airlines have gone crazy with all the fees being charged. Resort fees, baggage fees, upgrade fees, extra person fees, seat assignment fees, etc. The list goes on and on.

While I hope that these fees will end and get reigned in to something more reasonable, unfortunately, we are stuck with these fees for the foreseeable future. I can go on and on about the various fees which I detest but the one fee that truly gets me agitated is luggage fees with airlines. There have been a lot of articles written about baggage fees and the airlines are having a great time charging for them. A recent article just came out that indicated that the US airlines have made over $1 BILLION in revenue from baggage fees alone. Since I detest baggage fees, I am always trying to figure out the best way to avoid them all together. Luckily, there are some fairly easy ways to avoid them. SOUTHWEST AIRLINES: I have written about Southwest Airlines in the past, and they are a fantastic airline. They provide many benefits which most, if not all, of the other major carriers do not provide. One significant benefit is that they do not charge baggage fees for the 1st or 2nd bag. This is a tremendous perk and potentially the last airline that offers free baggage for any flyer. DELTA: Delta is a fairly good carrier. They have spent a lot of money and effort in making their in-flight experience better than the other carriers. I generally like Delta even though their frequent flyer program has significantly been devalued over time. Delta does not even publish award charts for their program so they are free to charge you any amount of miles they deem for redemption of skymiles. Delta also charges baggage fees. They charge $25 for the first bag and $35 for the second bag. These are high and are very frustrating to me especially when I purchase an expensive ticket. In order to avoid these fees, I carry the Gold Delta Skymiles Card from American Express. This card does come with an annual fee of $95 but is waived the first year. For this annual fee, you will receive the first checked bag for free for up to eight passengers on the same itinerary. While a lot of other cards claim to offer free checked baggage, the Delta cards are actually the best since you can book the flights from any travel agency, you do not need to pay for the flights with the actual card and it is valid on ANY Delta flights including international itineraries. Additionally, as of today, they have increased their signup bonus to 70,000 miles for the Platinum card. This is one of the highest offers and definitely worth it for the free baggage fees and signup bonus.

AMERICAN AIRLINES:

American Airlines charges $25 for the first bag and $35 for the second bag. American also offers free baggage with their co-branded credit card. You can receive up to 4 free bags for all passengers traveling on the same itinerary. The various offerings are described below.

I currently hold the Citi AAdvantage Platinum Select Card but have been disappointed with it. The material item is that the first free checked bag is ONLY FOR DOMESTIC ITINERARIES.

A lot of my travel is done internationally so this card does not help alleviate those fees on international trips. I think that this is an issue so you need to know this before you move forward with obtaining this card. However, if you normally fly domestic, this card can help with the annoying baggage fees on American Airlines. UNITED AIRLINES: United Airlines, like most of the other carriers, charges $25 for the first bag and $35 for the second bag. Again, like the other carriers, you can obtain the first bag for free for the primary card holder and one companion.

United's MileagePlus's Explorer Card is actually one of the most restrictive cards that offer free bags. While their free baggage policy is available for both domestic and international itineraries, you MUST PURCHASE THE TICKET WITH THE CARD TO BE ELIGIBLE FOR FREE BAGGAGE.

This is a very important issue that you must purchase the ticket with the specific card to be eligible. Many cards offer additional bonus points for airline purchases so it does not always make sense to book airline flights with the United Card. However, you need to do so if you want free baggage. CONCLUSION: Obtaining credit cards can be a great way to avoid baggage fees. While all of the above cards do require an annual fee, it actually may make sense to get these cards solely for the free baggage benefit. There are plenty of other cards available that may make more sense for daily spend but the free baggage perks that these cards offer can provide a lot of value. It does not take too many trips for the annual fee to pay for itself. Additionally, the baggage fees are just annoying and frustrating so getting them for "free", even with the annual fee, makes me feel better when traveling. We can also pack what we need without trying to fit everything into a carry on bag. The Delta cards provides the most flexibility but the other cards can be useful provided that you understand the restrictions and requirements of their free baggage policy. Make sure to subscribe below for additional information and to be informed on all timeshare and travel related deals!

When we travel, there are a few electronic items that are always brought with us. Phones, Ipads, cameras, etc. I recently starting bringing the Amazon Fire TV Stick with us on all our trips.

This is an awesome gadget. It is slightly bigger than a USB drive and has so many different functions. For those of you that are unfamiliar with the Amazon Fire TV Stick, it is a USB size gadget that will fit into the HDMI port of any TV. The Amazon Fire TV Stick has various apps that allow you to watch movies, TV shows, HBO, Showtime, Sports, etc. The list goes on and on. I ALWAYS bring the Amazon Fire TV Stick with us for a few reasons. We travel with kids a lot so having Netflix and Amazon Prime is essential to keep the kids happy on vacation. I love being able to plug this in to the TV and the kids have all the comforts of home with their shows and movies. It can provide my wife and I with a much needed break. Additionally, I rarely get the opportunity to catch up on shows and movies while at home. There seems to be always something to do. On vacation, it is different. With the Amazon Fire TV Stick, I can rent TV shows and movies from Amazon or watch Netflix and other sources and relax. Instead of having to pay hotel prices to get their movies on demand, I can rent movies directly through Amazon or other provides for a fraction of the cost. We recently stayed at a hotel and my wife and I wanted to watch a recently released movie. We reviewed the On-Demand functions and found a movie. The hotel wanted to charge us $17.99 to rent the movie! Instead, I plugged in my trusted Amazon Fire TV Stick and found the movie on Amazon and rented it for $3.99. An easy 77% savings. The Amazon Fire TV Stick has just been refreshed and will be released on October 20th. It is a bargain at $39.99. With my example above, it will pay for itself from the savings of not renting two movies from a hotel. With the refresh of the Amazon Fire TV Stick, Amazon is offering an amazing deal where you can get up to $65 of free digital content. This more than pays for the initial purchase price! Activate your All-New Fire TV Stick with Alexa Voice Remote by October 31st and receive 1 month of Sling TV, 2 Months of Hulu (Limited Commercials), and a $10 Amazon Video Credit. I have already ordered mine so that we can travel with two - one for the kids and one for the adults. This is a great deal especially with the added bonuses! Check it out below!

It is hard to believe that it is September and labor day weekend is upon us. For many, it marks the end of summer. It is definitely bitter sweet that the end of summer is here, kids are back in school and the weather is about to turn into winter.

While this is definitely unfortunate, this is a great time to think about the past summer and what was great and what you would want to do differently next week. Perhaps you didn't take a vacation or didn't get the requested week off from work. Maybe you didn't do all the things that you had planned to do. With all these memories fresh in your mind, this is actually the best time to begin making plans for Summer 2017!! A lot of people just can't plan that far in advance but if you have any desire to get prime weeks and prime resorts, now is the time to begin the planning. Believe it or not, most of my entire summer is currently planned with various options laid out which will ultimately depend on whether certain exchanges comes through with my timeshare. As explained in this post concerning timeshare planning, it is essential to plan far ahead and have multiple options so that you can get the desired vacation and be able to travel to luxurious destinations in luxurious accommodations on a tiny budget. If you want to achieve this, here is what you need to do! STEP ONE: SET UP AN EXCHANGE REQUEST If you own a timeshare and want to make excellent trades, put in a Request First with Interval International or do an Ongoing Search with RCI. For Interval International, you can do a search for the desired week and include the specific resorts that you want to travel to. THINK BIG! Put in a request for the Four Seasons property in Carlsbad, California or the Marriott property in St. Thomas or the Westin in St. John or the Marriott properties in Hawaii. Request the ultimate vacation of your dreams. This is the fun part of vacation planning! When you make the Request First reservation, Interval will charge you the exchange fee of $179 and I highly recommend getting E-Plus as discussed here. This can give you even more flexibility down the road. Remember that this is fully refundable if the exchanges does not occur. The fees are refunded and your deposited points or week is refunded. For RCI, in order to do a Ongoing Search, follow these steps:

Again, THINK BIG and try for the Hilton in Waikoloa, Hawaii, Casa Velas in Puerto Vallarta or the Pueblo Bonito in Cabo San Lucas - all highly rated luxurious timeshare properties. STEP 2: SET UP AIRFARE ALERTS Use Hopper. As discussed here, Hopper is a great tool for monitoring airfare. Put in the various times, dates and destinations for the specific weeks that you requested above. Hopper will track the cost of all these flights. Ignore the cost of the flights for the moment as you will continue to monitor them until the point that the airfare reaches a price point where you are comfortable spending. Put in multiple destinations so that you can track costs for all potential options that you chose in Step 1. STEP 3: BOOK BACKUP HOTEL PLANS Book hotel accommodations for the desired weeks. If you end up booking airfare first, you will need to have a good backup plan in case the desired timeshare does not go through. Again, ignore prices at the moment but do make sure that the reservations are fully cancellable. I will discuss various methods on how to get hotel accommodations for reasonable prices so that you can truly have a good backup plan in case the the timeshare does not get confirmed. If you have hotel points, this is a great time to book a speculative week on points so that you are assured a free week of accommodations. Again, getting these points are achievable and we can discuss various methods to do so in other posts. STEP 4: SET UP GETAWAY ALERTS Set up Interval Getaway alerts if you are an Interval International member. I currently have a saved searched called "Summer" for 2017 where I inserted all the top properties within Interval so that I can view when availability comes up and I can make a decision on whether to book with cash immediately or continue to wait for the desired week or timeshare property to become available. Using this method, I already saw a prime week in Hawaii for a Marriott property where the one bedroom cost under $600 for the week. I didn't grab it and it disappeared within a few minutes. If you see a deal like that, book immediately. Be aware that these Getways are non-refundable and non-changeable so make sure you can actually use it before booking. STEP 5: RENT A CAR AND USE AUTOSLASH Use Autoslash if you will be wanting to rent a car. As discussed in this post, Autoslash is the ultimate car rental reservation tool. You can make a reservation without using any credit card and Autoslash will automatically track the reservation and either alert you of a lower price or automatically rebook you for the lowest price available. Make multiple reservations that coincide with the various destinations that you chose in Step 1. Since there are no fees, credit card requirements or cancellation fees, book multiple weeks and once everything comes together, you can cancel the unused rental reservations. STEP 6: MONITOR EVERYTHING Monitor everything. Since everything is generally now on autopilot, just monitor everything so that when a exchange gets confirmed or a Getaway becomes available, you can quickly review the flights and determine if the costs are doable. In other posts, I will explain how to obtain and use frequent flyer miles so that the flights will be free but for now, the above steps should work well in order to set yourself up for a fantastic summer for 2017. STEP 7: SIT BACK AND RELAX Remember the summer that just passed and be excited for next summer. Travel planning can be difficult but when you plan ahead, you have a much better chance of getting awesome vacations in luxurious places and resorts for a fraction of the retail cost. Make sure to follow me on Twitter and Facebook for more ideas, tools, opportunities and information. Also, subscribe below!!

Nobody likes it when the time comes to pay your maintenance fees. They usually are more than last year and it always feels like a surprise even though you knew it would be arriving. In order to get the maximize value out of your maintenance fees, it is essential to use the proper credit card. All maintenance fees are generally categorized as “travel” within the credit card category and many credit cards provide bonus points for expenses relating to travel. However, most of the major timeshare companies such as Marriott, Hilton, Hyatt and Starwood each have their own branded credit cards. All of these co-branded cards give you bonus points for spending at their properties. The best secret is that the maintenance fees will generally trigger this bonus! If you use the right credit card to pay your maintenance fees, you can generally receive a free night at many hotels. Depending on the how you choose to redeem that night can essentially result in a 10-25% discount off your maintenance fees. In some circumstances, you can get even more value out of a hotel redemption. In order to show you how this is possible, I will assume that the maintenance fees are $1200 per year. Based on this amount, if I owned with Marriott, Hilton, Hyatt or Starwood and I used a specific co-branded credit card, I would receive bonus points. HILTON: The Hilton Hhonors reserve card is one of the Hilton branded hotel cards. It currently offers 2 free weekend night certificates after making $2500 in purchases within 4 months of the account opening. I have this card and used the initial bonus at the Grand Wailea in Maui. We can discuss the value of the initial bonus later but this saved me close to $1000 off hotel nights.

For these purposes, the Hilton Hhonors reserve card provides 10 HHonors Bonus Points per $1 spent on hotel stays within the Hilton Portfolio.

A $1200 spend would result in 12,000 Hilton Hhonors points. As per the following chart, 12,000 Hhonors points would get you almost to a free night in a category 2 hotel. There are approximately 76 category 2 hotels to choose from. Based on a few examples, I would say that this easily equates to about a $120 hotel room, therefore saving 10% off your maintenance fees.

MARRIOTT:

The Marriott Premier card is one of Marriott’s branded hotel cards. It is currently offering 80,000 bonus points after you spend $3,000 on purchases in the first 3 months. 80,000 bonus points is quite good as this is on the high end of recent bonuses.

For these purposes, the Marriott Premier card provides 5 Marriott bonus points per $1 spent at over 4,000 participating Marriott® locations worldwide.

A $1200 spend would result in 6,000 Marriott points. As per the chart here, 6000 bonus points would almost get you into a category 1 hotel or would definitely get you in on a pointsavers reward night for a category 1 hotel.

Assuming that you can secure a pointsavers night in a category 1 (this is not difficult), I would value the Marriott points at about $100, potentially more depending on the redemption. In this scenario, I would say that paying with a Marriott Premier card would result in about an 8% discount to your maintenance fees.

Additionally, you should be aware that card members receive an annual free night for category 1-5 hotels which can be very valuable. HYATT: The Hyatt Credit card issued by Chase is the only Hyatt branded credit card. It currently offers 2 free nights in ANY hotel worldwide after spending $2,000 in the first 3 months. The initial signup offer is fantastic since there are no restrictions on use. These two free nights can be used at very expensive hotels such as the Hyatt Ka’anapali in Maui, the Park Hyatt New York or the newest arrival, the Park Hyatt St. Kitts. Nightly rates can be close to $1000 per night so this initial signup bonus can be tremendously valuable.

For these purposes, the Hyatt credit card provides 3 points per $1 spent on purchases at all Hyatt properties.

A $1200 spent would result in 3,600 Hyatt points. 3,600 points is just shy of minimum of 5,000 points for a category 1 hotel. However, 3000 points does get you a club upgrade on a paid night which can be very valuable. Club rooms do get you access to the Regency club which offers complimentary food, beverage (sometimes alcohol) and breakfast.

Based on a few examples, I view the upgrade as potentially worth $150. If you assume that that you will obtain the additional points for a free night at a category 1, I would view this to be worth about $150, again, potentially more depending the redemption.

The Hyatt card also offers an annual free night for category 1-4 properties. This can easily be worth a few hundred dollars, again depending on its use. I personally have this card and typically use my free night for a ski trip in Park City, Utah which usually would cost $500 per night in a hotel. STARWOOD: The Starwood Preferred Guest Credit Card from American Express is the credit card for Starwood. Their current signup offer is 25,000 bonus starpoints. It has gone as high as 30,000 but this is generally their signup offer. Starpoints are very valuable currency as there are not as many ways to receive starpoints as other hotel currents.

The initial bonus offer is very valuable and could offer you 8 nights in a category 1 hotel, 6 nights in a category 2, 3 in a category 3 or 2 nights in a category 4 or 5. The award chart is found here:

The Starwood Preferred Guest Credit Card provides "you up to 5 Starpoints® for each dollar of eligible purchases at participating SPG® hotels – that's 2 Starpoints for which you may be eligible as a Card Member in addition to the 2 or 3 Starpoints for which you may be eligible as an SPG member. Get 1 Starpoint for all other purchases."

Basically, you will receive 2 Starpoints for each dollar and potentially receive an additional 2 or 3 points per dollar if you have Starwood Status. For this example, we should assume that we don’t have status. A $1200 spend would result in 2400 Starpoints. As per the chart above, 2400 starpoints is just shy of a free night in a category 1 hotel. Based on a review of their category 1 hotels, I would view the free night to be worth approximately $100. Again, this gives you an 8% discount off the maintenance fees. CHASE SAPPHIRE RESERVE: If you are involved in the credit card travel game, you have definitely heard about the Chase Sapphire Reserve card. This is a new awesome card that offers 3x points on Travel and Dining. The initial signup offer is huge and gives you 100,000 Chase Ultimate Reward Points. Chase Ultimate Reward Points are transferrable currency that allows you to transfer into frequent flyer accounts and hotel award programs. While it carries a $450 annual fee, it provides a $300 annual credit for travel related charges. A key perk to the Chase Sapphire Reserve is that the travel credit applies towards your maintenance fees! Basically, this is a very easy way to get $300 off your maintenance fees. The travel credit gets replaced in January so if you get the card now, you can save $300 now and $300 again in January. $600 easy savings! The initial bonus is easily worth $1500 but if used properly, can be worth thousands. Without too much work, this can easily be worth $3,000.

In our example, a $1200 charge for your maintenance fees would be categorized as travel and you would earn 3,600 Chase Ultimate Reward Points. This can be used for travel and redeemed for $54.00 through Chase or can be transferred into various programs including Hyatt.

I would value 3,600 Chase Ultimate Reward Points at about $75 but this is just a guestimate. The value would depend on how you use them. You could transfer them directly to Hyatt and get a club upgrade as discussed above. Chase Ultimate Reward Points are very valuable and in later posts will describe how to use these in relation to timeshare vacations. This is a stellar card and is highly recommended. The 100,000 sign up bonus is huge as it is rare for sign up bonuses to be that high. CITI PREMIER: The Citi Premier card is a solid card that earns Thankyou Reward Points. You can earn 3 points per $1 spent on Travel including Gas plus 2 points per $1 spent on Dining Out and Entertainment and 1 point per $1 spent on other purchases.

Citi’s Thankyou Reward program has gotten much better in recent years and you can now transfer points into various partners. These can provide tremendous amount of value if you redeem them properly. The Citi Premier is not offering any signup bonus so I would not apply at the moment but wait until a bonus appears.

In this example, a $1200 charge for maintenance fees would result in 3,600 Thankyou Reward Points. Redeeming these points for travel expenses would result in them being worth $45 since Citi values them a 1.25 cents when redeeming for airfare and other expenses. As discussed in other posts, you could also transfer these points to Citi’s partners that could result in better redemption rates. CONCLUSION: As stated above, if you use the proper credit card, a $1200 maintained fee would result in the following amount of points and potentially give you a material discount on your maintenance fees.

As shown, using the right credit card for your maintenance fees can essentially result in a significant discount. You should definitely make sure to use the right credit card when paying your maintenance fees.

Even if you own a timeshare not affiliated with the companies stated above, these charges still are categorized as travel and you can earn at least 3x the amount of points which can easily result in a meaningful discount. This blog is not meant to show you how to maximize frequent flyer, hotel or credit card points. There are already plenty out there to do so. However, if you travel each year, which I anticipate you must if you own a timeshare, you need to get reasonably versed in these types of program. They can be complicated but I know that they save me thousands of dollars per year in travel and you can use these tools for your advantage and to travel to some great destinations for much less or even free. More importantly, they provide me with the ability to travel to exotic locations for free. Over time, I will discuss the basic mechanics of these programs and how to use these programs, miles and points to complement timeshare ownership to allow you to travel in luxury for less. Additionally, as discussed in other posts and as I will discuss later, you always need to have a Plan B for timeshare planning. Since availability can be difficult to get in prime weeks or resorts, you need to be able to book airfare reasonably in advance to secure reasonable prices or use your frequent flyer miles. You can use hotel points to book a hotel room for the desired destination and be confident in your ability to book non-refundable airfare. We will discuss these types of strategies in other posts but it is absolutely necessary. Otherwise, if your desired week becomes available, the cost of airfare can quickly derail that vacation and you will need to start the planning all over again.

Traveling is definitely difficult. Things have drastically changed and traveling now requires a lot of effort. Going through security is a major challenge and delays, connections and travel issues constantly come up.

Food in airports can be awful, tolerable or actually pleasant. However, landing in a non-familiar airport, you are generally going to eat at whatever establishment is closest to your gate. I have found that this is not the best option as you will more often than not be disappointed. I have found Gate Guru to be an indispensable tool when traveling. Gate Guru provides reviews on the various restaurants and eateries in airports around the world. When I land somewhere, I pull up Gate Guru and it tells me what restaurants are located nearby and which ones get highly rated. Gate Guru has saved me from making bad choices on where to eat. Airport food can be awful but I have had a lot of success in using this app. Instead of guessing on what eatery to visit, I rely on the ratings of Gate Guru. It definitely has pointed me to some great finds in airports for places that I would have never found before. It is a free app and I think it is very beneficial to download. Check it out! |

Archives

April 2020

Categories

All

Archives

April 2020

|

RSS Feed

RSS Feed