Timeshare Purchase: Follow up to Post on whether eBay timeshare purchases of $1.00 are legitimate1/24/2019

In a previous post, I gave a broad overview of whether timeshare sales and subsequent purchases of timeshares selling for $1.00 on eBay were legitimate. You can read that post here.

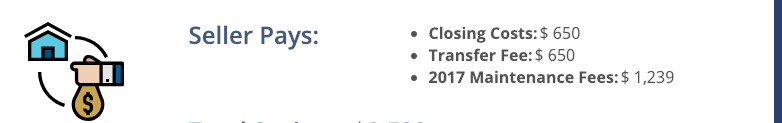

Essentially, my conclusion and position is that these auctions are legitimate, you definitely can purchase a timeshare for $1.00 BUT there may be other factors that need to be assessed where the actual winning bid could be $1,000's of dollars. I stand by that post but a lot of comments were given that I wish you would have given some examples of actual purchases and what to look for when purchasing them. As a result of those comments, in this post, I will go through some examples of eBay sales to show you what you need to look out for when making these purchases. Before we get started, I have done some other posts about determining what you timeshare is worth. One solid method that I actually use is eBay. In case you didn't know, you can actually search "completed listings" and "sold listings". There is a distinct difference between the two. Completed listings have ended but may not have sold and sold listings actually sold. You can see the exact price which they sold for. Here is the post on that topic. For the following examples, I have searched "sold listings" to see the actual selling price. Additionally, before I go through the actual examples, I wanted to again point out an important item that you should consider. My view is that timeshares are great but I would only recommend buying "name brand" timeshares such as Marriott, Hilton, Wyndham, Hyatt, Westin, Sheraton, etc. These timeshare brands have certain standards to adhere to, have regular brand recognition and have thousands of hotel counterparts which essentially markets the timeshares. Therefore, while not all of these name brand timeshares will have any value, the chances of being able to resale them for at least a $1.00 is much higher than a single destination timeshare. Example 1: Hyatt Wild Oak Ranch in San Antonio, Texas As you can see in the attached photo, a seller was selling an odd year, week 10 timeshare at the Hyatt Residence Club in San Antonio. The green price indicates that it sold for the whopping price of $0.01. If the price was grey, it would indicate that it was a completed but unsold auction. Buying a Hyatt for one penny is quite the bargain. Generally, the "gotcha" could occur for the various closing costs, transfer fees, past due maintenance fees or outstanding loans. Some, but not all of auctions, will list out the various fees and who will be responsible. Make sure that the auction clearly states the fees and responsible party. For this auction, the SELLER will pay the closing costs of $650 and the required transfer fee of $650. Additionally, as you can see below, since this auction ended in December of 2018, it is likely that the maintenance fees were not paid for 2017 and the SELLER will actually pay those as well. Once you read the description, you can also see that the ongoing maintenance fees are $1239 every year of use.

For years in which you do not have use which would be every even year, you still need to pay a fee which they do disclose of approximately $150-$180.

CONCLUSION:

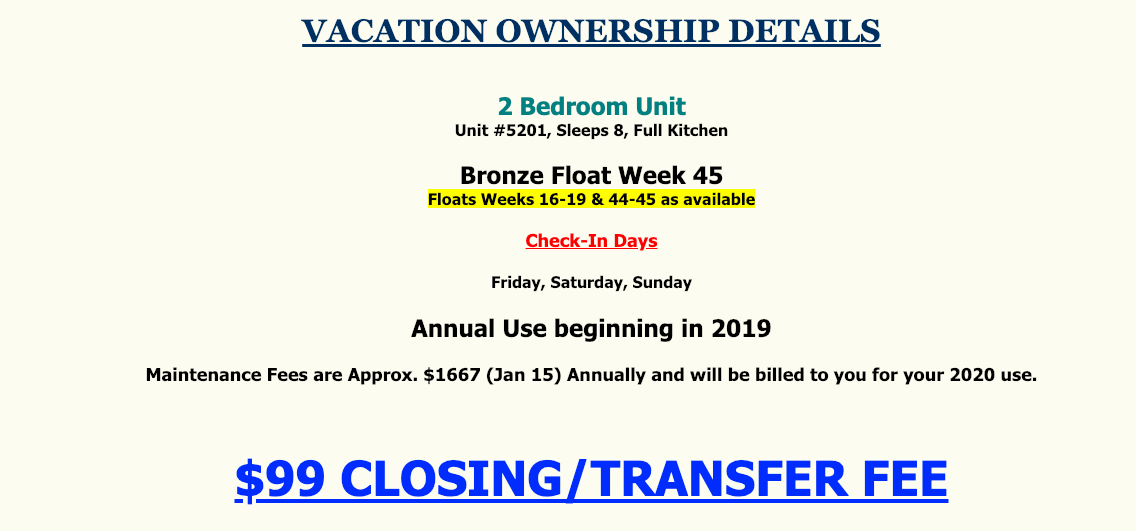

For this particular auction, it does not appear that there are any "gotchas" and the Buyer potentially purchased this particular timeshare for $0.01. The more difficult hurtle for the buyer will to pass Hyatt's Right of First Refusal. Hyatt has the right, but not the obligation to purchase the timeshare before the third party and I would be surprised if they wouldn't do so in this situation as they will likely be able to sell this unit through the developer for $10,000+ dollars. That is why it pays to buy resale! Example 2: Marriott Summit Watch in Park City Utah If you read this blog, you know that I am a big fan of Park City, Utah and a fan of the Marriott Summit Watch. Looking through these eBay sold results, I came across this one. It appears that 2 bedroom week sold at the Marriott Summit Watch sold for $1.00. Here are the details of the week:

Maintenance fees for this "floating" week are $1667 per year which the Seller has indicated has been paid for 2019. The closing costs are $99.

Looking through the other details of this auction, there are no further fees disclosed. Assuming that the facts put forth in the auction are accurate, this week likely sold for $1.00 PLUS $99 in closing costs. A pretty good bargain but the buyer will still need to get past Marriott's Right of First Refusal. The details of this auction are fairly straightforward and it looks like the buyer did purchase the timeshare for $1.00 with the obligation to pay $99 for the closing costs. They are also now obligated to pay the maintenance fees each and every year of $1667 which is definitely on the high side of fees. But, their initial up front cost was very nominal. However, upon looking closer at the Marriott timeshare, I would argue that this purchase is actually an awful deal for $1.00 plus $99.00. The Marriott maintenance fee of $1667 is quite expensive especially if you actually wanted to use the Marriott Summit Watch unit during those floating weeks. Those floating weeks actually occur during mud season which is during November and April, the least desirable timeframe for a mountain destination. I routinely see Interval International Getaways offering those types of weeks for approximately $400 per week even at the Marriott Summit Watch. If you actually wanted to use the "floating" week that you purchased, you would essentially be paying 4x what I can rent that same week for if not more. Additionally, Interval International offers Accommodations Certificates which allows you to get certain weeks for an exchange fee of $239. I routinely see those types of weeks offered at the Marriott Summit Watch and other high quality timeshares during these off-seasons. Overall, I think that purchasing the timeshare for $1.00 plus $99.00 of closing costs is a good deal but ONLY if you trade that Marriott for other weeks. Also, since you are essentially purchasing an extremely low demand week, you may not be able to trade it as freely as other properties to obtain the more desirable week. The reason that I like Hyatt properties is that each week, even legacy weeks, convert into points and you can use those points for exchanges. From interval's perspective, a point is a point regardless of the underlying week. Marriott's legacy program is different in that you trade a week for a week (or 3 studio weeks for a 2 bedroom week or 1 bedroom + a studio week for a 2 bedroom week) and when you do that, they assign a TDI or travel demand index to that week which could prevent you from getting a high demand week in exchange for your low demand week. Conclusion: Overall, buying a timeshare off eBay is great way to save tons off the the initial developer pricing. The original sellers of both of the timeshares listed above likely paid $10,000 - $25,000 for those weeks so buying them for $1.00 is a fantastic deal as a comparison. The real gotcha that you need to be aware of with these types of purchases is to ensure that there are no loans, past due maintenance fees, or other fees associated with these purchases. This is why an Estoppel Certificate from the developer is absolutely necessary. Here is a post I did on that topic. Assuming that the buyers can overcome the right of first refusal from Hyatt, that buyer got a great deal PROVIDED that they use the timeshare and understand how to maximize their use. I would argue that the Marriott timeshare is worthless and not even worth the $100.00. As you can see, there are many nuances to look into when purchasing a timeshare. Despite the low fees being offered on eBay, you need to understand what you are buying and how to use it properly to maximize tis value. Also, at some point of time in the future, you may be the one trying to sell the $1.00 timeshare that you purchased for $1.00. It is not always easy to find a buyer so you need to take that into consideration when you purchase that timeshare and make sure you understand exactly how they work and what you can trade. Have you bought a timeshare off eBay? What was your experience? |

Archives

April 2020

Categories

All

Archives

April 2020

|

RSS Feed

RSS Feed